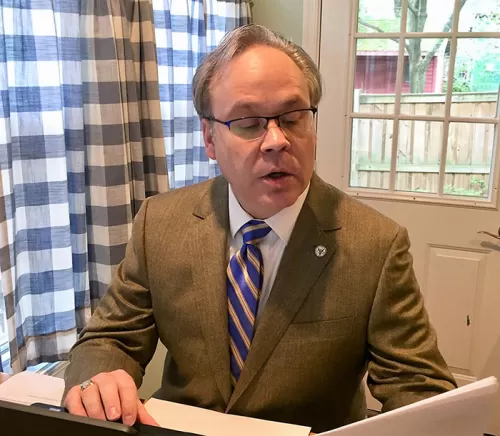

NCUA Board Member Todd M. Harper delivers remarks remotely from his home during the May 2020 Board Meeting.

As Prepared for Delivery on May 21, 2020

Tom and Frank, thank you for your informative briefing today. I appreciate your insights on the need for and desirability of approving this proposed rule. As noted in your presentation, this proposal affecting joint ownership share accounts would make the share insurance provided by the NCUA to members of a federally insured credit union comparable to the deposit insurance provided by the Federal Deposit Insurance Corporation to the customers at banks and thrifts.

The Federal Credit Union Act requires the NCUA to maintain a share insurance system comparable to the FDIC’s deposit insurance system. In seeking comments on this parity proposal today, we will move a step closer to clarifying the share insurance coverage treatment of joint accounts at federally insured credit unions. We will also be working to enhance the share insurance provided by the NCUA.

This change, therefore, is good for members and the federally insured credit unions to which they belong. What is more, these changes will promote consumer confidence in NCUA’s Share Insurance Fund.

I also appreciate the flexibility contained in this rulemaking. Going forward, the proposal should accommodate both technological changes and evolving recordkeeping processes at federally insured credit unions.

Additionally, I view state regulators as the NCUA’s partners. Some states, however, may have their own regulatory or statutory requirements for signature cards. As such, Frank and Tom, I would like to understand whether this proposed rule affects or supersedes existing state laws in any way. Thank you for those observations. I agree with you that we should respect existing state laws in this area.

In finalizing its joint account deposit insurance rule last year, the FDIC also noted that certain banks must have information technology systems and recordkeeping capabilities designed to calculate the amount of deposit insurance coverage available for each deposit account in the event of the failure of the bank. Generally, the FDIC’s recordkeeping rule applies to insured depositories with more than two million customer accounts for at least two quarters.

Even though there are now three credit unions with more than two million members and four others with more than one million members, the NCUA has not adopted a comparable recordkeeping requirement. A similar regulation at the NCUA could enhance the agency’s ability to pay share insurance claims as soon as possible after a federally insured credit union fails and to resolve a covered institution at the least cost to the Share Insurance Fund.

In my view, the NCUA Board therefore should consider and adopt a recordkeeping rule similar to the FDIC’s regulation. Such a change would make the Share Insurance Fund’s operations more comparable to the Deposit Insurance Fund, thus fulfilling our statutory mandate.

It would also ensure that surviving small credit unions do not ultimately end up paying unnecessarily more costs for resolving the failure of a large, complex federally insured credit union. I hope that the NCUA Board will consider this matter separately in the future.

Thank you, Mr. Chairman. I have no further comments or questions, and I will vote in favor of this proposed rule.