October 2010

Board Action Bulletin October 21, 2010

Board Action Bulletin

NCUA Guaranteed Notes classify as low-risk assets

The NCUA Board approved an interim final rule amending the definition of low-risk assets to add “debt instruments unconditionally guaranteed by the National Credit Union Administration” under Section 702.104(d) of NCUA Rules & Regulations. The revision will ensure NCUA Guaranteed Notes (NGNs) receive a zero risk weighting for PCA risk-based capital requirements consistent with the other federal financial regulators.

NCUA is offering NGNs to public investors as part of the corporate system resolution plan approved at the special open NCUA Board meeting on September 24. NGNs are permissible investments for credit unions. The interim final rule confirming the zero risk weight is intended to maximize credit union participation in NGN offerings.

The rule is effective when published in the Federal Register and has a 30 day comment period.

Merger Partner Registry available for CUs interested in expanding

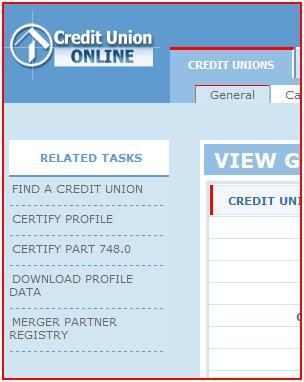

NCUA has created a Merger Partner Registry in the 5300 Call Report system, Credit Union Online. The registry enables credit unions to convey their interest in expanding their field of membership through a merger or purchase & assumption of a troubled credit union. NCUA and state supervisory authorities will use the information to broaden the pool of potential merger partners for troubled credit unions. The registry is confidential and cannot be viewed by other credit unions or released to the public.

Since the registry went live with third-quarter Call Reports in early October, 89 federally insured credit unions have registered (62 FCUs, 27 FISCUs). A hard copy merger registry form has been mailed to the 297 manual filers, and it will be incorporated in the hard copy Credit Union Profile form beginning in December. Credit unions can access the Merger Partner Registry by logging in online at www.ncua.gov under Credit Union Data/Credit Union Online/Login to Credit Union Online.

NCUA does not participate in the identification and selection process when two healthy credit unions elect to merge. However, if a merger or purchase & assumption becomes necessary and involves financial assistance, NCUA participates in identifying and selecting the continuing credit union partner.

NCUSIF Public Education Campaign Briefing

NCUA launched a comprehensive public education campaign October 4 to raise consumer awareness of federal deposit insurance coverage through the National Credit Union Share Insurance Fund (NCUSIF). The national campaign includes audio, video and print public service announcements (PSAs), a multimedia news release and matte release (a pre-written, ready-to-insert article for use in small daily and community newspapers), a radio and Internet media tour, social media outreach, and a new NCUA website combine to heighten awareness of the federal insurance protection provided to the vast majority of credit union members.

The campaign announcement, informational multimedia news release and matte release issued two weeks ago to nearly 1,000 outlets has the potential to reach many millions, while the majority of print medium pick-up is expected in the next 3-5 weeks.

PSAs featuring personal finance guru Suze Orman – with the tag line, “Keep Your Money NCUA-Safe” – were distributed to 1,500 cable and network TV stations and 4,300 cable and network radio stations. Plus, billboards featuring Orman were placed in targeted malls and bus shelters nationwide.

To kick off the campaign, NCUA Chairman Debbie Matz participated in 12 radio and Internet interviews with major radio networks and programs broadcast by 993 local stations, including The Wall Street Journal Network, MarketWatch, Federal News Radio, NPR and online Voice America Business.

Using social media tools, TheNCUA Tweets regularly; an active National Credit Union Administration Facebook site offers information and updates; while YouTube offers PSAs plus a behind-the-scenes interview with Orman so financial bloggers and the general public have easy access to this vital information.

A new agency webpage – www.ncua.gov/NCUAsafe.aspx -- includes NCUA’s Twitter Feed and a link to the e-Calculator to help members maximize their NCUSIF insurance coverage.

The webpage also includes a downloadable “widget” credit unions can place on their websites that links directly to the PSAs. NCUA encourages credit unions to add the widget to their websites so members have easy access to the educational PSAs about share insurance protection. NCUA plans to continue the NCUSIF public education campaign through 2011.

RegFlex amendments finalized

The NCUA Board, by 2-1 vote, approved final revisions to the agency’s Regulatory Flexibility Program (RegFlex) to strengthen safety and soundness requirements in Parts 701, 723 and 742 affecting fixed assets, member business loans (MBLs), stress testing investments, and discretionary control of investments to enhance safety and soundness for credit unions. Six other provisions for RegFlex-qualified credit unions remain unchanged.

Effective 30 days after publication in the Federal Register, some revisions require conforming amendments to NCUA’s fixed asset and MBL rules.

NCUSIF, TCCUSF reports

The National Credit Union Share Insurance Fund (NCUSIF) equity ratio was 1.18 percent on September 30, 2010, the same level reported for August 31, 2010. Invoices for the 1 percent capitalization deposit adjustment and 0.1242 percent premium assessment will be mailed in late October with a due date of November 22, 2010.

Year-to-date net losses for the Share Insurance Fund were reported at $563.7 million. Through September, the fund recorded $643.2 million in insurance loss expense bringing the month end reserve balance to $1.16 billion.

At September 30, 2010, 374 federally insured credit unions, with total assets of $45.3 billion, and total shares of $40.0 billion, were designated as CAMEL codes 4 or 5. Additionally, there were 1,769 CAMEL 3 credit unions with assets of $160.3 billion and shares of $141.6 billion. Together, nearly 23 percent of all assets are in credit unions with a CAMEL code of 3, 4 or 5.

Through September, 25 federally insured credit unions have failed in 2010, including 15 liquidations and 10 assisted mergers.

The Temporary Corporate Credit Union Stabilization Fund reported a total liabilities and net position of $369 million and revenue of $4 million. During September, the Fund used the amounts collected from the July special premium assessment and proceeds from a loan repayment to retire its $1.5 billion loan with the U. S. Treasury.

NCUA Strategic Plan 2011-2016 approved

The NCUA Board approved the NCUA Strategic Plan 2011-2016, which serves as the foundation for the agency’s performance management process. The plan provides guidance and direction to the agency by identifying the long-term goals used to indicate successful agency mission accomplishment. The plan was drafted based on internal input and two public comment periods. It was coordinated with agency leaders as well as Congress and the Office of Management and Budget.

Some significant enhancements to NCUA’s strategic plan include: a new concise mission statement and revised vision statement; two added strategic goals emphasize the agency’s commitment to increased transparency in regulations and to human capital management; greater specificity on corporate credit unions; and external factors that may affect agency performance.

The NCUA Strategic Plan 2011-2016 is available online at www.ncua.gov under Resources and Publications/Publications/Reports, Plans and Statistics.

The NCUA tweets all open Board meetings live. Follow @TheNCUA on Twitter, and access Board Action Memorandums and NCUA rule changes at www.ncua.gov. The NCUA also live streams, archives and posts videos of open Board meetings online.

Latest News

Latest News

Last week, the Financial Crimes Enforcement Network (FinCEN) announced a new Bank Secrecy Act…

1 min read

The National Credit Union Administration’s four funds again earned unmodified, or “clean,” audit…

1 min read

Guidelines for Newly Chartered and Urgent Needs Credit Union Grants

1 min read

Alexandria, VA (February 11, 2026) ― Today, the National Credit Union Administration (NCUA)…

1 min read