Chairman Neugebauer, Ranking Member Clay, and Members of the Committee, the National Credit Union Administration appreciates the invitation to testify about regulatory relief. I am Larry Fazio, Director of NCUA’s Office of Examination and Insurance.

Today, more than three-quarters of credit unions have less than $100 million in assets, and the median asset size of a credit union is $24.5 million.1 As smaller depository institutions, credit unions generally have limited resources available to respond to marketplace, technological, legislative, and regulatory changes. NCUA, therefore, recognizes and acts continually to fine-tune our rules and examinations to remove any unnecessary burden on credit unions.

NCUA scales our regulatory and supervisory expectations to credit union size and complexity. NCUA also seeks to provide broader regulatory relief when it is sensible and within the agency’s authority to do so. Over the past three years, we have taken many actions to cut red tape and provide lasting benefits to credit unions, including relaxing eight regulations and streamlining four processes. This year, we also have already proposed eliminating our fixed-assets rule and modifying the threshold for defining a small credit union to provide special consideration for regulatory relief in future rulemakings. And next week, the NCUA Board will consider a final rule to make it easier for federal credit unions to add new groups to their fields of membership.

Where regulation is needed to protect the safety and soundness of credit unions and the National Credit Union Share Insurance Fund, NCUA uses a variety of strategies to ensure our rules are effectively targeted.2 These strategies include fully exempting small credit unions from certain rules, using graduated requirements as size and complexity increase for others, and incorporating practical compliance approaches in agency guidance. Thus, we work to balance maintaining prudential standards with minimizing regulatory burden.

My testimony today will examine the state of the credit union system and the factors contributing to credit union consolidation. I will also outline some of NCUA’s ongoing efforts to support small credit unions. Additionally, I will review elements of NCUA’s current rulemaking process, including recent and prospective efforts to tailor regulation and supervision based on the size and complexity of credit unions, as well as NCUA’s voluntary participation in the current interagency review process under the Economic Growth and Regulatory Paperwork Reduction Act. I will further discuss NCUA’s efforts to reduce examination burdens. Finally, I will highlight several legislative recommendations to provide regulatory relief for credit unions.

Credit Union System Trends

The credit union system continues to experience steady growth in terms of members and assets. At the end of 2014, there were 6,273 credit unions serving nearly 99.3 million members. All but 227 of these credit unions had less than $1 billion in assets, the asset threshold used to define a community financial institution.

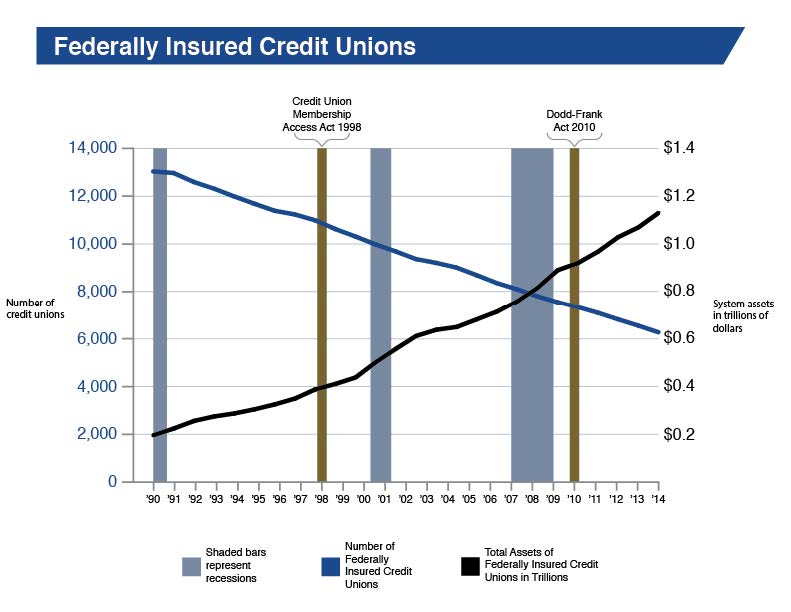

Nevertheless, long-time consolidation trends within the credit union system have continued. As the graph on the next page shows, the pace of credit union consolidation has been steady over more than two decades and across a variety of economic cycles, including the recession of the early 1990s, the bust of the technology boom in the early 2000s, and the recent Great Recession. The trend also has remained relatively constant after the passage of landmark laws like the Credit Union Membership Access Act of 1998 and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The long-term path of credit union consolidation is very similar to the consolidation trends occurring among banks and thrifts.

Despite the steady decline in the number of credit unions in the last 20 years, the assets within the credit union system have risen substantially over the same timeframe. Today, as shown in the same graph on the next page, credit union system assets exceed $1.1 trillion, a more than five-fold increase over 1990. Credit union membership also has nearly doubled over the same time period.

Credit union consolidation is primarily occurring among small institutions. During the past five years, 1,211 consumer credit unions have exited the system as a result of a merger. More than 90 percent of these former credit unions had assets of $50 million or less at the time of the merger, and another 6 percent held assets between $50 million and $100 million.

The existence of small credit unions is being challenged by the convergence of several circumstances. For example, the financial services marketplace is rapidly evolving, and it is difficult to keep pace with marketplace and regulatory developments. Additionally, small credit unions face challenges in attracting and retaining talent.

Another critical factor contributing to the decline in the number of small credit unions is that many generally cannot take advantage of economies of scale given their size. This results in relatively high operating costs and weak earnings. Lack of size and scope also makes it difficult for these credit unions to adopt the technological and product innovations demanded by consumers.

Today, roughly 50 percent of credit unions with less than $50 million in assets provide all four of these services: checking accounts, real estate loans, ATM and debit cards, and home banking services (including mobile banking). In contrast, almost all credit unions with assets of greater than $50 million provide each of these services. These differences have persisted over the past ten years, underscoring the competitive challenges small credit unions confront.

Other factors contributing to the decline of credit unions include the lack of adequate succession planning to compensate for the retirements of key employees and a single-sponsor credit union that loses its sponsor. Bad management decisions, insufficient internal controls, and employee fraud also have played a role in the system’s consolidation. In all, employee fraud was a contributing factor to $337 million in losses for the Share Insurance Fund between 2010 and 2014 at liquidated credit unions.

Support for Small Credit Unions

NCUA does what it can to help viable small credit unions to survive and thrive.

Through our Office of Small Credit Union Initiatives, we offer training, information on successful growth and service strategies, and support opportunities for small institutions to partner and collaborate. The webinars and videos produced by the office have been extremely popular among small credit unions. Topics covered by these videos include the responsibilities of supervisory review committees and fraud prevention. In 2014, NCUA trained 45,487 individuals, an increase of 76 percent over the previous year.

Additionally, the Office of Small Credit Union Initiatives provides affirmative assistance to small credit unions through free consulting, such as the net worth restoration plan assistance required by the Federal Credit Union Act.3 The office also awards grants and offers reduced-rate loans to low-income credit unions—many of which are small credit unions—through the Community Development Revolving Loan Fund.4

Finally, NCUA seeks, where possible, to keep regulatory burdens as low as possible, exempting many credit unions from certain rules and providing them with simplified compliance approaches for others. In recent years, NCUA also has streamlined exams for smaller credit unions. Each of these topics is discussed in greater detail below.

Regulatory Flexibility Act Threshold and Results

Under the Regulatory Flexibility Act, NCUA must publish an analysis in the Federal Register and give special consideration to the regulatory burden and alternatives for small credit unions whenever a proposed or final rule would impose a significant economic impact on a substantial number of small credit unions.5

In recognition of the operational and financial challenges faced by smaller credit unions, the NCUA Board has recently proposed and implemented substantial increases in the asset threshold used to define “small” for the purposes of the Regulatory Flexibility Act. In January 2013, the Board increased the asset threshold to $50 million, a five-fold increase from the previous $10 million. The change nearly doubled the number of credit unions classified as small. Today, 4,050 institutions representing 65 percent of all credit unions are covered by the small credit union definition.

At the same time it revised the small credit union definition, the NCUA Board provided immediate regulatory relief by exempting credit unions under $50 million from several regulatory requirements. First, the Board increased from $10 million to $50 million the threshold defining which credit unions are complex, narrowing the category of credit unions that could be subject to risk-based net worth requirements and the associated prompt corrective action mandates. Second, the Board increased from $10 million to $50 million the threshold used to exempt credit unions from our interest rate risk rule.

In a coordinated policy change, the Board nearly doubled the number of credit unions eligible to apply for NCUA’s Office of Small Credit Union Initiatives’ individualized consulting services by increasing the eligibility threshold to $50 million. Subsequently, the NCUA Board extended relief at the same level in new rules requiring certain liquidity contingencies and creditor notices in voluntary liquidations.

In January 2013, the NCUA Board also committed the agency to revisit the Regulatory Flexibility Act threshold in 2015 and every three years thereafter.6 The Board took this action to ensure the definition of a small credit union would keep pace with changes in the marketplace. Consequently, in February 2015, the Board approved a proposed rule and policy statement to double the threshold from $50 million to $100 million. This change would provide special consideration for regulatory relief in future rulemakings for an additional 734 credit unions.

Should the Board adopt a $100 million threshold in the final rule, 76 percent of all credit unions would be covered in future rulemakings for special consideration of regulatory relief.7 Taking this action also would recognize the challenges encountered by credit unions below $100 million in assets. They have slower deposit growth rates, slower membership growth rates, higher operating costs, and lower returns on average assets than peer credit unions above the threshold.8

Regulatory Review Efforts

NCUA is ever mindful of the impact of our regulations on credit unions, especially smaller ones. We are proactive in our efforts to identify outdated, ineffective, or excessively burdensome regulations. We also continually review and take appropriate steps to eliminate or ease burdens, whenever possible, without compromising safety and soundness.

Rolling Regulatory Review

Since 1987, NCUA has followed a well-delineated and deliberate process to continually review its regulations and seek comment from stakeholders, such as credit unions and trade associations. Through this agency-initiated process, NCUA conducts a rolling review of one-third of its regulations each year—meaning that we review all of our regulations at least once every three years.

This long-standing regulatory review policy helps to ensure NCUA’s regulations:

- Impose only the minimum required burdens on credit unions, their members, and the public.

- Are appropriate for the size of the credit unions regulated by NCUA.

- Are issued only after full public participation in the rulemaking process.

- Are clear and understandable.

This rolling review is fully transparent. NCUA publishes on our website a list of the applicable regulations up for review each year and invites public comment on any or all of the regulations.9

Economic Growth and Regulatory Paperwork Reduction Act

Additionally, NCUA is voluntarily participating in the ongoing interagency review process created by the Economic Growth and Regulatory Paperwork Reduction Act of 1996.10 EGRPRA requires the Federal Financial Institutions Examination Council and its member federal banking agencies to review their regulations at least once every 10 years to identify any rules that might be outdated, unnecessary, or unduly burdensome. NCUA is not required to participate in this process, but the agency has voluntarily elected to do so once again.

Under the EGRPRA review, each agency is issuing several categories of rules for public comment at regular intervals over two years—with an eye toward streamlining, modernizing, or even repealing regulations when appropriate. The categories developed and used by NCUA are:

- Agency Programs,

- Applications and Reporting,

- Capital,

- Consumer Protection,

- Corporate Credit Unions,

- Directors,

- Officers and Employees,

- Money Laundering,

- Powers and Activities,

- Rules of Procedure, and

- Safety and Soundness.

In May 2014, the NCUA Board released for review 33 regulations in the Applications and Reporting and Powers and Activities categories. NCUA subsequently received five comments. In response to these comments, Board Chairman Debbie Matz established two internal working groups to consider possible changes in the areas of field of membership and secondary capital. The working groups are now reviewing stakeholders’ suggestions from the first notice, as well as other ideas, and will make recommendations on potential regulatory and legislative changes in both areas before the end of the year.

Earlier this month, NCUA also moved ahead with streamlining the process by which low-income credit unions obtain secondary capital from investors.11 These supervisory changes will expedite the approval of secondary capital requests by regional offices and make it possible for low-income credit unions with secondary capital to return portions of the loans that no longer count towards net worth. The changes also give investors greater clarity and confidence.

In the agency’s second EGRPRA notice in December 2014, NCUA opened 17 rules for comment in three additional categories: Agency Programs, Capital, and Consumer Protection. Before the comment period closed in March, NCUA received eight comments from stakeholders.

As part of NCUA’s voluntary participation in the latest EGRPRA review, NCUA will evaluate the burden on credit unions for those regulations within NCUA’s control. The agency also has included in the EGRPRA review all rules over which NCUA has drafting authority, except for certain rules that pertain exclusively to internal operational or organizational matters, such as our Freedom of Information Act rule.

As our notice makes clear, however, credit unions also are subject to certain rules issued or administered by other regulatory agencies, such as the Consumer Financial Protection Bureau and the Department of the Treasury’s Financial Crimes Enforcement Network. Because we have no independent authority or ability to change such rules, our notices—as do the interagency joint notices—simply advise that comments submitted to us but focused on a rule administered by another agency will be forwarded to that other agency for appropriate consideration.

Regulatory Modernization Initiative

In 2011, Chairman Matz launched the agency’s Regulatory Modernization Initiative. The initiative balances two principles:

- Safety and soundness—strengthening regulations necessary to protect credit union members and the Share Insurance Fund, and

- Regulatory relief—revising and removing regulations that limit flexibility and growth, without jeopardizing safety and soundness.

In implementing this initiative, NCUA has held regular in-person and online town-hall meetings to solicit feedback from stakeholders. These events have identified regulatory relief issues on which the agency has since acted.

During its first three years, the initiative resulted in 15 actions to cut red tape and provide lasting benefits to credit unions of all sizes.12 Specifically, NCUA worked to ease eight regulations, providing regulatory relief to thousands of credit unions. NCUA also streamlined three processes, such as facilitating more than a thousand new low-income credit union designations and establishing an expedited process for examinations at smaller credit unions.13 NCUA additionally issued four legal opinions, allowing more flexibility in credit union operations.

Earlier this year at the Credit Union National Association’s Governmental Affairs Conference, Chairman Matz announced her continuing commitment to the Regulatory Modernization Initiative. Specifically, she said 2015 would be the year of regulatory relief.14 Her speech described five areas in which NCUA will work to provide relief: supplemental capital, fields of membership, fixed assets, asset securitization, and member business lending.

During their speeches at the same conference, NCUA Board Vice Chairman Rick Metsger and Board Member J. Mark McWatters also expressed support for providing credit unions with more regulatory relief.15 This relief will help credit unions of all sizes compete in a rapidly evolving marketplace.

Rulemaking Process

In developing any regulation, NCUA strives to ensure the agency’s rulemakings are reasonable and cost-effective. NCUA additionally conducts an analysis to support the agency’s decisions in advance of regulatory actions. The analysis ensures regulatory choices are made after appropriate consideration of the likely consequences to the parties affected by the rulemaking.

NCUA’s safety and soundness regulations protect credit unions, as well as strengthen the credit union system the agency supervises and insures.16 These regulations reduce the likelihood of credit union failures and, in doing so, promote stability and protect the Share Insurance Fund.

Any loss to the Share Insurance Fund is ultimately borne by surviving credit unions, which may be required to pay increased premiums. As member-owned cooperatives, this means the members—who are the owners and consumers of the credit unions—may ultimately have to repay these costs. As the developments of the last decade have demonstrated, the cost of regulatory inaction can result in failures that impose a greater cost to credit unions and society than the cost of action.17

Through the public comment process, the NCUA Board gains insights on potential costs, unintended consequences, and alternative strategies directly from credit unions, as well as other interested stakeholders. The Board then uses this information to make adjustments before issuing a final rule. A good example of this process in action is NCUA’s October 2013 final rule on emergency liquidity and contingency funding.

The proposed liquidity rule applied to all federally insured credit unions with more than $50 million in assets, but the public comment period yielded a number of important observations about the compliance requirements associated with establishing emergency lines of credit. Based on this information, the NCUA Board reconsidered the balance between costs and benefits specifically for credit unions holding $50 million to $250 million in assets.

The final rule on emergency liquidity and contingency funding exempted credit unions with assets up to $250 million from establishing emergency lines of credit with the Federal Reserve’s Discount Window, or NCUA’s Central Liquidity Facility, or both. Instead, the Board only required credit unions of this size to develop contingency funding plans that clearly set out strategies for meeting emergency liquidity needs.

Examples of Scaled Regulation

In addition to adjusting the emergency liquidity and contingency funding rule, NCUA has recently scaled other regulations based on the asset size of the credit union. Examples of such tailored regulations include the agency’s 2012 interest rate risk rule and the revised proposed risk-based capital rule issued in January.18

Interest Rate Risk Rule

NCUA’s focus on interest rate risk management has been constant for more than 15 years, as evidenced by a steady issuance of guidance to examiners and credit unions on asset-liability management. Since 2010, interest rate risk management has been a heightened focus for NCUA, and it is again a primary supervisory focus for the agency in 2015.

NCUA’s focus on interest rate risk exposure has increased due to the extraordinarily low level of interest rates and the overall lengthening of asset durations in the credit union system in recent years. NCUA is mindful that a period of rapidly rising rates could be a particularly challenging scenario for some credit unions. To mitigate this risk and maintain stable earnings, credit unions need to have policies in place to survive adverse rate environments.

These concerns led the NCUA Board to issue a final rule three years ago aimed at managing interest rate risk. Generally, the rule categorizes credit unions based on size, which is correlated to risk exposure, to determine the need to adopt a written policy on interest rate risk. Consistent with the Board’s policy to exempt small credit unions from regulations when prudent, the size and exposure criteria in the interest rate risk rule exempt credit unions with less than $50 million in assets, while protecting the Share Insurance Fund by covering most of the system’s assets.

The NCUA Board exempted smaller credit unions because they customarily have very low interest-rate-risk profiles as they are not as active in residential mortgage lending or long-term investing.19 Also, smaller credit unions typically have much higher capital levels and hold relatively more cash and short-term investments on their balance sheets.20

Revised Proposed Risk-Based Capital Rule

After reviewing 2,056 comments on the original risk-based capital proposal, the NCUA Board issued a revised proposed rule in January. NCUA’s primary goals for the revised proposed risk-based capital rule remain the same:

- To prevent or mitigate losses to the Share Insurance Fund by having a better calibrated, meaningful, and more forward-looking capital requirement to ensure credit unions can continue to serve their members during economic downturns without relying on government intervention or assistance, and

- To modernize the risk-based capital calculations and framework, in accordance with the Federal Credit Union Act’s directives.

The new proposal significantly narrowed the proposed rule’s scope by redefining “complex” credit unions. Under this rulemaking, the NCUA Board has proposed to limit the risk-based capital requirement to credit unions with more than $100 million in assets, rather than the $50 million threshold contained in the current rule and the earlier proposal.

By increasing the asset threshold, the revised proposed rule exempts more than three-quarters of credit unions. As a result, the revised proposed rule covers 1,455 credit unions that hold 89 percent of the system’s assets.21 In comparison, the original proposal covered 2,237 credit unions representing 94 percent of the system’s assets.22 The revised proposal also would result in the downgrade of fewer credit unions.23

As requested by stakeholders, including many members of the House Financial Services Committee, the revised proposed rule includes significant changes to the risk weights for investments, real estate loans, member business loans, corporate credit unions, and credit union service organizations. The risk weights contained in the new proposal are generally comparable to or more favorable than the risk weights applied to banks by federal banking agencies.

Finally, the revised proposed rule extends the implementation date to January 1, 2019. This date aligns with the risk-based capital rule implementation deadline for banks. It also allows credit unions covered under the rule ample time to prepare for the change.

The extended comment period on the revised proposed risk-based capital rule closes on April 27, 2015.

Other Regulatory Relief Proposals under Consideration

Going forward, NCUA is already working to provide additional regulatory relief for credit unions to fulfill Chairman Matz’s vision of making 2015 the year of regulatory relief.

NCUA is drafting a proposal to modernize our member business lending rule. The primary changes being considered involve removing prescriptive underwriting criteria and other outdated restrictions, thereby eliminating the need for credit unions to request waivers from NCUA to make certain types of business loans.

In April 2014, the NCUA Board also issued a proposed rule to define more clearly which associational groups do and do not qualify for membership in a federal credit union. The proposed rule would provide automatic approval for seven types of groups. Thus, credit unions would receive regulatory relief as they would no longer be required to devote resources to the process for approving additions to their fields of membership. The change also would enable NCUA to more efficiently use its own resources.

To facilitate greater access to credit union membership, several commenters suggested additional categories of well-established associational groups that also should be considered for automatic approval. The NCUA Board has carefully reviewed these suggestions and is expected to consider a final rule at its open meeting next week. This final rule will include substantially more regulatory relief than the proposed rule as NCUA responds to the comments received. For example, the Board will likely add five additional types of groups that will automatically satisfy the associational common bond provisions.

NCUA is additionally working to fine-tune a proposed rule on asset securitization. Approved in June 2014, this proposal would allow qualified federal credit unions to securitize loans they have originated under certain conditions. Once finalized, this rule would provide these federal credit unions with greater flexibility to manage interest rate and liquidity risks.

Finally, in March 2015, the NCUA Board proposed to eliminate the 5-percent fixed-assets cap. The proposed rule also would remove provisions in the current rule relating to waivers from the aggregate limit, simplify the rule’s partial occupancy requirements, and move oversight of federal credit union fixed-assets ownership from regulation to the supervisory process. When finalized, this rule will allow federal credit unions to make business decisions on upgrading technology, updating facilities, or making other purchases without filing waivers and without NCUA’s involvement in day-to-day business decisions.

Improvements in the Examination Program

Beyond providing targeted relief by issuing regulatory exemptions and adopting tailored rules, NCUA is providing regulatory relief by cutting burdens in the examination process.

Small Credit Union Examination Program

Since 2002, NCUA has followed a risk-focused exam program. This approach is designed to efficiently allocate agency resources to credit unions and areas of operations exhibiting the greatest potential risk exposure to the Share Insurance Fund. The program relies on examiner judgment to determine the areas needing review. Over time, NCUA has adjusted this approach by adding minimum scope requirements and establishing the National Supervision Policy Manual to ensure consistency of supervisory actions across the country.

While the risk-based examination program has generally worked well, in 2011 we determined the resources used to complete examinations were not in balance with the credit union system’s risks. NCUA was spending more exam hours on the smallest credit unions rather than the largest credit unions that have the greatest concentration of the system’s assets and the greatest potential risk exposure to the Share Insurance Fund.

NCUA has since moved to concentrate supervision on credit union activities posing the most risk. We recognized larger, more complex credit unions require more attention, so we began streamlining exams for the smallest credit unions and deploying examiners where their work will be most effective in protecting the Share Insurance Fund.

NCUA now has in place a targeted, streamlined examination program for financially and operationally sound federal credit unions with less than $30 million in assets. Through the Small Credit Union Examination Program, NCUA spends less time on average in small, well-managed federal credit unions. This decreased examination burden reflects a reduced overall scope but is more precisely focused on the most pertinent areas of risk in small credit unions—lending, recordkeeping, and internal control functions.

NCUA subsequently expanded the program. NCUA regions now have the discretion to choose a defined-scope examination for federal credit unions with between $30 million to $50 million in total assets that received a composite CAMEL rating of 1, 2, or 3 at their last examination.24 NCUA implemented the new procedures during the first quarter of 2015. For larger, more complex credit unions, NCUA will continue to perform risk-focused exams.

Broader Examination Reforms

NCUA is further working to streamline the examination process for all credit unions by harnessing technology. Improvements in computers, software, and security are allowing NCUA to design a new Automated Integrated Regulatory Examination System and revise our Call Report system to improve off-site monitoring capabilities and thereby potentially reduce the overall time NCUA spends onsite inside credit unions conducting examinations.

To improve consistency in the way field staff develop and use documents of resolution, NCUA also revised our policy and procedures in 2013 to clarify how and when documents of resolution should be used.25 The new policy states documents of resolution should only be used to address issues significant enough that a credit union’s failure to correct the problem would necessitate the examiner recommending an enforcement action. In addition, examiners must cite the appropriate law, regulation, or authoritative NCUA policy when including an issue as a finding or document of resolution in the examination report.

These procedural changes have resulted in clearer expectations for credit unions and NCUA field staff, as well as greater consistency nationwide in the examination process. Credit unions also have generally supported the change. As a result of these changes and an improved economy, the agency has experienced a decline in the number of documents of resolution issued.

Regulatory Relief Legislation

Finally, the Committee asked NCUA to identify ways to ease credit union regulatory burdens through legislation.

NCUA is very appreciative of the House Financial Services Committee’s efforts during the 113th Congress to enact into law the Credit Union Share Insurance Fund Parity Act by Congressmen Royce and Perlmutter and the American Savings Promotion Act by Congressman Kilmer.26 The first law allows federally insured credit unions to offer the same level of insurance on deposits as banks and thrifts for lawyers’ trust accounts. The second law permits federally insured financial institutions to offer prize-linked accounts to promote saving.

Looking ahead, NCUA has several proposals to share with the Committee related to regulatory flexibility, field-of-membership requirements, member business lending, supplemental capital, and vendor authority.

Regulatory Flexibility

Today, there is considerable diversity in scale and business models among financial institutions. As noted earlier, many credit unions are very small and operate on extremely thin margins. They are challenged by unregulated or less-regulated competitors, as well as limited economies of scale. They often provide services to their members out of a commitment to offer a specific product or service, rather than a focus on any incremental financial gain.

The Federal Credit Union Act contains a number of hard-coded provisions that limit NCUA’s ability to revise regulations and provide relief to such credit unions. Examples include limitations on the eligibility for credit unions to obtain supplemental capital, field-of-membership restrictions, curbs on investments in asset-backed securities, and the 15-year loan maturity limit, among others.27

To that end, NCUA encourages Congress to consider providing regulators like NCUA with flexibility to write rules to address such situations, rather than imposing rigid requirements. Such flexibility would allow the agency to effectively limit additional regulatory burdens, consistent with safety and soundness.

As previously noted, NCUA continues to modernize existing regulations with an eye toward balancing requirements appropriately with the relatively lower levels of risk smaller credit unions pose to the credit union system. By allowing NCUA discretion on scale and timing to implement new laws, we could more flexibly mitigate the cost and administrative burdens of these smaller institutions while balancing consumer and prudential priorities.

Field-of-Membership Requirements

The Federal Credit Union Act currently permits only federal credit unions with multiple common-bond charters to add underserved areas to their fields of membership. We recommend Congress act to modify the Federal Credit Union Act to give NCUA the authority to streamline field-of-membership changes and permit all federal credit unions to grow their membership by adding underserved areas.

Allowing federal credit unions with a community or single common-bond charter the opportunity to add underserved areas would open up access for many more unbanked and underbanked households to credit union membership. This legislative change also could eventually enable more credit unions to participate in the programs offered through the congressionally established Community Development Financial Institutions Fund, thus increasing the availability of credit and savings options in distressed areas.28

Congress also may want to consider other field-of-membership statutory reforms. For example, Congress could allow federal credit unions to serve underserved areas without also requiring those areas to be local communities. Additionally, Congress could simplify the “facilities” test for determining if an area is underserved.29 This issue is one that the field-of-membership working group created by Chairman Matz also is exploring.

The internal working group additionally is examining ideas for other legislative or policy changes to facilitate access to credit unions and ease credit union compliance burdens. NCUA stands ready to work with the Committee on these ideas, as well as other options to provide consumers more access to affordable financial services through credit unions.

Member Business Lending

NCUA reiterates the agency’s long-standing support for legislation to adjust the member business lending cap, such as H.R. 1188, the Credit Union Small Business Jobs Creation Act, sponsored by Congressmen Royce and Meeks. This bipartisan bill contains appropriate safeguards to ensure NCUA can protect safety and soundness as qualified credit unions gradually increase member business lending.

For federally insured credit unions, the Federal Credit Union Act limits member business loans to the lesser of 12.25 percent of assets or 1.75 times net worth, unless the credit union qualifies for a statutory exemption.30 For smaller credit unions with the membership demand and the desire to serve the business segments of their fields of membership, the restriction makes it very difficult or impossible to successfully build a sound member business lending program. As a result, many credit unions are unable to deliver commercial lending services cost effectively, which denies small businesses in their communities access to an affordable source of credit and working capital.

These credit unions miss an opportunity to support the small business community and to provide a service alternative to the small business borrower. Small businesses are an important contributor to the local economy as providers of employment and as users and producers of goods and services. NCUA believes credit union members that are small business owners should have full access to financial resources in the community, including credit unions, but this is often inhibited by the statutory cap on member business loans.

NCUA additionally supports H.R. 1422, the Credit Union Residential Loan Parity Act, which Congressmen Royce and Huffman have recently introduced. This bipartisan legislation addresses a statutory disparity in the treatment of certain residential loans made by credit unions and banks.

When a bank makes a loan to purchase a 1- to 4-unit, non-owner-occupied residential dwelling, the loan is classified as a residential real estate loan. If a credit union were to make the same loan, it is classified as a member business loan; therefore, it is subject to the member business lending cap. To provide parity between credit unions and banks for this product, H.R. 1422 would exclude such loans from the cap. The legislation also contains appropriate safeguards to ensure NCUA will apply strict underwriting and servicing standards for these loans.

Supplemental Capital

NCUA supports legislation to allow more credit unions to access supplemental capital, such as H.R. 989, the Capital Access for Small Businesses and Jobs Act. Introduced by Congressmen King and Sherman, this bill would allow healthy and well-managed credit unions to issue supplemental capital that will count as net worth. This bipartisan legislation would result in a new layer of capital, in addition to retained earnings, to absorb losses at credit unions.

The high-quality capital that underpins the credit union system is a bulwark of its strength and key to its resiliency during the recent financial crisis. However, most federal credit unions only have one way to raise capital—through retained earnings, which can grow only as quickly as earnings. Thus, fast-growing, financially strong, well-capitalized credit unions may be discouraged from allowing healthy growth out of concern it will dilute their net worth ratios and trigger mandatory prompt corrective action-related supervisory actions.

A credit union’s inability to raise capital outside of retained earnings limits its ability to expand its field of membership and to offer greater options to eligible consumers. Consequently, NCUA has previously encouraged Congress to authorize healthy and well-managed credit unions to issue supplemental capital that will count as net worth under conditions determined by the NCUA Board. Enactment of H.R. 989 would lead to a stronger capital base for credit unions and greater protection for taxpayers.

Vendor Authority

Finally, NCUA requests that the House Financial Services Committee consider legislation to provide the agency with examination and enforcement authority over third-party vendors—including credit union service organizations, or CUSOs for short. Obtaining this authority is the agency’s top legislative priority.

This authority would provide a small measure of regulatory relief for credit unions. The ability to address weaknesses at the source (service provider) could easily save NCUA and credit unions time and valuable resources by eliminating the time needed to mitigate the same issue repeatedly at hundreds of credit unions. In other words, credit unions would no longer be stuck in the middle of trying to resolve problems between their vendors and NCUA. Further, NCUA could remove current regulations requiring credit unions to maintain and modify contracts with CUSOs to govern key aspects of these operations, like accounting standards and examination access to financial information.

The Government Accountability Office has noted that NCUA has a limited ability to assess the risks third-party vendors, including CUSOs, pose for credit unions and ultimately the Share Insurance Fund, and to respond to any problems.31 NCUA may only examine CUSOs and vendors with their permission and cannot enforce any recommended corrective actions. This lack of authority stands in contrast to the powers of the Federal Deposit Insurance Corporation, the Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and most state regulators.

The types of services CUSOs and other third-party vendors provide credit unions vary widely depending on the size and complexity of the credit union.32 Thus, the variety of potential risks to a credit union, its members, and the Share Insurance Fund depend on the services provided.

In requesting vendor authority, NCUA seeks to close a regulatory blind spot: non-transparent, ongoing risks to the credit union system from certain types of CUSOs and third-party vendors that either originate loans or are business technology providers or payment system providers. Without vendor authority, NCUA cannot accurately assess the actual risk present in the credit union system and whether current CUSO or third-party vendor risk-mitigation strategies are adequate and can effectively protect the system from a propagated contagion.

The gaps in NCUA’s supervision program created by the lack of vendor authority are material. In all, approximately 46 percent of credit unions receive service from a credit union system-only vendor. This leaves thousands of credit union clients, billions in assets, and millions of their members potentially exposed. Furthermore, nearly all of the core technology service providers exclusively serving credit unions have declined a voluntary review by NCUA in recent years.

Even where CUSOs agree to submit to NCUA reviews, without enforcement authority they are free to reject NCUA’s recommendations to implement appropriate corrective actions to mitigate identified risks. Moreover, NCUA may not receive information about a troubled vendor as early as other regulators, because we do not have comparable authority, and our ability to more completely disclose information with credit unions is limited.

NCUA has issued supervisory guidance urging credit unions to improve due diligence in third-party vendor relationships because of the recurring problems uncovered during the examination process. The agency has had to issue repeated guidance because many credit unions have failed to perform third-party due diligence well. In part, this is due to their limited influence or authority over vendors. This may also be attributable to staffing issues and lack of internal expertise within credit unions.

NCUA is especially concerned about our ability to effectively mitigate cybersecurity threats absent third-party vendor authority. Our cybersecurity concerns predominantly relate to cyber-threats against financial services vendors, some of which may exclusively serve credit unions and large numbers of them, or that have access to extensive personally identifiable information for millions of credit union members. NCUA needs to exercise oversight to ensure proper and robust safeguards are in place to protect such systems and data. With respect to such technology service providers, NCUA would seek information related to their cybersecurity safeguards, ongoing vulnerability assessments, and mitigation strategies in the event of being compromised.

Today, the top five technology service providers serve more than half of all credit unions representing 75 percent of the credit union system’s assets. Thus, a failure of even one vendor represents potential risk to the Share Insurance Fund. The potential for losses are not hypothetical. Since 2008, nine CUSOs have caused more than $300 million in direct losses to the Share Insurance Fund and led to the failures of credit unions with more than $2 billion in aggregate assets. In one such example, one CUSO caused losses in 24 credit unions, some of which failed.

These vendors also provide an array of products and services to credit unions, and like other small financial institutions, credit unions rely heavily on third parties in this area. Credit unions often use common third-party services designed specifically for small institutions. When third-party vendors perform functions that include online banking, transaction processing, fund transfers, and loan underwriting, the data are being stored on these vendors’ servers. In addition, vendors that process funds, such as shared branching networks, can create gaps in anti-money laundering oversight.

Finally, the lack of transparency of information needed to evaluate risk is compounded by the fact that the use of third-party vendors is growing and vendors themselves are consolidating. Data from the fourth quarter of 2014 show that credit unions using the services of a CUSO accounted for $992.4 billion in assets or 88 percent of system assets. This figure is up from 79 percent of assets at year-end 2009, but it does not include third-party vendors that are not CUSOs. Thus, the actual number could be higher.

NCUA’s past experience informs how the agency would utilize enhanced vendor authority today. From 1998 to 2001, Congress granted NCUA the authority it currently seeks out of concerns with Y2K issues. At that time, the agency redeployed existing resources without incurring significant costs. Today, the trend is to replace existing examiners with specialists, so to the extent that any additional specialists are necessary with the new authority, there would only be incremental costs.

If granted this authority, Chairman Matz also has publicly indicated that there would be no material change in NCUA’s budget. Instead of regularly examining every third party, NCUA would focus on examining those vendors with red flags or posing greater risks. When material or widespread safety and soundness issues are identified, we would have the authority to mitigate the risk and decrease losses for the Share Insurance Fund.

NCUA has developed a legislative proposal which we believe would afford the agency the appropriate statutory authority to address these problems. NCUA stands ready to work with the Committee on legislation to effectuate the necessary changes so that all credit unions can responsibly and effectively utilize the services of CUSOs and third-party vendors.

Thank you again for the invitation to testify. I am happy to answer any questions.

APPENDIX I

|

Historical Performance by Asset Class 2014, Fourth-Quarter Median |

|||||||||

|

Less than $10 million |

$10 million to $50 million |

$50 million to $100 million |

$100 million to $250 million |

Over $250 million |

|||||

|

Loan Growth Rate (annual) |

0.35% |

2.23% |

4.44% |

6.35% |

9.61% |

||||

|

Asset Growth Rate (annual) |

-0.52% |

1.56% |

2.52% |

3.67% |

4.99% |

||||

|

Membership Growth Rate (annual) |

-1.52% |

-0.86% |

0.05% |

0.96% |

3.29% |

||||

|

Loan-to-Share Ratio |

57.11% |

55.58% |

61.70% |

70.36% |

75.71% |

||||

|

Net Worth Ratio |

14.16% |

11.51% |

10.69% |

10.33% |

10.51% |

||||

|

Return on Average Assets Ratio |

0.09% |

0.24% |

0.41% |

0.53% |

0.74% |

||||

|

Delinquency Ratio |

1.26% |

0.85% |

0.86% |

0.77% |

0.69% |

||||

|

Non-Interest Expenses-to-Total Assets Ratio |

3.54% |

3.49% |

3.76% |

3.72% |

3.32% |

||||

|

Full-Time Equivalent Employees |

2 |

7 |

22 |

45 |

149 |

||||

|

5-Year Median |

|||||||||

|

Less than $10 million |

$10 million to $50 million |

$50 million to $100 million |

$100 million to $250 million |

Over $250 million |

|||||

|

Loan Growth Rate (annual) |

-0.25% |

0.70% |

2.11% |

3.20% |

5.45% |

||||

|

Asset Growth Rate (annual) |

0.86% |

3.03% |

3.90% |

4.27% |

5.38% |

||||

|

Membership Growth Rate (annual) |

-1.49% |

-0.63% |

0.45% |

1.12% |

2.87% |

||||

|

Loan-to-Share Ratio |

56.68% |

57.03% |

62.39% |

68.42% |

71.43% |

||||

|

Net Worth Ratio |

14.06% |

11.57% |

10.54% |

10.07% |

9.98% |

||||

|

Return on Average Assets Ratio |

-0.06% |

0.18% |

0.35% |

0.45% |

0.69% |

||||

|

Delinquency Ratio |

1.85% |

1.13% |

1.04% |

1.04% |

1.01% |

||||

|

Non-Interest Expenses-to-Total Assets Ratio |

3.79% |

3.72% |

3.84% |

3.81% |

3.45% |

||||

|

Full-Time Equivalent Employees |

2 |

7 |

21 |

43 |

139 |

||||

|

10-Year Median |

|||||||||

|

Less than $10 million |

$10 million to $50 million |

$50 million to $100 million |

$100 million to $250 million |

Over $250 million |

|||||

|

Loan Growth Rate (annual) |

-0.01% |

1.98% |

3.66% |

4.93% |

6.63% |

||||

|

Asset Growth Rate (annual) |

0.34% |

3.19% |

4.76% |

5.36% |

6.56% |

||||

|

Membership Growth Rate (annual) |

-1.40% |

-0.39% |

0.70% |

1.34% |

2.88% |

||||

|

Loan-to-Share Ratio |

64.67% |

64.35% |

68.94% |

73.73% |

76.85% |

||||

|

Net Worth Ratio |

15.03% |

12.39% |

11.12% |

10.52% |

10.31% |

||||

|

Return on Average Assets Ratio |

0.09% |

0.30% |

0.43% |

0.44% |

0.61% |

||||

|

Delinquency Ratio |

2.20% |

1.22% |

1.10% |

1.03% |

0.95% |

||||

|

Non-Interest Expenses-to-Total Assets Ratio |

3.86% |

3.91% |

4.00% |

4.03% |

3.56% |

||||

|

Full-Time Equivalent Employees |

2 |

7 |

20 |

43 |

131 |

||||

APPENDIX II

National Credit Union Administration

Regulatory Modernization Initiative

2011–2014 Results

|

NCUA ACTIONS |

BENEFITS |

|

IMPROVED RULES |

|

|

Modernized Definition of "Small" Credit Unions |

• Expanded NCUA’s consideration of regulatory exemptions for credit unions with assets of less than $50 million, up from the previous $10 million. • Exempted two-thirds of the entire credit union system from NCUA rules on risk-based net worth and interest rate risk management. • Eased the compliance requirement for small credit unions to access emergency liquidity. • Doubled the number of credit unions receiving special consideration for regulatory relief in future NCUA rulemakings. |

|

Eased Troubled Debt Restructurings |

• Encouraged credit union loan modifications and ended manual reporting. • Prevented unnecessary foreclosures. • Kept more credit union members in their homes throughout the crisis. |

|

Expanded Rural Districts |

• Raised potential membership for federal credit unions in rural districts from a hard cap of 200,000 residents to a sliding scale: 250,000 residents or 3 percent of the state population, whichever is larger. • Permitted federal credit unions to serve rural districts and Indian reservations in states experiencing extraordinary population growth, as well as in smaller states. |

|

Authorized "Plain Vanilla" Derivatives |

• Encouraged qualified federal credit unions to use "plain vanilla" derivatives to reduce risks. • Permitted approved federal credit unions to continue mortgage lending while offsetting interest rate risk. • Protected the credit union system by providing an extra buffer against potential losses at large credit unions. |

|

Approved Treasury Inflation-Protected Securities |

• Offered federal credit unions an additional investment backed by the federal government with zero credit risk. • Provided returns indexed to inflation rates rather than interest rates. |

|

Established Charitable Donation Accounts |

• Empowered federal credit unions to safely pool investments designed to benefit national, state, or local charities. |

|

Proposed Eliminating Fixed Assets Cap |

• Eliminated federal credit unions’ 5-percent cap on fixed assets. • Empowered federal credit unions to make their own business decisions on purchases of land, buildings, office equipment, and technology. |

|

Proposed Asset Securitization |

• Authorized qualified federal credit unions to securitize their own assets. • Offered an additional tool to manage interest rate and liquidity risks. |

|

STREAMLINED PROCESSES |

|

|

Low-Income Credit Union Designation |

• Implemented an "opt-in" process whereby eligible credit unions can simply say "yes" to receive the low-income designation. • More than doubled the number of low-income designations, reaching more than 2,200 credit unions serving 27 million members. • Low-income credit unions are authorized by statute to expand member business lending beyond the statutory cap, obtain supplemental capital, raise non-member deposits, and apply for Community Development Revolving Loan Fund grants and loans. |

|

Blanket Waivers |

• Released guidance encouraging credit unions to apply for blanket waivers for member business loans meeting certain conditions. • Eliminated the requirement for many business owners to pledge personal guarantees against loans with high-value collateral based on sound underwriting principles. • Blanket waivers eliminated the need for credit unions to apply for loan-by-loan waivers. |

|

Expedited Examinations |

• Created an expedited exam process for well-managed credit unions with CAMEL ratings of 1, 2, or 3 and assets of less than $30 million, with the program expanding to $50 million in 2015. • Enables these credit unions to dedicate more resources to serving members. |

|

ISSUED LEGAL OPINIONS |

|

|

Extended Loan Maturities |

• Permitted loan maturities up to 40 years after loan modifications. • Significantly reduced monthly payments for borrowers in need. |

|

Expanded Vehicle Fleets |

• Modernized the definition of "fleet" from two to five vehicles for member business loans. • Provided regulatory relief and expanded access to credit for small businesses and startups. |

|

Modernized Service Facilities |

• Included full-service video tellers in the definition of federal credit union service facilities. • Empowered federal credit unions to expand services in underserved areas without necessarily purchasing more brick-and-mortar branches. |

|

Changing Charters in Mergers |

• Permitted credit unions to change charters to facilitate voluntary mergers. • Retained credit union service for members of merging credit unions. |

APPENDIX III

|

Examples of Efforts to Scale Regulation and Support Small Credit Unions Rule/Program |

Description |

|

Small Credit Union Definition |

• A credit union with less than $50 million in assets is excluded from certain NCUA rules. • NCUA also must specifically consider the potential regulatory burden and alternatives for small credit union in any rulemaking. • NCUA will review the small credit union definition in 2015 and then every three years. The review will keep the definition up-to-date as the credit union system evolves. |

|

Interest Rate Risk |

• Credit unions with $50 million or less in assets are excluded. |

|

Liquidity and Contingency Funding |

• Credit unions with less than $50 million in assets must maintain a basic written liquidity policy. • Credit unions with $50 million and over in assets must establish and document a contingency funding plan. • Credit unions with $250 million and over in assets also must establish and document access to at least one contingent federal liquidity source. |

|

Voluntary Liquidations Creditor Notices |

• Federal credit unions with less than $1 million in assets are exempt. • Federal credit unions with less than $50 million in assets but more than $1 million in assets are required to place just one creditor notice. |

|

Risk-Based Capital |

• Credit unions with less than $50 million in assets are excluded under the existing risk-based net worth rule. • The revised proposed risk-based capital rule would exempt credit unions with less than $100 million in assets. |

|

One-on-One Consulting Services |

• Credit unions with less than $50 million in assets are eligible to apply for customized consulting from NCUA’s Office of Small Credit Union Initiatives. |

|

Net Worth Restoration Plans |

• Credit unions with less than $10 million in assets must receive NCUA assistance in developing net worth restoration plans, if the credit union requests. |

|

New Credit Union Support |

• Federal credit unions with less than $10 million in assets and less than 10 years in operation are eligible for NCUA consulting assistance. • Federal credit unions with less than $10 million in assets must receive NCUA assistance with business plan revisions, if the credit union requests. |

|

Generally Accepted Accounting Principles |

• Credit unions with assets under $10 million are exempted from complying with the reporting requirements of Generally Accepted Accounting Principles. |

|

Additional Small Credit Union Assistance |

• NCUA’s Office of Small Credit Union Initiatives additionally offers: partnership opportunities with other government, nonprofit, and industry leaders; resources such as white papers, guides, and manuals; and training, including webinars and videos. |

|

Audits |

• Credit unions holding between $10 million to $500 million in assets may choose one of three lower-cost alternatives for their annual financial statement audits: a balance sheet audit, a report on examination of internal control over Call Reporting, or an Audit per the Supervisory Committee Guide. |

|

Truth in Savings Act |

• Non-automated credit unions with $2 million or less in assets after subtracting any non-member deposits are exempted from the Truth in Savings Act. |

|

Operating Fees |

• Federal credit unions with less than $1 million in assets are exempted from the annual operating fee that funds federal credit union regulation. • Federal credit unions with more than $1 million in assets pay annual operating fees scaled to size. |

|

Small Credit Union Examination Program |

• Operationally sound federal credit unions with less than $10 million in assets received streamlined exams averaging 40 hours. • Operationally sound federal credit unions with assets between $10 million and $30 million receive streamlined examinations averaging 65 hours. |

|

Federally Insured, State-Chartered Credit Union Examinations |

• Federally insured, state-chartered credit unions with less than $250 million in assets are generally not subject to an annual onsite NCUA examination. |

|

Electronic Filing |

• To assist in the migration to electronic filing of quarterly Call Reports, NCUA helped manual filers obtain computers and assigned an Economic Development Specialist to work with small credit unions identified as filing manually each quarter. |

1 The term “credit union” is used throughout this testimony to refer to federally insured credit unions. NCUA does not oversee approximately 129 state-chartered, privately insured credit unions. As of December 31, 2014, federally insured credit unions represented 98 percent of all credit unions in the United States.

As a policy matter, in 2007 NCUA issued a report to Congress concluding that the federal government should be the sole provider of primary deposit insurance. Federal deposit insurance has played an important role in maintaining confidence in the financial system and the stability of our economy, and the lessons learned from failures of private deposit insurance schemes should not be forgotten. See http://www.ncua.gov/Legal/Documents/DepositInsuranceStudyReporttoCongress-Ver6-4.pdf for more details.

2 Congress established the National Credit Union Share Insurance Fund in 1970 as part of the Federal Credit Union Act (P.L. 91-468) and amended the Share Insurance Fund’s operations in 1984 (P.L. 98-369). The fund operates as a revolving fund in the U.S. Treasury under the administration of the NCUA Board for the purpose of insuring member share deposits in all federal credit unions and in qualifying state-chartered credit unions that request federal insurance. Funded by federally insured credit unions, the Share Insurance Fund is backed by the full faith and credit of the United States.

3 12 U.S.C. 1790d(f)(2).

4 Created and funded by Congress, the Community Development Revolving Loan Fund enables low-income credit unions to provide financial services and stimulate economic activities in underserved communities, as well as reach members who have limited access to basic financial services. In 2014, NCUA awarded more than $1.5 million in grants to 276 low-income designated credit unions, of which 170 were first-time awardees. Demand for these funds has consistently and significantly exceeded available appropriations.

5 The Regulatory Flexibility Act provides NCUA with the opportunity to define which credit unions fall under the law’s coverage. 5 U.S.C. 601(4).

6 This triennial review of the small credit union definition under the Regulatory Flexibility Act is in addition to NCUA’s rolling three-year review of all regulations.

7 Credit unions with less than $100 million in assets hold 10 percent of the system’s assets as of December 31, 2014.

8 See Appendix I for a breakdown of credit union performance by asset class over time.

9 See http://www.ncua.gov/Legal/Regs/Pages/Regulations.aspx.

10 12 U.S.C. 3311.

11 See http://www.ncua.gov/News/Pages/NW20150406NSPMSecondaryCapital.aspx.

12 See Appendix II for a complete list of these actions.

13 A low-income credit union is one in which a majority of its membership (50.01 percent) qualifies as low-income members. Low-income members are those members who earn 80 percent or less than the median family income for the metropolitan area where they live, or the national metropolitan area, whichever is greater. In non-metropolitan areas, the qualification threshold is a median family income at or below 80 percent of the state median family income for non-metropolitan areas, or, if greater, the national median family income for non-metropolitan areas. Under the Federal Credit Union Act, the low-income designation offers certain benefits and regulatory relief, such as an exemption from the statutory cap on member business lending, eligibility for Community Development Revolving Loan Fund grants and low-interest loans, the ability to accept deposits from non-members, and authorization to obtain supplemental capital.

14 See http://www.ncua.gov/News/Documents/SP20150309MatzGAC.pdf.

15 See http://www.ncua.gov/News/Documents/SP20150309MetsgerGAC.pdf and http://www.ncua.gov/News/Documents/SP20150310McWattersGAC.pdf, respectively.

16 NCUA has a number of regulations that address issues other than safety and soundness, such as those rules related to field of membership, the Community Development Revolving Loan Fund, payday alternative loans, the organization of federal credit unions, agency procedures, and examiner post-employment restrictions, among others.

17 The collapse of five corporate credit unions during the 2007–2009 financial crisis best illustrates this point. To date, credit unions have paid $4.8 billion in assessments and experienced $5.6 billion in losses in the form of contributed capital. These costs incurred during the financial crisis reduced credit union earnings and assets and, as a result, during that time may have decreased interest paid on share deposits, increased loan rates, and constrained credit union services for their members.

18 See Appendix III for a more complete listing of efforts to scale regulations and examinations and to provide assistance designed to address the unique circumstances of smaller credit unions.

19 As of December 31, 2014, real estate loans at credit unions with more than $50 million in assets accounted for 33.4 percent of total assets, compared to 15.9 percent at credit unions below this threshold.

20 As of December 31, 2014, credit unions with $50 million or less in assets maintained cash and short-term investment balances at 22.4 percent of total assets, compared to 13.2 percent for credit unions above this threshold.

21 Data as of December 31, 2013.

22 Same as above.

23 The reformulated risk-based capital proposal would downgrade the capital status of just 19 of 1,455 covered credit unions, based on data as of December 31, 2013. For more information about the revised risk-based based capital proposed rule, see http://www.ncua.gov/Resources/Pages/risk-based-capital-resources.aspx.

24 The CAMEL rating system is based upon an evaluation of five critical elements of a credit union’s operations: Capital adequacy, Asset quality, Management, Earnings, and Liquidity. The CAMEL rating system is designed to take into account and reflect all significant financial, operational, and management factors that examiners assess in their evaluation of a credit union’s performance and risk profile. CAMEL ratings range from 1 to 5, with 1 being the highest rating.

25 Examiners use documents of resolution to outline plans and agreements reached with credit union officials to reduce areas of unacceptable risk. An area of unacceptable risk is one for which management does not have the proper structure for identifying, measuring, monitoring, controlling, and reporting risk.

26 P.L. 113-252 and P.L. 113-251, respectively.

27 12 U.S.C. 1751 and what follows.

28 Located within the U.S. Department of the Treasury, the Community Development Financial Institutions Fund’s mission is to expand the capacity of financial institutions to provide credit, capital, and financial services to underserved populations and communities in the United States.

29 The Federal Credit Union Act presently requires an area to be underserved by other depository institutions, based on data collected by NCUA or federal banking agencies. NCUA has implemented this provision by requiring a facilities test to determine the relative availability of insured depository institutions within a certain area. Congress could instead allow NCUA to use alternative methods to evaluate whether an area is underserved to show that although a financial institution may have a presence in a community, it is not qualitatively meeting the needs of an economically distressed population.

30 12 U.S.C. 1757a.

31 See https://www.gao.gov/products/gao-04-91.

32 These services include data processing, item processors, loan servicing, ATM networks, insurance products, branch networks, student loan originations, business loan originations, mortgage loan originations, electronic transaction services, payroll processing, and credit card originations, among others.