Chairman Meeks, Ranking Member Luetkemeyer, and Members of the Subcommittee, as the Director of the National Credit Union Administration’s Office of Credit Union Resources and Expansion (CURE Office), I appreciate your invitation to testify today about the state of Minority Depository Institution (MDI) credit unions, and to provide background on the NCUA’s efforts to support these important institutions.

The NCUA’s mission is to “provide, through regulation and supervision, a safe and sound credit union system, which promotes confidence in the national system of cooperative credit.”1 This system is vital to the American economy, touching more than one-third of all U.S. households.2 In turn, the NCUA protects the safety and soundness of the credit union system by identifying, monitoring, and reducing risks to the National Credit Union Share Insurance Fund.

The agency takes seriously its paramount responsibilities to regulate and supervise approximately 5,300 federally insured credit unions with more than 118 million member-owners and more than $1.52 trillion in assets across all states and U.S. territories.3 As part of that mission, the agency has developed initiatives to make it easier for credit unions to serve their members more effectively, including members of modest means and those in underserved areas.4

The CURE Office, which I lead, is responsible for administering the MDI Preservation Program. We offer support services to foster credit union development, with a particular focus on low-income-designated credit unions and MDIs. The CURE Office is also responsible for:

- chartering and field-of-membership matters;

- grant and loan programs;

- charter conversions;

- bylaw amendments; and

- online training to credit union board members, management, and staff.

Some of the CURE Office’s programs, such as grant and loan funding, have specific eligibility requirements, while others, such as training, are open to all federally insured credit unions.

Credit unions are, by design, different from other financial institutions. They are member-owned-and-controlled, not-for-profit, cooperative entities. Their boards of directors are comprised entirely of volunteers. Their central mission is to give groups of people access to affordable financial services and the ability to participate in their institutions’ management. MDI credit unions, more particularly, serve the financial needs of racial minorities because such populations traditionally have been underserved by the financial system.

To qualify as an MDI credit union, a federally insured credit union’s percentage of current minority members, potential minority members, and minority board members must each exceed 50 percent. This requirement generally is consistent with the definition set forth in Section 308 of The Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended (FIRREA).

The NCUA appreciates the significant value MDI credit unions represent to their members and communities, as well as the challenges they face. A diverse and inclusive financial services sector provides innumerable benefits, including better service, greater innovation, improved solutions, and a larger customer or membership base. At the NCUA, we further believe that it is optimal for a financial institution’s board members, managers, senior leaders, and employees to reflect the community that it serves. Take, for example, how the following MDI credit union in the NCUA’s Western Region helped its community:

The MDI credit union is low-income-designated and its membership is largely comprised of Spanish and Portuguese speaking individuals. Management noticed that many members of the credit union’s local community were farm workers who were uncertain about the benefits of financial services and how to access them. As a result, many were unserved or underserved. The credit union introduced a youth program that has benefited this membership segment. It established a branch at a local high school with a program that features a unique curriculum involving students in work-based learning.

Three years following the program’s inception, many students trained their parents to understand and trust the credit union. As a result, membership in the credit union has increased, as has the credit union’s lending business. The credit union plans to continue its partnership with the school district and explore the possibility of expanding the program to additional high schools.

This MDI credit union is but one example of why the NCUA is committed to supporting MDI credit unions and the communities they serve.

The first part of my testimony today focuses on my personal experience working for, and with, small credit unions and MDI credit unions. Next, I will discuss the state of MDI credit unions. Finally, I will focus on the initiatives the NCUA has undertaken assist and preserve MDI credit unions.

Personal Credit Union Experience

I know firsthand the importance of credit unions and the role they play within their communities. One of my earliest experiences with credit unions was as a manager of a small, faith-based credit union in Michigan. Our credit union was located in a room of the church’s school. Members felt comfortable enough with our small credit union that they slipped cash deposits under the door leaving the money exposed until we opened the next day, or they would see us working after hours and knocked on our windows to slip in a car payment so they wouldn’t be late. We were also there for members in times of emergency when members needed access to funds outside of normal business hours. This is why these institutions exist, it is why members volunteer their time to help these credit unions continue, and it is why the NCUA is committed to helping them succeed. They provide access and resources to communities that might not otherwise be part of the financial mainstream.

Current State of MDI Credit Unions

MDI credit unions perfectly capture the challenge of operating as mission-driven institutions in today’s financial services landscape, one that is dominated by larger institutions who can so easily take advantage of economies of scale and access to resources. MDIs, in general, have to navigate the difficult path of providing intensive, consumer-focused services and education to populations that have historically been cut off from the benefits that come from being part of the financial mainstream, while at the same time dealing with the day-to-day operational challenges attendant with being a small financial institution, from attracting and keeping qualified professionals and volunteers to staying abreast of the latest changes in the law and the marketplace. By recognizing these issues, the NCUA can support the MDI mission in a way that creates value for MDI credit unions and their members.

As of June 30, 2019, there are 526 federally insured MDI credit unions, representing approximately ten percent of all federally insured credit unions. Collectively, MDI credit unions serve 3.9 million members, manage $39.6 billion in assets, have aggregate deposits of $34 billion, and hold $27.5 billion in loans. MDI credit unions tend to be smaller institutions, which by NCUA’s definition is less than $100 million in assets. In fact, 87 percent of MDIs report total assets of $100 million or less, with 58 percent of all MDI credit unions having less than $10 million in assets. These credit unions are generally located in church, factory, and even home office locations. As with the smallest of credit unions, many MDI credit unions are run and staffed by volunteers.

During 2018, MDI credit unions provided $26.8 billion in loans to the individuals and communities they serve. The loans were primarily concentrated in mortgages and vehicle loans, each comprising approximately 40 percent of aggregate loans. Sixty-seven percent of first mortgages offered by MDI credit unions were fixed-rate loans, compared with only 57 percent offered by all federally insured credit unions. Compared with the national average for federally insured credit unions, MDI credit unions provide relatively greater percentages of funding for vehicles and unsecured loans.

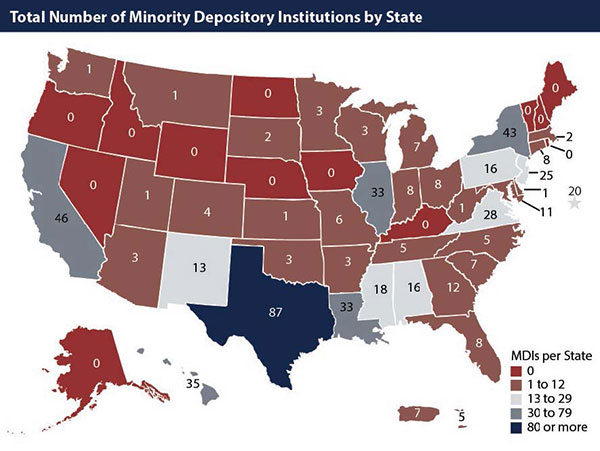

MDIs are located in 37 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands. The map below shows the geographic distribution of MDI credit unions throughout the country.5 As of December 31, 2018, the largest number of MDI credit unions are in Texas, California, New York, Hawaii, Illinois, and Louisiana, respectively.

There were 37 fewer MDI credit unions in 2018 than in 2017. The declining trend in the number of MDI credit unions mirrors the decline in the overall number of federally insured credit unions. It also reflects the challenges, noted above, encountered by small financial institutions in general.

In 2018, mergers accounted for sixty-two percent of the decrease in the number of MDI credit unions. Twenty-four percent of the continuing credit unions were MDI credit unions. In 2018, 57 percent of merging MDI credit unions said their merger reflected their desire to offer expanded services to their members, 24 percent cited poor financial condition, followed by an inability to attract leadership at 14 percent, and lack of growth at five percent.

As a group, MDI credit unions underperformed the low-income, small, and all federally insured credit union groups in all categories of growth, including assets, membership, member shares, loans, and net worth. The driving factor was the loss in membership and member shares. MDI credit unions lost almost 420,000 members, resulting in a decline of $3.1 billion in shares.

On the positive side, over the last five years, 13 new federally insured credit unions have been chartered, with a third of those self-designating as an MDI credit union. Fields of memberships for these institutions are faith-based and professionally based.

The NCUA’s MDI Preservation Program

The NCUA Board approved the MDI Preservation Program in June 2015. The final policy statement6 details the program’s objectives for preserving and encouraging MDI credit unions in accordance with the goals set forth in FIRREA. These goals are consistent with the NCUA’s mission and strategic goal of ensuring a safe, sound, and sustainable credit union system.

The NCUA’s MDI Preservation Program provides needed support to federally insured credit unions that serve communities and individuals who may lack access to mainstream financial products and services. In many cases, our examiners in the field and CURE Office staff provide ongoing assistance to MDIs by working directly with them, sharing their knowledge of the credit union system and best practices, coordinating mentor relationships between large and small credit unions, and generally acting as a knowledgeable point of contact and resource.

NCUA assists with MDI expansion plans. During 2018, NCUA approved field of membership expansions for 28 MDIs, allowing them to add more than 650 groups or geographic areas to their membership. NCUA staff understand the benefits these credit unions provide the communities in which they provide financial services.

I would like to highlight an example of the NCUA’s work with MDI credit unions:

An MDI credit union was returned to viability, generating positive earnings, after an NCUA examiner worked with management and officials to implement its strategic business plan. The plan was developed after the long-time former CEO retired. Under the prior management, the credit union was not earning enough to cover its operating expenses. After several years of losses, the credit union was faced with the possibility of merger. The examiner suggested that, among other things, the credit union seek opportunities to participate in loans with other financial institutions to improve earnings. Credit union officials implemented the plan, including pursuing loan participation opportunities.

The CURE Office provides no-cost training to MDI credit unions. In our experience, training for credit union management, board members, and staff can significantly influence an MDI credit union’s success. In the past, we have offered training in financial statement analysis, succession planning and best practices to grow your credit union. Last year, the agency updated its Learning Management Service, which provides online access to a variety of training topics helpful to MDI credit unions, such as credit union governance, operations, and products and services. Participants can sign up for courses, receive certificates of completion and keep track of their progress.

In addition to preserving existing MDIs, the NCUA is focused on increasing the number of MDI credit unions throughout the country. For example, in 2018, coinciding with Minority Enterprise Development Week, we launched a social media campaign to identify new MDI credit unions. It is important to note, however, that designation as an MDI credit union is voluntary. A credit union may qualify for the MDI designation, but may have chosen not to seek it. Unlike the low-income designation, which confers a number of benefits, such as grants, access to secondary capital, and the ability to accept non-member deposits, the MDI designation does not by itself bestow specific incentives.

In an effort to bridge this gap, earlier this year, the NCUA created a new pilot mentoring program for small, low-income credit unions that are also designated as MDIs. The MDI Mentoring Pilot is designed to encourage mentor relationships between larger low-income designated credit unions (mentors) and small low-income MDIs (mentees).

The purpose of the MDI Mentoring Pilot is to encourage strong and experienced credit unions to provide technical assistance to small MDI credit unions to increase their ability to serve minority, low-income and underserved populations. The larger credit unions will provide technical assistance, such as building staff capacity through training, improvements to credit union operations, and assistance with the modernizing processes. The NCUA will use the results of this pilot program to explore the possibility of expanding the initiative in the future.

The agency supports the creation of new and preservation existing of MDI credit unions. For example, one of the priorities of the NCUA Chairman Rodney E. Hood is to enhance and modernize the federal credit union chartering process with the goal of promoting greater financial inclusion.

The NCUA has also developed initiatives to create opportunities to promote financial education and financial inclusion, and foster an environment where those with low-to-moderate incomes, people with disabilities, and the otherwise underserved have access to affordable financial services.

Today, one of the many ways that credit unions fulfill their mission is through offering payday alternative loans or PALs loans. While many credit unions offer some type of safer small-dollar loan product to their members, in 2010, the NCUA began authorizing a unique PALs program for federal credit unions. These PALs loans have fewer fees and are offered at low rates capped at 28 percent – which is nothing close to the triple-digit rates charged by online and storefront payday lenders. Furthermore, as member-owned, not-for-profit financial cooperatives, credit unions play a key role in investing in their members’ financial futures. They provide access to financial education, the possibility of establishing savings, and other services to ensure their members are on a pathway to financial stability. In fact, over 80 percent of federal credit unions offering PALs loans report their members’ payments to credit bureaus – a critical step towards borrowers building credit increasing access to mainstream financial services and breaking the cycle of debt.

As of the end of 2018, 502 federal credit unions reported that they made PALs loans during the year. These credit unions reported making 211,574 loans amounting to $145.2 million in PALs during the year. In comparison, in 2012, 476 federal credit unions reported that they made 115,809 loans amounting to $72.6 million of lending during the year.

Earlier this year, the NCUA Board expanded the PALs program to give federal credit unions additional flexibility to offer their members meaningful alternatives to traditional payday loans while maintaining many of the key structural safeguards of the original PALs program.

Small credit unions, low-income designated credit unions, and MDI credit unions all play a critical role in providing affordable financial services to millions of Americans. Often, these credit unions are the only federally insured financial institutions in underserved and rural communities.

The NCUA is committed to doing everything it can to help MDI credit unions continue, grow, and thrive. As you consider further legislative initiatives to provide new avenues for financial institutions to grow and enhance their services, please keep in mind the unique structure of credit unions. Oftentimes, legislation may be drafted with larger, shareholder-owned financial institutions in mind and can pose a challenge for credit unions, which are generally much smaller institutions, and, by design, structured as non-profit, member-owned cooperatives with a different statutory and regulatory framework than that of the banking regulators.

As always, the NCUA would be happy to work with you on any future legislative initiatives.

Thank you for the opportunity to provide an update on MDI credit unions and to discuss the NCUA’s work in this area.

I look forward to your questions.

1 See NCUA Mission and Vision, https://www.ncua.gov/about-ncua/mission-values.

2 NCUA calculations using the Federal Reserve’s Survey of Consumer Finances, 2016.

3 Based on June 30, 2019 Call Report Data.

4 Serving the Underserved, National Credit Union Administration, https://www.ncua.gov/support-services/credit-union-resources-expansion/field-membership-expansion/serving-underserved. The Federal Credit Union Act specifies that this national system is intended to meet “the credit and savings needs of consumers, especially persons of modest means.” Credit Union Membership Access Act, Pub. L. No. 105-219, § 2(4), 112 Stat. 913, 914 (1998).

5 The star represents the District of Columbia.

6 The NCUA Final Interpretive Ruling and Policy Statement 13-1, Minority Depository Institution Preservation Program, available at https://www.ncua.gov/files/publications/interpretive-rulings-policy-statements/IRPS2013-1.pdf.