December 19, 2016

The Financial Accounting Standards Board (FASB) issued a new accounting standard, Accounting Standards Update (ASU) No. 2016-13, Topic 326, Financial Instruments – Credit Losses, on June 16, 2016. The new accounting standard introduces the current expected credit losses methodology (CECL) for estimating allowances for credit losses.

The Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC) (hereafter, the agencies) issued a Joint Statement on June 17, 2016, summarizing key elements of the new accounting standard and providing initial supervisory views with respect to measurement methods, use of vendors, portfolio segmentation, data needs, qualitative adjustments, and allowance processes.

The agencies have developed these frequently asked questions (FAQ) to assist institutions and examiners. The agencies plan to publish additional FAQs and/or update existing FAQs periodically.1

The new accounting standard applies to all banks, savings associations, credit unions, and financial institution holding companies (hereafter, institutions), regardless of size, that file regulatory reports for which the reporting requirements conform to U.S. generally accepted accounting principles (GAAP).

Further, ASU 2016-13 applies to all financial instruments carried at amortized cost (including loans held for investment (HFI), net investment in leases, held-to-maturity (HTM) debt securities, as well as trade and reinsurance receivables and receivables that relate to repurchase agreements and securities lending agreements) and off-balance-sheet credit exposures not accounted for as insurance, including loan commitments, standby letters of credit, and financial guarantees. The new accounting standard does not apply to trading assets, loans held for sale, financial assets for which the fair value option has been elected, or loans and receivables between entities under common control. While there are differences between CECL and current U.S. GAAP, the agencies expect the new accounting standard will be scalable to institutions of all sizes. However, inputs to allowance estimation methods will need to change to properly implement CECL.

The new accounting standard also makes targeted improvements to the accounting for credit losses on available-for-sale (AFS) debt securities, including lending arrangements that meet the definition of debt securities under U.S. GAAP and are classified as AFS.

Until the new standard becomes effective, institutions must continue to follow current U.S. GAAP on impairment and the allowance for loan and lease losses (ALLL) along with the related supervisory guidance on the ALLL.

1. Why is the FASB changing the existing incurred loss methodology?

In the period leading up to the global economic crisis, institutions and financial statement users expressed concern that current U.S. GAAP restricts the ability to record credit losses that are expected, but that do not yet meet the “probable” threshold. After the crisis, various stakeholders requested that accounting standard-setters2 work to enhance standards on loan loss provisioning to incorporate forward-looking information. Standard-setters concluded that the existing approach for determining the impairment of financial assets, based on a “probable” threshold and an “incurred” notion, delayed the recognition of credit losses on loans and resulted in loan loss allowances that were “too little, too late.”

2. What are some of the concerns the FASB is addressing with CECL?

By issuing CECL, the FASB:

- Removed the “probable” threshold and the “incurred” notion as triggers for credit loss recognition and instead adopted a standard that states that financial instruments carried at amortized cost should reflect the net amount expected to be collected.

- Broadened the range of data that is incorporated into the measurement of credit losses to include forward-looking information, such as reasonable and supportable forecasts, in assessing the collectability of financial assets.

- Introduced a single measurement objective for all financial assets carried at amortized cost.

3. What does the new accounting standard change in existing U.S. GAAP?

Introduction of a new credit loss methodology.3

The new accounting standard developed by the FASB has been designed to replace the existing incurred loss methodology in U.S. GAAP. Under CECL, the allowance for credit losses is an estimate of the expected credit losses on financial assets measured at amortized cost, which is measured using relevant information about past events, including historical credit loss experience on financial assets with similar risk characteristics, current conditions, and reasonable and supportable forecasts that affect the collectability of the remaining cash flows over the contractual term of the financial assets.4 In concept, an allowance will be created upon the origination or acquisition of a financial asset measured at amortized cost. The allowance will then be updated at subsequent reporting dates. The allowance for credit losses under CECL is a valuation account, measured as the difference between the financial assets’ amortized cost basis and the amount expected to be collected on the financial assets (i.e., lifetime credit losses).5

Earlier recognition of credit losses

Today’s incurred loss methodology is based on a “probable” threshold and an “incurred” notion, the effect of which is to delay the recognition of credit losses on loans, and thereby resulting in allowances that are “too little, too late.” By removing the “probable” threshold and the “incurred” notion, CECL eliminates the triggers used for recognizing credit losses under existing U.S. GAAP. Under CECL, the total amount of net chargeoffs on financial assets does not change, but rather the timing of credit loss provision expenses changes.

Although the measurement of credit loss allowances is changing under CECL, the FASB’s new accounting standard does not address when a financial asset should be placed in nonaccrual status. In addition, the FASB retained the existing write-off guidance in U.S. GAAP, which requires an institution to write off a financial asset in the period the asset is deemed uncollectible.

Leverage of existing credit risk management practices.

Similar to today’s practices under the incurred loss methodology, management will continue to incorporate qualitative and quantitative factors, including information related to underwriting practices, when estimating allowances for credit losses under CECL. However, better alignment of allowance estimation practices with existing credit risk assessment and risk management practices is likely, as the new accounting standard allows a financial institution to leverage its current internal credit risk systems as a framework for estimating expected credit losses.

Forward-looking information.

CECL is forward-looking and broadens the range of data that must be considered in the estimation of credit losses. More specifically, CECL requires consideration of not only past events and current conditions, but also reasonable and supportable forecasts that affect expected collectability. Institutions must revert to historical credit loss experience for those periods of the contractual term of financial assets beyond which the institution is able to make or obtain reasonable and supportable forecasts of expected credit losses.

Reduction in the number of credit impairment models.

Impairment measurement under existing U.S. GAAP has often been considered complex because it encompasses five credit impairment models for different financial assets. 6 In contrast, CECL introduces a single measurement objective to be applied to all financial assets carried at amortized cost, including loans HFI and HTM debt securities. That said, CECL does not specify a single method for measuring expected credit losses; rather, it allows any reasonable approach, as long as the estimate of expected credit losses achieves the objective of the FASB’s new accounting standard. Under today’s incurred loss methodology, institutions use various methods, including historical loss rate methods, roll-rate methods, and discounted cash flow methods, to estimate credit losses. CECL allows the continued use of these methods; however, certain changes to these methods will need to be made in order to estimate lifetime expected credit losses.

Purchased credit-deteriorated financial assets.

CECL introduces the concept of purchased credit-deteriorated (PCD) financial assets, which replaces purchased credit-impaired (PCI) assets under existing U.S. GAAP. The differences in the PCD criteria compared to today’s PCI criteria will result in more purchased loans HFI, HTM debt securities, and AFS debt securities being accounted for as PCD financial assets. In contrast to today’s accounting for PCI assets, the new standard requires the estimate of expected credit losses embedded in the purchase price of PCD assets to be estimated and separately recognized as an allowance as of the date of acquisition. This is accomplished by grossing up the purchase price by the amount of expected credit losses at acquisition, rather than being reported as a credit loss expense.

AFS debt securities.

The new accounting standard also modifies today’s accounting for impairment on AFS debt securities. Under this new standard, institutions will recognize a credit loss on an AFS debt security through an allowance for credit losses, rather than a direct write-down as is required by current U.S. GAAP. The recognized credit loss is limited to the amount by which the amortized cost of the security exceeds fair value. A write-down of an AFS debt security’s amortized cost basis to fair value, with any incremental impairment reported in earnings, would be required only if the fair value of an AFS debt security is less than its amortized cost basis and either (1) the institution intends to sell the debt security, or (2) it is more likely than not that the institution will be required to sell the security before recovery of its amortized cost basis.

Vintage disclosures by public business entities (PBE) in U.S. GAAP financial statements.

Under the new accounting standard, disclosures of credit quality indicators of financing receivables and net investment in leases, such as loan-to-value ratios, credit scores, and risk ratings, need to be disaggregated by vintage (i.e., year of origination) to provide users of financial statements greater transparency regarding the credit quality trends within the portfolio from period to period. This information can be used to better understand and evaluate management’s prior and current estimates of credit losses.7

For PBEs,8 the disaggregation of credit quality indicators by vintage is required for a minimum of five annual reporting periods, with the balance for financing receivables and net investment in leases originated before the fifth annual reporting period shown in the aggregate. For example, assume an institution is preparing disclosures for the year ended December 31, 2020. The vintage-based disclosure should include information for financing receivables and net investment in leases originated during 2020, 2019, 2018, 2017, 2016, and prior to 2016. The standard provides transition relief for PBEs that are not U.S. Securities and Exchange Commission (SEC) filers.9 Institutions that are not PBEs have the option to make the vintage disclosures in their U.S. GAAP financial statements, but are not required to do so.

4. When does the new accounting standard take effect?10

The FASB issued the final standard on June 16, 2016, and set three different effective dates. The effective date applicable to an institution depends on the institution’s characteristics.

For a PBE that is an SEC filer, as both terms are defined in U.S. GAAP, the new credit losses standard is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Thus, for an SEC filer that has a calendar year fiscal year, the standard is effective January 1, 2020, and it must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for the quarter ended March 31, 2020. An SEC filer is an entity that is required to file its financial statements with the SEC under the federal securities laws or, for an insured depository institution, the appropriate federal banking agency under section 12(i) of the Securities Exchange Act of 1934.

For a PBE that is not an SEC filer, the credit losses standard is effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. Thus, for a PBE that is not an SEC filer and has a calendar year fiscal year, the standard is effective January 1, 2021, and the entity must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for the quarter ended March 31, 2021. A PBE that is not an SEC filer includes (1) an entity that has issued debt or equity securities that are traded, listed, or quoted on an over-the-counter market, or (2) an entity that has issued one or more securities that are not subject to contractual restrictions on transfer and is required by law, contract, or regulation to prepare U.S. GAAP financial statements11 and make them publicly available periodically (e.g., pursuant to section 36 of the Federal Deposit Insurance Act and Part 363 of the FDIC’s regulations).

For an entity that is not a PBE, the credit losses standard is effective for fiscal years beginning after December 15, 2020, and for interim period financial statements for fiscal years beginning after December 15, 2021. Thus, an entity with a calendar year fiscal year that is not a PBE must first apply the new credit losses standard in its financial statements and regulatory reports (e.g., the Call Report) for December 31, 2021. However, such an institution would include the CECL provision for expected credit losses for the entire year ended December 31, 2021, in the income statement in its financial statements and regulatory reports for year-end 2021.

Early application of the new credit losses standard will be permitted for all institutions for fiscal years beginning after December 15, 2018, including interim periods within those fiscal years.

The following table provides a summary of the effective dates. * represents institutions with calendar year ends below.

| Type | U.S. GAAP Effective Date | Regulatory Report Effective Date* |

|---|---|---|

| PBEs That Are SEC Filers | Fiscal years beginning after 12/15/2019, including interim periods within those fiscal years | 3/31/2020 |

| Other PBEs (Non-SEC Filers) | Fiscal years beginning after 12/15/2020, including interim periods within those fiscal years | 3/31/2021 |

| Non-PBEs | Fiscal years beginning after 12/15/2020, and interim periods for fiscal years beginning after 12/15/2021 | 12/31/2021 |

| Early Application | Early application permitted for fiscal years beginning after 12/15/2018, including interim periods within those fiscal years | N/A |

5. How should an institution apply the new accounting standard upon initial adoption?

As of the new accounting standard’s effective date, institutions will apply the standard based on the characteristics of financial assets as follows:12

Financial assets carried at amortized cost (e.g., loans HFI and HTM debt securities) that are not PCD assets:

A cumulative-effect adjustment for the changes in the allowances for credit losses will be recognized in retained earnings on the statement of financial position (balance sheet) as of the beginning of the first reporting period in which the new standard is adopted.

Purchased credit-deteriorated assets:

Financial assets classified as PCI assets prior to the effective date of the new standard will be classified as PCD assets as of the effective date. For all assets designated as PCD assets as of the effective date, an institution will be required to gross up the balance sheet amount of the financial asset by the amount of its allowance for expected credit losses as of the effective date. Subsequent changes in the allowances for credit losses on PCD assets will be recognized by charges or credits to earnings. The institution will continue to accrete the noncredit discount or premium to interest income based on the effective interest rate on the PCD assets determined after the gross-up for the CECL allowance at adoption.

AFS and HTM debt securities:

A debt security on which other-than-temporary impairment had been recognized prior to the effective date of the new standard will transition to the new guidance prospectively (i.e., with no change in the amortized cost basis of the security). The effective interest rate on such a debt security before the adoption date will be retained and locked in. Amounts previously recognized in accumulated other comprehensive income (OCI) related to cash flow improvements will continue to be accreted to interest income over the remaining life of the debt security on a level-yield basis. Recoveries of amounts previously written off relating to improvements in cash flows after the date of adoption will be recognized in income in the period received.

6. Does the new accounting standard apply to all institutions?

The new accounting standard applies to all banks, savings associations, credit unions, and financial institution holding companies, both public and private, regardless of size, that file regulatory reports for which the reporting requirements conform to U.S. GAAP.

7. What are some acceptable methods for estimating allowance levels under CECL?

CECL does not prescribe the use of specific estimation methods.13 Rather, allowances for credit losses may be determined using various methods that reasonably estimate the expected collectability of financial assets and are applied consistently over time. For example, acceptable methods include loss rate, roll-rate, vintage analysis, discounted cash flow, and probability of default/loss given default methods. Neither a vintage nor a discounted cash flow method is required for estimating expected credit losses. Additionally, an institution may apply different estimation methods to different groups of financial assets. To properly apply an acceptable estimation method, an institution’s credit loss estimates must be well supported.

However, inputs will need to change in order to achieve an appropriate estimate of expected credit losses. For instance, the inputs to a loss rate method would need to reflect expected losses over the contractual term, rather than the annual loss rates commonly used under the existing incurred loss methodology. In addition, institutions would need to consider how to adjust historical loss experience not only for current conditions, as is required under the existing incurred loss methodology, but also for reasonable and supportable forecasts that affect the expected collectability of financial assets. Nevertheless, taking these factors into account, the agencies expect that smaller and less complex institutions will be able to adjust their existing allowance methods to meet the requirements of the new accounting standard without the use of costly and/or complex modeling techniques.

CECL allows institutions to apply judgment in developing estimation methods that are appropriate and practical for their circumstances. The agencies expect supervised institutions to make good faith efforts to implement the new accounting standard in a sound and reasonable manner. After the effective date of CECL, the agencies will assess the implementation of the accounting standard and consider the need to issue additional supervisory guidance to aid in the development of practices for the sound application of the standard.

8. How should institutions segment held-for-investment loan and HTM debt security portfolios under CECL?

CECL requires institutions to measure expected credit losses on financial assets carried at amortized cost on a collective or pool basis when similar risk characteristics exist. Similar risk characteristics may include one or a combination of the following:14

- Internal or external (third-party) credit scores or credit ratings;

- Risk ratings or classifications;

- Financial asset type;

- Collateral type;

- Asset size;

- Effective interest rate;

- Term;

- Geographical location;

- Industry of the borrower;

- Vintage;

- Historical or expected credit loss patterns; and

- Reasonable and supportable forecast periods.

Although the new accounting standard provides examples of similar risk characteristics, smaller and less complex institutions may conclude that the segmentation practices they have used under the incurred loss methodology are also appropriate under the expected loss methodology, or they may refine those practices. In addition, institutions will need to determine how to segment their HTM debt securities portfolios.

If a financial asset does not share risk characteristics with other financial assets, the new accounting standard requires the expected credit losses on that asset to be measured on an individual asset basis. As under the incurred loss methodology, financial assets on which expected credit losses are measured on an individual basis should not also be included in a collective assessment of expected credit losses.

9. Will there be an allowance for credit losses on off-balance-sheet credit exposures under CECL?15

For off-balance-sheet credit exposures, an institution will estimate expected credit losses over the contractual period in which they are exposed to credit risk. Similar to today’s practices, an institution will report in net income as an expense the amount necessary to adjust the allowance for credit losses on off-balance-sheet credit exposures, which is reported as a liability, for management’s current estimate of expected credit losses on these exposures. For the period of exposure, the estimate of expected credit losses should consider both the likelihood that funding will occur and the amount expected to be funded over the estimated remaining life of the commitment or other off-balance-sheet exposure.

In contrast, the FASB decided that no credit losses should be recognized for off-balance-sheet credit exposures that are unconditionally cancellable by the issuer. To illustrate, Bank A has a significant credit card portfolio, including funded balances on existing cards and unfunded commitments (i.e., available credit) on credit cards. Bank A’s cardholder agreements stipulate that the available credit may be unconditionally cancelled at any time. When determining the allowance for expected credit losses, Bank A estimates the expected credit losses over the estimated remaining lives of the funded credit card loans. However, Bank A would not evaluate or record an allowance for unfunded commitments on credit cards because it has the ability to unconditionally cancel the available lines of credit.

10. How will CECL affect the HTM debt securities portfolio?

CECL applies to HTM securities since they are carried at amortized cost and are within the scope of the standard. Therefore, in contrast to today’s accounting, institutions generally will need to establish allowances for credit losses on their HTM debt securities as of the date they adopt CECL and maintain such allowances thereafter. Because CECL requires institutions to measure expected credit losses on a collective or pool basis when similar risk characteristics exist, HTM securities that share similar risk characteristics will need to be collectively assessed for credit losses.

11. Does the accounting for credit losses on AFS debt securities change under the new accounting standard?16

Yes. The new accounting standard makes targeted improvements to the accounting for credit losses on AFS debt securities. Under this standard, institutions will record credit losses on AFS debt securities through an allowance for credit losses rather than the current practice of write-downs of individual securities for other-than-temporary impairment.

Similar to today, at each reporting date, an institution must determine whether a decline in the fair value of an individual AFS debt security below its amortized cost basis is the result of credit factors or other factors.

Other targeted improvements to the existing impairment methodology for AFS debt securities include:

- Limiting allowances for credit losses on individual AFS debt securities to the excess of the amortized cost basis over fair value; and

- Permitting the reversal of allowance amounts in current period earnings to the extent that expected cash flows improve.

When evaluating whether a credit loss exists on an individual AFS debt security that is impaired, an entity would not be permitted to ignore whether credit losses exist simply because fair value has been less than amortized cost for only a limited period of time.

Finally, the AFS debt security impairment methodology retains today’s “intend to sell” and “more-likely-than-not required to sell” guidance that requires a write-down to fair value through earnings.

| Current U.S. GAAP | New Accounting Standard |

|---|---|

| Credit losses recognized through a direct write-down of the amortized cost basis. | Allowance approach. |

| Credit losses can exceed total unrealized losses. | Fair value floor for credit losses. |

| No immediate reversals of previously recognized credit losses. | Allows immediate full or partial reversals of previously recognized credit losses, as appropriate. |

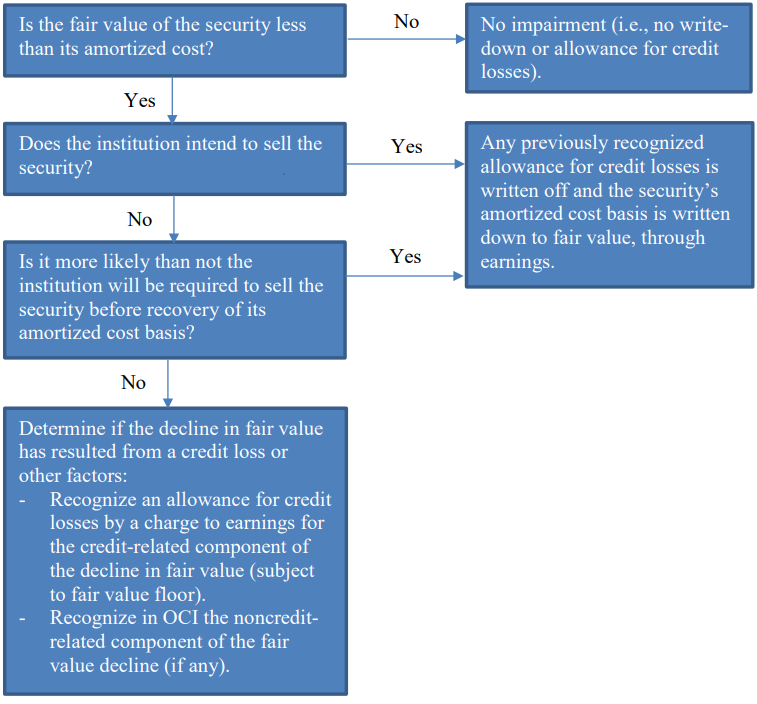

The AFS impairment methodology is summarized in the following diagram:

- Is the fair value of the security less than its amortized cost?

- If no, then no impairment (i.e., no write-down or allowance for credit losses).

- If yes, does the institution intend to sell the security?

- If yes, then any previously recognized allowance for credit losses is written off and the security’s amortized cost basis is written down to fair value, through earnings.

- If no, is it more likely than not the institution will be required to sell the security before recovery of its amortized cost basis?

- If yes, then any previously recognized allowance for credit losses is written off and the security’s amortized cost basis is written down to fair value, through earnings.

- If no, then determine if the decline in fair value has resulted from a credit loss or other factors:

- Recognize an allowance for credit losses by a charge to earnings for the credit-related component of the decline in fair value (subject to fair value floor).

- Recognize in OCI the non-credit-related component of the fair value decline (if any).

12. Is there a difference between the AFS methodology and CECL under the new accounting standard?

Yes. CECL requires an institution to measure expected credit losses upon the initial recognition of financial assets carried at amortized cost (e.g., loans HFI and HTM securities) and perform the credit loss assessment on such assets on a collective (pool) basis when similar risk characteristic(s) exist. In contrast, for AFS debt securities, the new accounting standard maintains the current requirement to assess credit losses at the individual security level only when the amortized cost of an AFS debt security exceeds fair value.17 In addition, AFS impairment is required to be measured using a discounted cash flow approach, whereas CECL does not specify a measurement approach.

13. Will the accounting for a troubled debt restructuring (TDR) change?

Yes. Although the guidance for determining whether a modification of terms on a financial asset is a TDR will remain unchanged from today’s U.S. GAAP, the new standard makes certain changes to the existing accounting for TDRs. An institution will continue to account for a modification as a TDR if the institution for economic or legal reasons related to a borrower’s financial difficulties grants a concession to the borrower that it would not otherwise consider. However, the FASB determined that credit losses on TDRs should be calculated under the same expected credit loss methodology that is applied to other financial assets carried at amortized cost – in other words, under CECL. This is in contrast to current guidance, which requires that impairment on loans that are TDRs be measured using specific methods applicable to individually impaired loans (e.g., discounted cash flow and fair value of collateral).

Further, the new accounting standard requires:

- The value of concessions made by the creditor in a TDR to be incorporated into the allowance estimate; and

- The pre-modification effective interest rate to be used to measure credit losses on a TDR when applying the discounted cash flow method.

14. How should institutions account for PCD financial assets under CECL?

CECL introduces the concept of PCD financial assets, which replaces PCI assets under existing U.S. GAAP. For PCD assets, the new accounting standard requires institutions to estimate and record an allowance for credit losses for these assets at the time of purchase. This allowance is then added to the purchase price to establish the initial amortized cost basis of the PCD assets, rather than being reported as a credit loss expense. In contrast, for purchased financial assets within the scope of CECL that are not PCD assets, an institution is required to measure expected credit losses by a charge to the provision for credit losses (expense) in the period the non-PCD assets are acquired.

In addition, the definition of PCD assets is broader than the definition of PCI assets in current accounting standards. The new accounting standard defines “purchased financial assets with credit deterioration” as “acquired individual financial assets (or acquired groups of financial assets with similar risk characteristics) that, as of the date of acquisition, have experienced a more-than-insignificant deterioration in credit quality since origination, as determined by an acquirer’s assessment.”18

In practical terms, loans HFI, HTM debt securities, and AFS debt securities that qualify as PCD will reflect an allowance for credit losses and a noncredit discount (or premium) for the difference between the asset’s par value (unpaid principal balance) and purchase price as of the acquisition date. This is accomplished by grossing up the purchase price by the amount of expected credit losses at acquisition. This method is less complex and more transparent compared with the requirements of today’s PCI model, and creates comparability of allowances for credit losses with non-PCD purchased and originated loans and non-PCD debt securities.

For example, assume that Bank A pays $750,000 for a loan with an unpaid principal balance of $1 million.19 The loan will be HFI and measured on an amortized cost basis. At the time of purchase, Bank A estimates the allowance for credit losses on the unpaid principal balance to be $175,000.

At the purchase date, Bank A’s statement of financial position would reflect an amortized cost basis for the loan of $925,000 (that is, the amount paid plus the allowance for credit losses) and an initial allowance for credit losses of $175,000 associated with the loan.

The difference between the unpaid principal balance of $1 million and the amortized cost of $925,000 at the acquisition date is a noncredit discount. This $75,000 noncredit discount would be accreted into interest income over the life of the financial asset on a level-yield basis (provided the loan appropriately remains on accrual status). The allowance for credit losses is evaluated each quarter and adjusted as necessary by a charge or credit to the provision for credit losses.

| Account | Debit | Credit |

|---|---|---|

| Loan (HFI) – Unpaid principal balance | $1,000,000 | N/A |

| Loan (HFI) – Noncredit discount | N/A | $75,000 |

| Allowance for credit losses | N/A | $175,000 |

| Cash | N/A | $750,000 |

When accounting for PCD financial assets under CECL, other changes from today’s practices include:

- An entity must allocate the noncredit discount or premium resulting from the acquisition of a pool of PCD financial assets to each individual asset in the pool;

- When using a method to estimate the allowance for credit losses that discounts expected future cash flows, the discount rate used is the rate that equates the purchase price of the PCD asset with the present value of the estimated future cash flows at the acquisition date; and

- When using a method to estimate the allowance for credit losses other than one that discounts expected future cash flows, the allowance estimate is based on the unpaid principal balance (face or par value) of the PCD asset.

15. Has the “collateral-dependent” definition changed in the new accounting standard?

Yes. The “collateral-dependent” definition has been altered slightly. The new accounting standard defines a collateral-dependent financial asset as “a financial asset for which the repayment is expected to be provided substantially through the operation or sale of the collateral when the borrower is experiencing financial difficulty based on the entity’s assessment as of the reporting date.”20

The standard allows institutions to use, as a practical expedient, the fair value of the collateral to measure expected credit losses on collateral-dependent financial assets.

Similar to existing U.S. GAAP, if an institution uses the practical expedient on a collateral-dependent financial asset and repayment or satisfaction of the asset depends on the sale of the collateral, the fair value of the collateral should be adjusted for estimated costs to sell (on a discounted basis). However, the institution would not need to incorporate in the net carrying amount of the financial asset the estimated costs to sell the collateral if repayment or satisfaction of the financial asset depends only on the operation, rather than on the sale, of the collateral.

Example 6 in ASU 2016-13 illustrates one way to implement the collateral-dependent concepts.21 The example below is based on Example 6 in the standard. Assume that:

- Bank F provides commercial real estate loans to developers of luxury apartment buildings. Each loan is secured by a respective luxury apartment building. Over the past two years, comparable standalone luxury housing prices have dropped significantly, while luxury apartment communities have experienced an increase in vacancy rates.

- At the end of 20X7, Bank F reviews its commercial real estate loan to Developer G and observes that Developer G is experiencing financial difficulty as a result of, among other things, decreasing rental rates and increasing vacancy rates in its apartment building.

- After analyzing Developer G’s financial condition and the operating statements for the apartment building, Bank F believes that it is unlikely Developer G will be able to repay the loan at maturity in 20X9. Therefore, Bank F believes that repayment of the loan is expected to be substantially through the foreclosure and sale (rather than the operation) of the collateral.

- As a result, in its financial statements for the period ended December 31, 20X7, Bank F utilizes the [collateral-dependent] practical expedient and uses the apartment building’s fair value, less costs to sell, when developing its estimate of expected credit losses.

16. Should institutions use third-party vendors to assist in measuring expected credit losses under CECL?

The agencies will not require institutions to engage third-party service providers to assist management in calculating allowances for credit losses under CECL. If an institution chooses to use a third-party service provider to assist management with this process, the institution should follow the agencies’ guidance on third-party service providers.22

Specifically with regard to data, to implement CECL, an institution should collect and maintain relevant data to support its estimates of lifetime expected credit losses in a way that aligns with the method or methods it will use to estimate its allowances for credit losses. As such, the agencies encourage institutions to discuss the availability of historical loss data internally and with their core loan service providers because system changes related to the collection and retention of data may be warranted. Depending on the estimation method or methods selected, institutions may need to capture additional data and retain data longer than they have in the past on loans that have been paid off or charged off to implement CECL.

17. Will the agencies establish benchmarks or floors for allowance levels?

No. At the time of adoption, the actual impact of CECL on an institution’s allowance levels will depend on many factors. These factors include current and future expected economic conditions, the level of an institution’s allowance balances, its portfolio mix, its underwriting practices, and its geographic locations and those of its borrowers. Because allowance levels depend on these institution-specific factors, the agencies cannot reasonably forecast the expected change in allowance levels across all institutions. For similar reasons, the agencies will not establish benchmark targets or ranges of allowance levels upon adoption of CECL or for allowance levels going forward.

18. Will adoption of the new accounting standard impact U.S. GAAP equity and regulatory capital?

Yes. Upon initial adoption, the earlier recognition of credit losses under CECL will likely increase allowance levels and lower the retained earnings component of equity, thereby lowering common equity tier 1 capital for regulatory capital purposes.23

However, the actual effect of CECL upon implementation will vary by institution and depend on many factors, such as those identified in the response to question 17, and the effect of these factors on the collectability of an institution’s held-for-investment loans and HTM debt securities upon adoption.

The agencies will monitor changes to institutions’ regulatory capital due to the adoption of the expected credit loss methodology.

19. Can institutions build their allowance levels in anticipation of adopting CECL?

No. Institutions must continue to use the existing U.S. GAAP incurred loss methodology until CECL becomes effective. It is not appropriate to begin increasing allowance levels beyond those appropriate under existing U.S. GAAP in advance of CECL’s effective date.

When estimating allowance levels before CECL’s effective date, the implementation of the CECL methodology is a future event. It is therefore inappropriate to treat CECL as a basis for qualitatively adjusting allowances measured under the existing incurred loss methodology.

20. How will the agencies coordinate their efforts to address the implementation of CECL?

Recognizing the operational impact CECL may have, particularly for smaller and less complex institutions, the agencies are working together to ensure consistent and timely communications, training, and supervisory guidance.

The agencies will develop supervisory guidance to clarify expectations, but will not provide an approved formula or mandate a single approach that institutions must follow when applying CECL.

The agencies’ accounting policy staffs are cataloguing current policy statements, examination materials, reporting forms and instructions, and training programs to determine the revisions needed in response to CECL.

21. Will the agencies provide support to institutions?

Yes. The agencies are performing ongoing outreach to the industry and other stakeholders to understand potential implementation issues and communicate supervisory views. The agencies will use this information to determine the nature and extent of support and other assistance needed.

The agencies issued a Joint Statement on June 17, 2016, summarizing key elements of the new accounting standard and providing initial supervisory views with respect to measurement methods, use of vendors, portfolio segmentation, data needs, qualitative adjustments, and allowance processes.

The agencies have developed these FAQs to assist institutions and examiners. The agencies plan to publish additional FAQs and/or update existing FAQs periodically.

22. What should institutions do to prepare for the implementation of CECL?

To plan and prepare for the transition to and implementation of the new accounting standard, each institution is encouraged to:

- Become familiar with the new accounting standard and educate the board of directors and appropriate institution staff about CECL and how it differs from the incurred loss methodology;

- Determine the applicable effective date of the standard based on the PBE criteria in U.S. GAAP;

- Determine the steps and timing needed to implement the new accounting standard;

- Identify the functional areas within the institution that should participate in the implementation of the new standard;

- Discuss the new accounting standard with the board of directors, audit committee, industry peers, external auditors,24 and supervisory agencies to determine how to best implement the new standard in a manner appropriate for the institution’s size and the nature, scope, and risk of its lending and debt securities investment activities;

- Review existing allowance and credit risk management practices to identify processes that can be leveraged when applying the new standard;

- Determine the allowance estimation method or methods to be used;

- Identify currently available data that should be maintained, data needs, and necessary system changes to implement the new accounting standard consistent with the new standard’s requirements, the allowance estimation method or methods to be used, and supervisory expectations;

- Consider whether any additional data may need to be collected or maintained to implement CECL. Examples of types of data that may be needed to implement CECL include: origination and maturity dates, origination par amount, initial and subsequent charge-off amounts and dates, and recovery amounts and dates by loan; and cumulative loss amounts for loans with similar risk characteristics;25 and

- Evaluate and plan for the potential impact of the new accounting standard on regulatory capital.

CECL is scalable to institutions of all sizes and the agencies expect most smaller and less complex institutions will not need to adopt complex modeling techniques to implement the new standard.

23. What should institutions expect from their examination teams prior to the effective date of the new accounting standard?

During the early part of the implementation phase for the new accounting standard, examiners may begin discussing the status of an institution’s implementation efforts.26 Throughout the implementation phase, examiners will tailor their expectations based on the size and complexity of the institution and the effective date of the new accounting standard applicable to the institution. In doing so, examiners will be mindful of the scope and scale of changes necessary for each institution to make a good faith effort to achieve a sound and reasonable implementation of the new accounting standard. For further information on planning and preparing for the new accounting standard, including examples of initial implementation efforts, refer to the response to question 22.

Until CECL’s effective date, the agencies will continue to examine credit loss estimates and allowance balances using examination procedures applicable to ensuring compliance with an incurred credit loss methodology consistent with existing U.S. GAAP, the guidance in the December 2006 Interagency Policy Statement on the Allowance for Loan and Lease Losses, and the agencies’ policy statements on allowance methodologies and documentation.27

Footnotes

1 The focus of the FAQs is on the application of CECL and related supervisory expectations.

2 Collectively, the FASB and the International Accounting Standards Board.

3 A complete copy of ASU 2016-13 is available here.

4 When determining the contractual term of a financial asset, an entity should consider expected prepayments but not expected extensions, renewals, or modifications, unless the entity reasonably expects it will execute a troubled debt restructuring with a borrower. Refer to Accounting Standards Codification (ASC) 326-20-30-6 in ASU 2016-13.

5 Refer to ASC 326-20-30-1 for the description of this valuation account.

6 Current U.S. GAAP includes five different credit impairment models for instruments within the scope of CECL: ASC Subtopic 310-10, Receivables-Overall; ASC Subtopic 450-20, Contingencies-Loss Contingencies; ASC Subtopic 310-30, Receivables-Loans and Debt Securities Acquired with Deteriorated Credit Quality; ASC Subtopic 320-10, Investments-Debt and Equity Securities - Overall; and ASC Subtopic 325-40, Investments-Other-Beneficial Interests in Securitized Financial Assets.

7 Refer to ASC 326-20-50-6 for more information on vintage-based disclosures and ASC 326-20-55-79 for Example 15: Disclosing Credit Quality Indicators of Financing Receivables by Amortized Cost Basis.

8 For information on the meaning of PBEs, as well as PBEs that are not SEC filers, refer to the response to question 4.

9 For PBEs that are not SEC filers, the FASB allows a “phase-in” approach. This option permits such entities to start with a three-year vintage disclosure and then phase in over the next two years to the full five-year requirement described above. For example, for PBEs that are not SEC filers that adopt CECL as of January 1, 2021, their financial statements for December 31, 2021, should include vintage disclosures for years 2021, 2020, 2019, and prior to 2019. The financial statements for December 31, 2022, would include vintage disclosures for years 2022, 2021, 2020, 2019, and prior to 2019.

10 Refer to ASC 326-10-65-1 for effective dates.

11 The Consolidated Reports of Condition and Income (Call Report) filed by banks and savings associations and the 5300 Call Report filed by credit unions are not considered U.S. GAAP financial statements.

12 Refer to ASC 326-10-65-1 for transition considerations.

13 Refer to ASC 326-20-30-3 for the use of measurement methods.

14 Refer to ASC 326-20-55-5. The list of risk characteristics is not intended to be all inclusive.

15 Refer to ASC 326-20-30-11 and ASC 326-20-55-54 for Example 10: Application of Expected Credit Losses to Unconditionally Cancellable Loan Commitments.

16 This question does not address accounting for credit losses on a transferor’s interests in securitized transactions accounted for as sales and purchased beneficial interests in securitized financial assets covered by the guidance in ASC Subtopic 325-40, Investments-Other-Beneficial Interests in Securitized Financial Assets. Refer to ASC 325- 40-35-6A through 325-40-35-10A.

17 Refer to ASC 326-30-30-2, 326-30-35-1, 326-30-35-2, and 326-30-35-4 for additional information on this requirement.

18 Refer to the “Glossary” section of ASC 326.

19 Refer to ASC 326-20-55-61 through ASC 326-20-55-65 for Example 12: Recognizing Purchased Financial Assets with Credit Deterioration.

20 Refer to ASC 326-20-35-5.

21 Refer to paragraphs 326-20-55-41 through 326-20-55-44.

22 For the agencies’ guidance on third-party service providers, refer to the following:

- FRB, Supervision and Regulation Letter 13-19/Consumer Affairs Letter 13-21, “Guidance on Managing Outsourcing Risk”

- FDIC, Financial Institution Letter 44-2008, “Guidance for Managing Third-Party Risk”

- NCUA, Supervisory Letter No. 07-01, “Evaluating Third Party Relationships”

- OCC, Bulletin 2013-29, “Third-Party Relationships: Risk Management Guidance”

23 For credit unions, implementation of CECL will impact retained earnings and will likely lower regulatory net worth. However, it will not impact the measurement under the risk-based capital rule which becomes effective in 2019. Under this new rule, the entire allowance balance will be reflected in capital for purposes of the new riskbased capital calculation.

24 When discussing the new accounting standard and its implementation with their external auditors, institutions and their audit committees should be mindful of applicable independence requirements.

25 Refer to the response to question 8 for information on segmenting portfolios.

26 The implementation phase is the period from the issuance of the final standard to its adoption date by an institution.

27 Refer to the Policy Statement on Allowance for Loan and Lease Losses Methodologies and Documentation for Banks and Savings Institutions issued by the FRB, the FDIC, and the OCC in July 2001 and to Interpretative Ruling and Policy Statement 02-3, Allowance for Loan and Lease Losses Methodologies and Documentation for Federally Insured Credit Unions, issued by the NCUA in May 2002.