In 2025, the National Credit Union Administration (NCUA), along with other federal agencies, began a major initiative to review, and revise, as appropriate, all its regulations. This review follows Executive Order 14192, Unleashing Prosperity Through Deregulation.

In 2026 and beyond, NCUA’s mission is to enable access to financial services by facilitating safe, sound, and resilient credit unions. With public input, NCUA is reviewing all existing regulations to ensure that the regulations documented in Title 12, Chapter VII of the Code of Federal Regulations are focused on the safety, soundness, or resilience of credit unions.

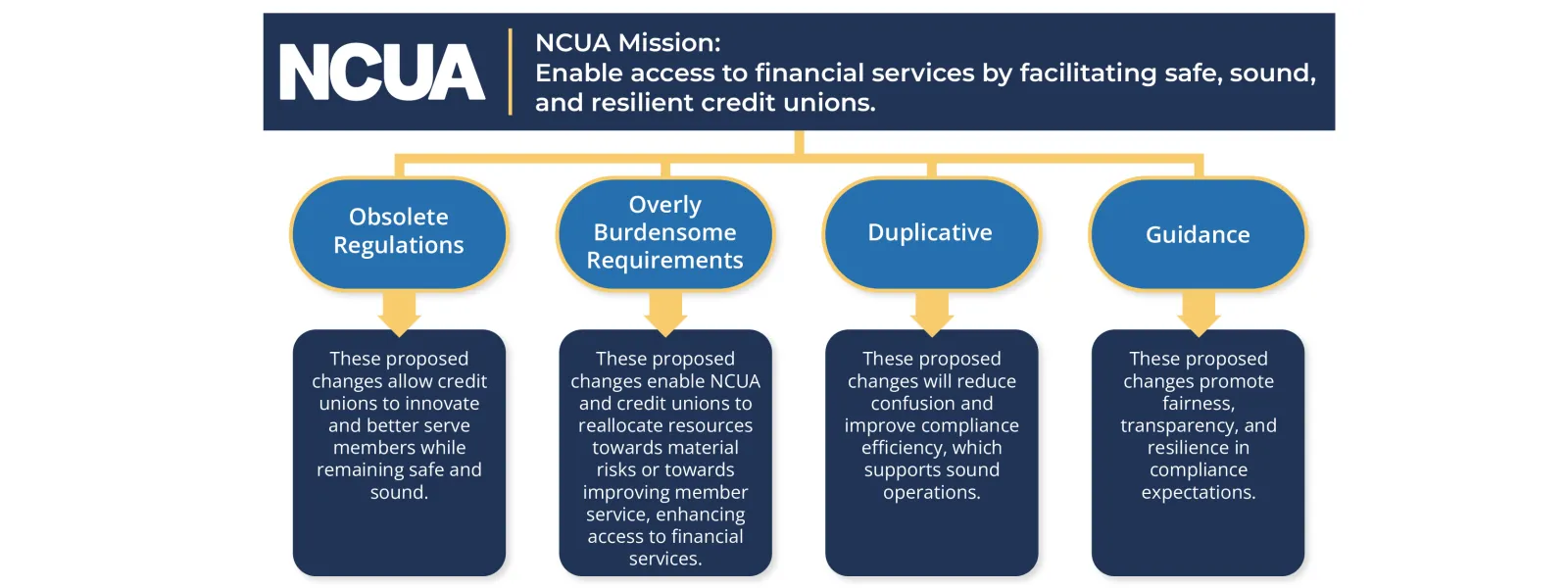

As part of the Deregulation Project, NCUA initially will propose changing or removing regulations that are:

- Obsolete;

- Duplicative;

- Intended to serve as guidance, not requirements; or

- Overly burdensome.

As part of this effort, NCUA is providing the following resources to assist the public in understanding the scope and impact of the proposed changes.

List of Proposed Regulation Changes

12 CFR 701.4(b)(3) – Post-Election Training for New Board Members

Status: Comment period close on April 27, 2026

NPRM Summary

The NCUA Board (Board) solicits public comment on a proposal to eliminate the regulatory requirement that each director of a federal credit union (FCU) attain a working familiarity with finance and accounting within six months after election or appointment. The Board believes the regulation is unnecessarily prescriptive.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03753/post-election-training-for-new-board-members

Simplified Summary

Currently, this regulation requires FCU directors to attain a working familiarity with finance and accounting within six months after election or appointment. The Board is proposing to eliminate this requirement. Certainly, the Board continues to believe that directors must have a working familiarity with basic finance and accounting practices. Nonetheless, specifically requiring that new FCU directors receive specific training in a certain period of time may be unduly burdensome and inadvertently undermine the ability of a credit union’s members to elect their board.

Proposed Changes

- The Board proposes to remove the regulatory requirement for a credit union director to have or obtain expertise in finance and accounting within six months after appointment.

- Impact on credit unions: Removing this requirement reduces overall compliance burden on volunteer boards.

12 CFR 701.20(c)(3) and 701.20(d) – Surety and Guarantor Requirements

Status: Comment period closes on February 27, 2026

NPRM Summary

The NCUA Board seeks comment on a proposed rule to remove the segregated deposit and collateral requirements when a federally insured credit union (FICU) acts as a surety and guarantor. Removing this regulation will provide FICUs with greater flexibility to design products that meet member needs. FICUs would remain subject to the other requirements regarding surety and guaranty agreements.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-23857/suretyship-and-guaranty-segregated-deposit-and-collateral

Simplified Summary

Currently, credit unions must keep a separate deposit or collateral (like cash or property) to fully cover the risk when they guarantee a member’s obligation. These lending requirements can limit a federally insured credit unions’ flexibility in lending. The proposed rule would remove that requirement, meaning credit unions would not have to set aside funds or collateral from the member for these agreements anymore. If the rule were to be made final, credit unions would still need to:

- Limit their guarantee to a specific dollar amount and time period.

- Make sure the guarantee creates a loan that follows all normal lending rules.

This proposed change would also apply to federally insured, state-chartered credit unions. Federal credit unions would still be subject to the applicable regulations and statutes that govern lending activities and relationships.

Proposed Changes to Rule

- Change 1: Surety and Guaranty Agreement Requirement (12 CFR 701.20(c)(3))

- The Board proposes removing entirely the requirement that a federal credit union obtains a segregated deposit sufficient to cover its potential liability.

- Impact on Credit Unions: Credit unions would have the flexibility to manage surety agreements without overly burdensome requirements for managing collateral.

- Change 2: Collateral on a Segregated Deposit (12 CFR 701.20(d))

- The Board proposes removing entirely provisions that specify the collateral requirements when federally insured credit unions act as surety and guarantor in order to provide FICUs flexibility to serve member needs.

- Impact on Credit Unions: Credit unions would be able to determine the types of collateral they would accept, market value, and method for securing an interest in the collateral that they choose to obtain.

12 CFR 701.21(c)(8) – Loan Compensation/Commission

Status: Comment period closes on April 27, 2026

NPRM Summary

The NCUA Board (Board) is issuing for public comment a proposal to amend the NCUA’s regulation that limits federally insured credit union (FICU) official and employee compensation in connection with loans to members and lines of credit to members. These regulations have generated confusion and are unduly restrictive. To provide clearer and more flexible standards, the proposed rule would expressly permit incentives and bonuses to employees, including senior management, to incorporate lending metrics as part of compensation based on a credit union’s overall financial performance.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03754/compensation-in-connection-with-loans-to-members-and-lines-of-credit-to-members

Simplified Summary

The NCUA Board seeks to amend 12 CFR 701.21(c)(8) which establishes a blanket prohibition on the direct or indirect receipt of any commission, fee, or other compensation by a FICU official, employee, or their immediate family members, in connection with any loan made by their FICU. While the regulation carves out certain exceptions to this prohibition, FICUs have expressed confusion and uncertainty about what is permitted and the definition of “overall financial performance”. They also have asserted that the regulation is subject to varying interpretations and levels of enforcement across the NCUA’s regions.

While NCUA has determined limitations on compensation tied to lending are still necessary, the proposed rule would change the regulation to provide clearer and more flexible standards by adding a definition for “overall financial performance”. Additionally, the proposed rule would expressly permit incentive and bonuses to employees, including senior management, to incorporate lending metrics as part of compensation based on a credit union’s overall financial performance.

Proposed Changes

- Change 1 - Add a definition of “overall financial performance.”

- The Board is proposing to add a definition of “overall financial performance” to 12 CFR 701.21(c)(8) to clarify requirements related to FICU compensation plans that include incentives or bonuses related to lending metrics as part of the FICU’s overall financial performance.

- Impact on credit unions: This change would provide clarity about the meaning of the regulation in a way that makes the regulation less burdensome for credit unions. This change would help credit unions recruit and retain staff, which is an important aspect of credit union resiliency.

- Change 2 - Clarify that senior management may receive incentives or bonuses.

- The Board is proposing to add the phrase “including a senior management employee” to the exception on payments of an incentive or bonus to an employee based on overall financial performance.

- Impact on credit unions: This change would provide clarity about the meaning of the regulation in a way that makes the regulation less burdensome for credit unions. This change would help credit unions recruit and retain staff, which is an important aspect of credit union resiliency.

12 CFR 701.23 – Eligible Obligations

Status: Comment period closes on April 27, 2026

NPRM Summary

The NCUA Board (Board) solicits public comment on a proposal to streamline its regulations governing the purchase, sale, and pledge of eligible obligations. The Board proposes to remove the prescriptive lists of items that must be addressed in the written policies adopted by a federal credit union (FCU). Although FCUs would still be required to maintain written policies, removing the mandated items will enable a more efficient and principles-based approach. The Board also proposes to remove detailed requirements regarding conflicts of interest and compensation. These regulatory provisions are unnecessary since FCUs are already governed by broader conflict of interest provisions in their bylaws and by the fiduciary duties of their officials.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03755/purchase-sale-and-pledge-of-eligible-obligations

Simplified Summary

The Federal Credit Union Act authorizes federal credit unions to purchase, sell, and pledge eligible obligations to provide great flexibility in meeting member demand and improving liquidity. NCUA implements this authority through provisions in 12 CFR 701.23, which includes the requirement that a credit union must have policies governing its purchase, sale, and pledge of eligible obligations and a list of items that those policies must address. The proposed revisions would retain the requirement that a credit union must have policies that address eligible obligations, but it would remove the prescriptive lists of items that must be addressed in written policies.

Proposed Changes

- Change 1 – Revise requirements related to written purchase policies.

- Currently, 12 CFR 701.23(b)(6) imposes several requirements on a purchasing credit union when the credit union goes to purchase the eligible obligations and notes of other credit unions that are being liquidated. The provisions are specific, detailed requirements that apply to the written internal policies of the credit union interested in making the purchase. The Board believes these requirements are unduly burdensome, especially for smaller FCUs, and proposes to revise the requirements to say just that the eligible obligations and notes of liquidating credit unions must comply with the purchasing FCU’s internal written policies.

- Impact on credit unions: This change would remove unduly burdensome, overly prescriptive requirements related to an FCU’s internal policies while still requiring the purchasing credit union to have written policies appropriate to their unique portfolio.

- Change 2 – Revise requirements related to the sale of eligible obligations.

- Currently, 12 CFR 701.23(c) requires federal credit unions to comply with several prescriptive elements in their written policies on the sale of eligible obligations. The Board proposes to revise this requirement in a way that provides the credit union board of directors’ the authority to establish the limitations of their written sale policies.

- Impact on credit unions: The change would reduce administrative burden without eliminating the requirement that FCUs manage their operations responsibilities. It would also give the FCU more flexibility to tailor their process to its needs and risk profiles.

- Change 3 – Remove payments and compensation requirements.

- The Board proposes to remove 12 CFR 701.23(g), regarding payments and compensation, finding the requirement to be duplicative and unduly burdensome. FCUs are governed by broader conflict of interest provisions in their bylaws and by the fiduciary duties of their officials.

- Impact on credit unions: The change would address a provision that is duplicative of other requirements and unduly burdensome

12 CFR 701.24 – Refund of Interest (Loans)

Status: Comment period closes on April 27, 2026

NPRM Summary

The NCUA Board (Board) is issuing for public comment a proposal to rescind its regulation § 701.24, which addresses the refund of interest to members. This regulation is redundant, as it restates the authority already granted to a federal credit union’s (FCU’s) board of directors by the Federal Credit Union Act (FCU Act) section 113(9).

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03756/refund-of-interest

Simplified Summary

The NCUA Board is proposing to eliminate 12 CFR 701.24 because it is duplicative of the Federal Credit Union Act (FCU Act, see 12 U.S.C. 1761b(9)). The FCU Act authorizes FCU’s board of directors to refund interest to members at the close of business on the last day of any dividend period. This refund is in proportion to the interest paid by the member in that dividend period. This proposal would reduce regulatory burden by limiting the number of sources that FCUs must check to ensure compliance with laws and regulations.

Proposed Changes

- The Board proposes to remove 12 CFR 701.24 because it is duplicative of the FCU Act.

- Impact on credit unions: This change would minimize compliance burden by centralizing requirements into one place. FCUs would only need to reference the FCU Act (12 U.S.C. 1761b(9)) to confirm requirements for refunds of interest to members.

12 CFR 701.25(b) – Limits on Loans to Other Credit Unions

Status: Comment period closes on February 27, 2026

NPRM Summary

The NCUA Board seeks comment on a proposed rule to remove the regulations related to approval and policies on making loans to other credit unions. While this provision would no longer be codified in regulation, federal credit unions would remain subject to statutory requirements related to making loans to credit unions. Federally insured, state-chartered credit unions would remain subject to any other applicable NCUA or state law or regulation.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-23855/limits-on-loans-to-other-credit-unions

Simplified Summary

Federal law requires a federal credit union’s board of directors to approve loans to other credit unions. (See 12 U.S.C 1757(5)(c).) The current regulation goes beyond what is required by statute and is overly prescriptive, which is why the NCUA Board is proposing to remove it.

Proposed Changes to Rule

- The Board proposes to remove 12 CFR 701.25(b). NCUA would no longer require a federal credit union to have a separate policy for lending to other credit unions.

- Impact on Credit Unions: Credit unions would be able to reduce the number of lending policies they would need to manage and approve.

12 CFR 701.26 – Credit Union Service Contracts

Status: Comment period closes on April 27, 2026

NPRM Summary

The NCUA Board (Board) is proposing to revise its regulations governing the organization and operation of federal credit unions (FCUs) by eliminating a provision related to credit union service contracts. The Board intends to reduce administrative costs and compliance complexity with this revision, enabling FCUs to serve their members more efficiently.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03757/credit-union-service-contracts

Simplified Summary

The Board proposes to rescind 12 CFR 701.26 which outlines the authority for an FCU to enter into contracts for assets or services that relate to its daily operations with other credit unions and organizations. The authority for an FCU to enter into contracts for operational services is inherent in its charter and its general powers under the FCU Act. Under current regulation, these agreements must be in writing and must advise all parties subject to the agreement that the goods and services provided are subject to examination by the NCUA to the extent permitted by law. The regulation’s principal requirement – that such agreements be in writing – is a standard business practice, which exists regardless of whether it is mentioned in the NCUA’s regulations. Rescinding this regulation does not change the basic operating expectations for credit unions.

Proposed Changes

- The Board proposes to remove 12 CFR 701.26, which authorizes FCUs to enter into contractual agreements, but requires agreements be in writing. .

- Impact on credit unions: This change would minimize compliance complexity by removing superfluous requirements.

12 CFR 701.31 – Nondiscrimination Requirements

Status: Comment period closes on March 16, 2026

NPRM Summary

The NCUA Board (Board) is publishing this proposed rule to remove a redundant and outdated regulation regarding nondiscrimination in lending. While the regulation was intended to summarize the Fair Housing Act (FHA) prohibitions on discrimination related to real estate related loans, appraisals, and advertising, the Board’s last substantive amendment to the regulation was finalized in 2001. Thus, the regulation may not reflect all case law or regulatory developments under the FHA, a statute that primarily falls under the jurisdiction of the U.S. Department of Housing and Urban Development (HUD) and continues to apply to federal credit unions (FCUs) regardless of the NCUA’s regulations. Thus, the Board believes the current regulation may cause confusion and unnecessary burden because it has not kept up with changes in FHA interpretation and implementation. For these reasons, the Board is proposing to remove this regulation in its entirety.

Simplified Summary

The Board last updated this regulation, which addresses discrimination in real estate loans, appraisal, and advertising, in 2001. NCUA’s regulation was intended to summarize other statutes and regulations. However, it has not been revised to keep up with current law, and thus, may cause confusion and unnecessary burden.

FCUs are required to comply with other federal laws and their implementing regulations, including more comprehensive discrimination laws such as the FHA and the Equal Credit Opportunity Act (ECOA). This action proposes to eliminate a redundant and obsolete NCUA regulation without weakening anti-discrimination protections that are required elsewhere in law.

Proposed Changes to Rule

- The Board proposes to remove 12 CFR 701.31. NCUA will no longer attempt to summarize requirements more appropriately issued by other agencies.

- Impact on Credit Unions: This does not change credit unions’ compliance obligations regarding the FHA and ECOA, but it should lessen any confusion caused by 701.31 which has not kept pace with current law.

12 CFR 701.32(b)(2) – Public Unit and Nonmember Shares

Status: Comment period closes on March 30, 2026

NPRM Summary

The NCUA Board (Board) seeks comment on a proposed rule to amend the NCUA’s public unit and nonmember share rule to remove the requirement for a written plan to document the intended use of any borrowings, public unit, or nonmember shares if, collectively, those funds exceed 70 percent of the federally insured credit union’s (FICU’s) paid-in and unimpaired capital and surplus. FICUs would remain subject to the limits and other regulatory requirements governing public unit and nonmember shares. Removing this regulation will provide greater flexibility while holding FICUs accountable for managing the associated risks through a principles-based supervisory approach.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-01696/public-unit-and-nonmember-shares

Simplified Summary

The Federal Credit Union Act allows some nonmembers to place funds in a Federal Credit Union (FCU). Specifically, “public units” such as state, local, and tribal governments may place deposits, Additionally, other nonmembers such as other credit unions or corporate credit unions may also place deposits at FCUs. Low-income designated FCUs may also accept deposits from other nonmembers. FISCUs may accept nonmember deposits as allowed by state law or regulation. These deposits are held in share accounts and the FCU may pay dividends on the balance.

Currently, 12 CFR 701.32(b)(2) requires a credit union board to develop a written plan on the intended use of public unit and nonmember shares if those funds, along with any borrowings, would exceed 70 percent of paid-in unimpaired capital and surplus. The proposed rule would eliminate the requirement for a written plan, but would not repeal or change the aggregate limits on public unit and nonmember shares.

Proposed Changes

- The Board proposes removing a requirement for a written plan in 12 CFR 701.32(b)(2).

- Impact on Credit Unions: This proposed change would give FICU boards the option of developing their own policies for managing public unit and nonmember shares within existing aggregate limits, allowing credit union boards to manage their funding sources and reliance on these funds with greater flexibility.

12 CFR 701.39(a)(1) – Definitions related to Statutory Lien

Status: Comment period close on April 27, 2026

NPRM Summary

The NCUA Board (Board) is publishing this proposed rule to remove a provision under section 12 CFR 701.39 of NCUA regulations regarding federal credit unions’ (FCUs) statutory lien authority. The Board believes it is redundant to continue to include a definition of the term “except as otherwise provided by law or except as otherwise provided by federal law” when it is axiomatic that a law that supersedes this regulation would be controlling. The provision does not provide any assistance to FCUs in determining whether such statutory or case law exists, therefore it has no material value.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-03758/statutory-liens

Simplified Summary

12 CFR 701.39, related to statutory liens, states that an FCU has the power to impress and enforce a lien against a member’s shares and dividends to satisfy any outstanding obligations owed to the credit union. 12 CFR 701.39(a)(1) defines the phrase “except as otherwise provided by law or except as otherwise provided by federal law.” The NCUA Board proposes to remove the definition of this phrase because the language is unnecessary and obvious. The definition does not add anything to the plain meaning of these words.

Proposed Changes

- The Board proposes to eliminate the definition of “except as otherwise provided by law or except as otherwise provided by federal law” from NCUA regulation 12 CFR 701.39.

- Impact on credit union: Removing unnecessary text makes the regulation easier to understand and reduces the compliance burden.

12 CFR 704.8 and 704.15 – Corporate Credit Unions

Status: Comment period closes on February 9, 2026

Video: https://youtu.be/dV9GIlcpaG4?si=A5eQNpjFTU9OPw-y

NPRM Summary

The NCUA Board (Board) is proposing to amend its regulations for corporate credit unions by removing the requirement that a corporate credit union’s asset and liability management committee (ALCO) must have at least one member who is also a member of the corporate credit union’s board of directors. The proposed rule would also remove filing and notification requirements related to a corporate credit union’s annual report and any management letter or other report issued by its independent public accountant. The intended effect is to reduce unnecessary regulatory burden and provide corporate credit unions with greater flexibility.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-22487/corporate-credit-unions

Simplified Summary

The NCUA Board proposes removing a requirement that a corporate credit union’s ALCO must have at least one member who is also a member of the corporate credit union’s board of directors. The proposed rule also removes filing and notification requirements related to a corporate credit union’s annual report and independent public accountant’s management letter or other report.

Proposed Changes to Rule

- Change 1: ALCO Committee Representation (12 CFR 704.8)

- The Board now proposes to rescind the requirement for each corporate credit union’s ALCO to have at least one member who is also a member of the board of directors.

- Impact on Credit Unions: Corporate credit union boards would have the ability to determine their ALCO membership. The change would also reduce burden on board members.

- Change 2: Filing requirements related to a corporate credit union’s annual report (12 CFR 704.15)

- The Board proposes to:

- Rescind the requirement to file a copy with NCUA of an annual report within 180 days after the end of the calendar year and any management letter or other report issued by its independent public accountant within 15 days after receipt by the corporate credit union.

- Rescind the requirement for NCUA to make the annual report available for public inspection.

- Rescind requirements related to untimely filings.

- Remove the requirement to report on the engagement of an independent public accountant.

- NCUA can access this information through other means. The proposed changes only remove the requirements for the corporate credit union to file the documents with NCUA but does not limit NCUA’s access to the information.

- The change related to the independent public accountant engagement is intended to reduce burden. Corporate credit unions would still need to inform NCUA when its independent public accountant is dismissed or resigns.

- Impact on Credit Unions: Eliminating these filing requirements will remove unnecessary and unduly burdensome requirements on corporate credit unions.

- The Board proposes to:

12 CFR 708a – Conversion of Insured Credit Unions to Mutual Saving Banks

Status: Comment period closes on April 13, 2026

NPRM Summary

The NCUA Board (Board) is proposing to amend its regulations governing the conversion of insured credit unions into banks. The NCUA Board proposes to eliminate certain prescriptive procedural, disclosure, and communication requirements. This action reduces unnecessary regulatory burdens and provides credit union boards of directors with greater flexibility to exercise their business judgment. The intended effect of these changes is to simplify compliance for credit unions, reduce administrative costs, and modernize the conversion process, while ensuring members receive clear and effective disclosures.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-02763/bank-conversions-and-mergers-conversion-of-insured-credit-unions-to-mutual-savings-banks

Simplified Summary

The Board proposes to amend its regulations related to conversion of insured credit unions into mutual savings banks. This proposal would eliminate certain prescriptive procedural, disclosure, and communication requirements. At present, the regulations governing the conversion process are outdated and overly burdensome. Additionally, the regulations currently include items that are guidance, which may be confusing. NCUA is proposing to simplify compliance and clarify guidance by removing these provisions and relocating guidance to elsewhere on NCUA.gov.

Proposed Changes to Rule

The Board proposes to reduce regulatory burden and increase flexibility by eliminating some procedural, disclosure, and communications requirements for converting insured credit unions to mutual saving banks.

- Change 1: Remove “clear and conspicuous” definition.

- This definition mandates specific formatting, such as bold type and a minimum 12-point font size for disclosures. The Federal Credit Union Act requires a credit union to notify members of a conversion but doesn’t speak to formatting. This overly prescriptive definition is unnecessary and can hinder effective communication.

- Impact on Credit Unions: Removing this provision would simplify regulatory compliance for conversion disclosures and allow credit unions the flexibility to design disclosures that are effective and clear for their members.

- Change 2: Remove newspaper publishing requirement.

- The requirement to publish the proposed conversion in a newspaper is overly burdensome and may no longer be one of the most effective ways to communicate with members. Credit unions are still required to notify members in their home office lobby and on their website’s home page.

- Impact on Credit Unions: Removing this provision will reduce unnecessary costs associated with communicating a conversion via newspaper.

- Change 3: Remove typographical disclosure requirements and prescriptive language that defines “plain language.”

- This change would remove specific and overly burdensome 1) requirements for regulatory disclosure text to members about their vote, like text must be in a box, on the front side of a single piece of paper, and immediately follow the cover letter, and 2) examples of factors to consider in determining whether a communication from a converting credit union to its members is in plain language.

- Impact on Credit Unions: Compliance would be simplified, and credit unions would have more flexibility in their conversion communications.

- Change 4: Remove provisions regarding improper submissions.

- This change would remove the requirement for a credit union to consult their Regional Director when a member requests information about the conversion be sent to other members and when the credit union believes this request is improper.

- Impact on Credit Unions: Credit unions would be able to determine when to engage their Regional Director about improper requests.

- Change 5:Remove “Voting Guidelines” from the regulation.

- This section states the NCUA provides the guidelines as suggestions to help a credit union obtain a fair and legal vote and otherwise fulfill its regulatory obligations. These guidelines are non-binding and may be provided elsewhere.

- Impact on Credit Unions: This proposal would remove guidance from regulation so that credit unions aren’t confused about what is required.

12 CFR 708b – Mergers of Insured Credit Unions Into Other Credit Unions; Voluntary Termination or Conversion of Insured Status

Status: Comment period closes on April 13, 2026

NPRM Summary

The NCUA Board (Board) proposes to amend its regulations governing the voluntary termination of federal share insurance to streamline member communication requirements. This action is necessary to reduce regulatory burden by eliminating overly prescriptive formatting rules for the mandatory disclosure statement that credit unions must provide to members. The intended effect is to simplify compliance and provide credit unions with greater flexibility in designing effective communications, while still ensuring that members receive clear and prominent notice of a proposed termination of federal insurance.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-02764/mergers-of-insured-credit-unions-into-other-credit-unions-voluntary-termination-or-conversion-of

Simplified Summary

The NCUA Board (Board) proposes to amend its regulations to streamline member communication requirements with regards to proposed mergers or voluntary termination of federal share insurance. Currently, credit unions must notify members about an upcoming vote on a proposed merger or a credit union’s intentions to terminate its federal share insurance. This proposal would retain the requirement to notify members about the loss of federal insurance coverage for deposits but would remove overly prescriptive formatting requirements for how that notification is conducted. The proposal would also eliminate the requirement for NCUA to post member comments regarding proposed mergers.

Proposed Changes to Rule

The Board proposes to retain the core disclosure and notification requirements when a credit union’s members vote on a decision to merge or terminate federal share insurance coverage and convert to private insurance, but eliminate prescriptive requirements associated with those disclosures.

- Change 1: Remove the requirement for NCUA to post members’ merger-related comments.

- It would no longer be mandatory for NCUA to post member comments on mergers on a website. Low rates of member feedback indicate affected parties put little value on agency efforts to circulate their views.

- Impact on Credit Unions: Relaxing this dictate will provide modest merger-related cost savings and reduce unnecessary burden.

- Change 2: Removes typographical and formatting requirements for insurance conversion disclosures.

- This proposal aims to simplify compliance and lessen the burden of overly prescriptive formatting rules for the mandatory disclosure statement that credit unions must provide to members. Disclosures continue to be required and easy to find but would no longer have overly prescriptive formatting mandates.

- Impact on Credit Unions: These changes will provide credit unions with greater flexibility in designing effective communications, while still ensuring that members receive clear and prominent notice of a proposed termination of federal insurance.

12 CFR 715 – Supervisory Committee Audits and Verifications

Status: Comment period closes on February 9, 2026

Video: https://youtu.be/dV9GIlcpaG4?si=D-P11tUOJcFmL69x&t=278

NPRM Summary

The NCUA Board is proposing to amend its regulations governing supervisory committee audits to eliminate unnecessary, redundant, and overly prescriptive provisions. This action will reduce regulatory burden, increase operational flexibility for credit unions, and streamline the rules by removing requirements that are outdated or duplicative of other authorities. The intended effect of this proposal is to simplify compliance for credit unions without compromising the integrity of the audit process.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-22488/supervisory-committee-audits-and-verifications

Simplified Summary

The NCUA Board proposes to amend its regulations governing supervisory committee audits. The intended effect of this proposal is to simplify compliance for credit unions without compromising the integrity of the audit process.

Proposed Changes to Rule

- Change 1 – Updating definition of “Internal controls.”

- The Board is proposing to amend 12 CFR 715.2(h), which defines “Internal control” for part 715. NCUA proposes to remove the elements of the definition that are overly prescriptive and risk becoming obsolete. This change would make the definition more durable and allow federally insured credit unions (FICUs) and auditors to apply current, industry-accepted frameworks for evaluating internal controls.

- Change 2 – Verification of member accounts

- The Board is proposing to amend 12 CFR 715.8(a), which details specific methods for the verification of member accounts. The FCU Act, at 12 U.S.C. 1761d, requires the supervisory committee to verify member accounts at least once every two years. The regulation is overly prescriptive when it requires members’ accounts to be verified against the records of the treasurer of the credit union. The Board proposes to remove the words “of the treasurer” to state more generally that members’ accounts must be verified against the credit union’s records.

- Change 3 – Auditor engagement letter

- The Board is proposing to amend 12 CFR 715.9(b), which requires the scope of work with an outside, compensated auditor to be documented in an engagement letter contracted with the supervisory committee. The Board proposes to remove the overly prescriptive requirement that the engagement letter must be signed by both parties.

- Change 4 – Copy of Audit Reports

- The Board is proposing to amend 12 CFR 715.10(a) by removing the sentence that requires a supervisory committee to provide NCUA with a copy of audit reports upon request. This requirement is unnecessary as NCUA has the authority to access all federally insured credit union books and records during its examination and supervision activities.

- Change 5 – Objectives of a Financial Audit

- The Board proposes to remove two sentences from 12 CFR 715.12(b) that describe the objective of a financial statement audit compelled by NCUA.

- This language is unnecessary. The provision already requires an audit be performed in accordance with Generally Accepted Auditing Standards (GAAS), and GAAS already establishes the objectives of a financial statement audit.

- The adverse opinion or disclaimer of opinion commentary in the regulation is best read as guidance and could cause confusion if auditing standards evolve to provide different objectives or expectations for financial statement audits.

12 CFR 740.0 and 740.5 – Accuracy of Advertising and Notice of Insured Status

Status: Comment period closes on February 27, 2026

NPRM Summary

The NCUA Board is issuing this proposed rule to streamline its regulations governing advertising and the notice of insured status. This proposed rule would eliminate provisions concerning the official advertising statement. This action is undertaken to reduce regulatory complexity, and the intended effect is to reduce the administrative burden and costs for federally insured credit unions (FICUs) and provide them with greater flexibility in their advertising activities. The proposed rule would not amend requirements related to displaying the official sign.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-23854/accuracy-of-advertising-and-notice-of-insured-status

Simplified Summary

The Board is proposing changes to regulations related to how federally insured credit unions provide key information to members and potential members. Credit union advertising must be truthful, accurate, and clear about the NCUA insurance status associated with member accounts. The Board is proposing to remove overly burdensome requirements that are obsolete in relation to the modern advertising landscape. The proposed changes would simplify the regulation by removing the requirement to include the official advertising statement, while leaving in place requirements that FICU advertising be accurate and truthful.

Proposed Changes to Rule

- Change 1: Remove Requirements for the Official Advertising Statement (12 CFR 740.5)

- The Board proposes to remove the requirements for a credit union to include an official NCUA advertising statement in their advertising and marketing materials. The requirements are highly prescriptive, inflexible, and not well suited to modern advertising.

- Impact on Credit Unions: Removing this provision would mean credit unions would have fewer rules to comply with when advertising, marketing, and developing incidental promotional items.

- Change 2: Accuracy of Advertising (12 CFR 740.0)

- The Board proposes amending the scope of the regulation such that FICUs would no longer have to display a specific official advertising statement when advertising.

- Impact on Credit Unions: Alongside the proposed change to 12 CFR 740.5, this proposed change would reduce confusion about which rules apply to credit union advertising.

12 CFR 741.2 – Maximum Borrowing Authority

Status: Comment period closes on March 30, 2026

NPRM Summary

The NCUA Board (Board) seeks comment on a proposed rule to remove the maximum borrowing authority from the NCUA’s regulations that establish the requirements for obtaining and maintaining federal share insurance with the National Credit Union Share Insurance Fund (Share Insurance Fund). This provision applies to all federally insured credit unions (FICUs). Removing this regulation would eliminate an unnecessary provision that duplicates the statutory maximum borrowing limit for federal credit unions (FCUs). For federally insured, state-chartered credit unions (FISCUs), removing this section would reduce the federal regulatory burden associated with the federal limit and related waiver provision.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-01697/requirements-for-insurance-maximum-borrowing-authority

Simplified Summary

Currently, 12 CFR 741.2 establishes a maximum borrowing authority for FISCUs, limiting aggregate borrowing from any source to an amount not more than 50 percent of its paid-in and unimpaired capital and surplus. For FCUs, this provision is duplicative of statutory requirements found at 12 U.S.C. 1757(9). The Board proposes to eliminate section 741.2 from the NCUA’s regulations, which applies to all FICUs.

Proposed Changes to Rule

- The Board proposes eliminating 12 CFR 741.2, which establishes a borrowing limit for FISCUs and duplicates a statutory borrowing limit for FCUs.

- Impact on Credit Unions: The proposal would eliminate a duplicative provision for FCUs. For FISCUs, the applicable state law would govern maximum borrowing authority while NCUA would still examine for safety and soundness.

12 CFR 741.5 – Notice of Termination of Excess Insurance Coverage

Status: Comment period closes on March 30, 2026

NPRM Summary

The NCUA Board (Board) is issuing for public comment a proposal to amend the NCUA’s regulations that establish the requirements for obtaining and maintaining federal share insurance with the National Credit Union Share Insurance Fund (Share Insurance Fund). The provisions of this part apply to all federally insured credit unions (FICUs). The proposal would reduce regulatory burden by amending the provision on the timing of prior notice provided to members of the termination of excess non-federal insurance coverage.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-01698/termination-of-excess-insurance-coverage

Simplified Summary

Currently, 12 CFR 741.5 requires a FICU with share insurance coverage that supplements the coverage provided by the National Credit Union Share Insurance fund to give its members a 30-day notification if it plans to end its supplemental coverage. The Board is proposing to eliminate this requirement as the 30-day period may be overly prescriptive. A FICU board must provide notice of a change in insurance coverage; however, the specific 30-day requirement may not be sufficiently flexible, and it may not align with certain state law or contractual requirements.

Proposed Changes to Rule

- The Board proposes removing the specific 30-day notice requirement associated with the termination of excess share insurance coverage. FICUs’ boards of directors would still be required to notify members, but without an overly prescriptive time frame.

- Impact on Credit Unions: This proposed change would give FICU boards additional flexibility.

12 CFR 741.10 – Disclosure of Share Insurance

Status: Comment period closes on March 30, 2026

NPRM Summary

The NCUA Board (Board) is issuing for public comment a proposal to amend the NCUA’s regulations that establish the requirements for obtaining and maintaining federal share insurance with the National Credit Union Share Insurance Fund (Share Insurance Fund). The provisions of this part apply to all federally insured credit unions (FICUs). The proposal would reduce regulatory burden by eliminating unnecessary and redundant requirements related to disclosing when nonmember accounts are not covered by federal share insurance.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-01699/requirements-for-insurance

Simplified Summary

Under 12 CFR 741.10, a federally insured, state-charted credit union (FISCU) that is permitted by state law to accept nonmember shares or deposits that are not federally insured must identify such accounts on all required reports and notify all nonmember account holders in writing that their accounts are not insured by the Share Insurance Fund. The Board is proposing to eliminate this requirement because it is duplicative of the disclosures FISCUs are already required to make as part of their agreement for maintaining federal share insurance.

Proposed Changes to Rule

- The Board proposes removing a duplicative notification requirement for FISCUs that accept nonmember shares or deposits that are not protected by the Share Insurance Fund.

- Impact on Credit Unions: This proposed change would reduce the number of regulatory requirements FISCUs must follow, simplifying their compliance burden while leaving in place notification requirements for those who may have accounts not covered by the Share Insurance Fund.

12 CFR 748 Appendix A – Guidelines for Safeguarding Member Information

Status: Comment period closes on February 9, 2026

Video: https://youtu.be/dV9GIlcpaG4?si=DJEJYdZ1y9_hhZeQ&t=419

NPRM Summary

The NCUA Board (Board) is proposing to remove Appendix A to part 748, guidelines for safeguarding member information, from the Code of Federal Regulations (12 CFR Part 748 Appendix A). Appendix A was issued to satisfy NCUA’s statutory obligation to establish appropriate standards for federally insured credit unions (FICUs) to protect the security and confidentiality of customer records and information and to protect against unauthorized access to or use of such records. The Board now believes that the placement of Appendix A in the CFR may be confusing because Appendix A is not a regulation but rather a set of guidelines intended to assist FICUs with their statutory compliance obligations. The Board proposes to remove Appendix A from the CFR and publish its contents as a Letter to Credit Unions, which enables more efficient revisions, streamlines NCUA’s regulations, and ensures guidance is conveyed as guidance.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-22488/supervisory-committee-audits-and-verifications

Simplified Summary

The NCUA Board proposes removing guidelines for safeguarding member information from 12CFR 748, Appendix A because it may be confusing to have guidance presented through regulation. These guidelines are intended to assist FICUs with their statutory compliance obligations—they are not independently enforceable. The Board will remove Appendix A from the CFR and publish its contents online.

Proposed Changes to Rule

- Change: Remove guidance from regulations

- The Board intends to remove the content of Appendix A from the Code of Federal Regulations. The guidelines provided by Appendix A related to Safeguarding Member Information are guidance, and the content will be published online later should the rule be finalized. This option will be a better vehicle for conveying and updating this information and will help to streamline NCUA’s regulations.

12 CFR 748 Appendix B – Guidance on Response Programs for Unauthorized Access to Member Information and Member Notice

Status: Comment period closes on February 9, 2026

Video: https://youtu.be/dV9GIlcpaG4?si=GtsPyaYpGKVovTCR&t=555

NPRM Summary

The NCUA Board (Board) is proposing to remove Appendix B to part 748, Guidance on Response Programs for Unauthorized Access to Member Information and Member Notice. Appendix B was issued in June 2005. Its purpose was to provide federally insured credit unions (FICUs) with guidance for creating programs to address and respond to instances of unauthorized access to member information. The Board now believes that the placement of Appendix B in the Code of Federal Regulations (CFR) may be confusing because Appendix B itself is guidance to assist FICUs in developing the response programs required pursuant to regulation. The Board instead would publish the content of Appendix B as guidance. This will be a better vehicle for conveying and updating this information and will help to streamline NCUA’s regulations.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-22490/guidance-response-programs-for-unauthorized-access-to-member-information-and-member-notice

Simplified Summary

The NCUA Board proposes 12 CFR 748 Appendix B be removed from the regulation and published as guidance to assist FICUs.

Proposed Changes to Rule

- Change: Remove guidance from rule

- The Board intends to publish the content of Appendix B as guidance. This will be a better vehicle for conveying and updating this information and will help to streamline NCUA’s regulations.

12 CFR 748.1(b) – Catastrophic Act Reporting

Status: Comment period closes on February 27, 2026

NPRM Summary

The NCUA Board is publishing this proposed rule to amend the requirements for federally insured credit unions (FICUs) to report catastrophic acts to the agency. By providing more time for FICUs to notify the agency of the occurrence of a catastrophic act and by eliminating the specific list of items to be documented, the Board expects the proposed rule to reduce the compliance burden and allow FICUs to focus their resources on recovery and core functions without compromising safety and soundness.

Link to full proposal: https://www.federalregister.gov/public-inspection/2025-23856/catastrophic-act-reporting

Simplified Summary

When a catastrophic act impacts a federally insured credit union, NCUA must be notified. Under NCUA’s catastrophic act report regulation (12 CFR 748.1(b)), credit unions have five business days after the event to report to their regional director. The proposed revision requires credit unions to report directly to NCUA within 15 calendar days of a catastrophic event, allowing credit unions to manage the immediate aftermath while ensuring timely notification. Documentation of a catastrophic event remains mandatory; however, specifics of what that documentation should entail would be at the discretion of the credit union.

Proposed Changes to Rule

- Change 1: Recipient of Report

- The Board proposes requiring credit unions to report to the NCUA rather than to a regional director.

- Impact on Credit Unions: This change would modernize the reporting process and provide greater operational flexibility for FICUs. This may help smaller credit unions, which may be operating under emergency conditions.

- Change 2: Reporting Window

- The Board proposes allowing credit unions to have 15 calendar days to report a catastrophic act, an increase from the current requirement of 5 business days.

- Impact on Credit Unions: This proposed change would provide credit unions experiencing a catastrophic act additional time to stabilize operations and assess the full scope of damage. Calendar days are also easier to calculate when determining compliance.

- Change 3: Facts to be Reported

- The Board proposes requiring credit unions to report the basic facts of the event rather than requiring the credit union to report specific types of information. The proposal would also make the regulation clearer by revising wording that makes this requirement sound like guidance.

- Impact on Credit Unions: This change would provide FICUs with the ability to reduce undue regulatory burden while still maintaining a record of events.

Interpretive Ruling and Policy Statement (IRPS) 06-1 Organization and Operation of Federal Credit Unions

Status: Comment period closes on April 13, 2026

NPRM Summary

The NCUA Board proposes to rescind its Interpretative Ruling and Policy Statement 06-1 (IRPS 06-1). Rescinding IRPS 06-1 would ease the compliance burden on Federal credit unions (FCUs) by limiting the number of sources that FCUs must check to ensure compliance with applicable chartering and field of membership (FOM) requirements.

Link to full proposal: https://www.federalregister.gov/public-inspection/2026-02765/chartering-and-field-of-membership-for-federal-credit-unions---interpretive-rulings-and-policy

Simplified Summary

The NCUA Board proposes to rescind its Interpretative Ruling and Policy Statement 06-1 (IRPS 06-1) to limit the number of sources an FCUs must check to ensure compliance with applicable chartering and field of membership (FOM) requirements.

IRPS 06-1 shares similar information about FOM policies and procedures as the Chartering Manual. By rescinding IRPS 06-1, NCUA is eliminating duplicative information that may be confusing or increase compliance burden.

Proposed Changes to Rule

- The Board proposes to rescind IRPS 06-1 because the current FOM requirements are in the Chartering Manual.

- Impact on Credit Unions: This change would eliminate a redundant standard currently listed in more than one area. This would ease the compliance burden on FCUs Federal Credit Unions by limiting the number of sources they must check to ensure compliance with applicable community chartering and FOM requirements.

Interpretive Ruling and Policy Statement (IRPS) 08-2 Service to Underserved Areas

Status: Comment period closes on March 16, 2026

NPRM Summary

The NCUA Board proposes to rescind its Interpretive Ruling and Policy Statement 08-2 (IRPS 08-2). Rescinding IRPS 08-2 would ease the compliance burden on federal credit unions (FCUs) by limiting the number of sources that FCUs must check to ensure compliance with applicable chartering and field of membership (FOM) requirements.

Simplified Summary

The Board proposes rescinding IRPS 08-2, which was published in 2008. IRPS 08-2 provided four modifications to the Chartering and Field of Membership Manual to update and clarify the process of approving credit union service to “underserved areas.”1 In 2010, the NCUA Board issued a Final Rule that established the Chartering and Field of Membership Manual in Appendix B of 12 CFR 701, but did not rescind IRPS 08-02.

The current requirements for service to underserved areas are stated in Chapter 3 of the Chartering and Field of Membership Manual, making IRPS 08-2 not necessary.2 The proposal to rescind IRPS 08-02 would not add, remove, clarify, or otherwise change the substantive requirements already established in the FCU Act and the Chartering Manual.

Proposed Changes to Rule

- The Board proposes to eliminate Interpretive Ruling and Policy Statement 08-2.

- Impact on Credit Unions: This change would eliminate a redundant standard currently listed in more than one area. This would ease the compliance burden on FCUs by limiting the number of sources that FCUs must check to ensure compliance with applicable chartering and FOM requirements.

1 73 FR 73392 (Dec. 2, 2008).

2 See 12 CFR part 701, App. B. Ch. 3, § III.

Interpretive Ruling and Policy Statement (IRPS) 10-1 Community Chartering Policies

Status: Comment period closes on March 16, 2026

NPRM Summary

The NCUA Board (Board) proposes to rescind its Interpretive Ruling and Policy Statement 10-1 (IRPS 10-1), which was issued as an amendment to IRPS 08-2. Rescinding IRPS 10-1 would ease the compliance burden on federal credit unions (FCUs) by limiting the number of sources that FCUs must check to ensure compliance with applicable chartering and field of membership (FOM) requirements.

Simplified Summary

The Chartering and Field of Membership Manual (as published in Appendix B to part 701) sets forth the NCUA’s current field of membership policies and procedures. Because the current FOM rules are stated in the Chartering and Field of Membership Manual, IRPS 10-1 is duplicative and not necessary.

The proposal to rescind IRPS 10-01 would not add, remove, clarify, or otherwise change the substantive requirements already established in the FCU Act and the Chartering Manual.

Proposed Changes to Rule

- The Board proposes to eliminate its Interpretive Ruling and Policy Statement 10-1.

- Impact on Credit Unions: This change would eliminate a redundant standard currently listed in more than one area. This would ease the compliance burden on FCUs by limiting the number of sources that FCUs must check to ensure compliance with applicable community chartering and FOM requirements.

Interpretive Ruling and Policy Statement (IRPS) 11-2 Federal Corporate Credit Union Chartering

Status: Comment period closes on March 16, 2026

NPRM Summary

The NCUA Board (Board) is issuing for public comment a proposal to rescind its Interpretive Ruling and Policy Statement (IRPS) 11-02, which addresses chartering corporate credit unions, because it is redundant to the Federal Corporate Credit Union Chartering Manual. This action will eliminate potential confusion.

Simplified Summary

Following the 2008-2009 financial crisis, the NCUA Board issued uniform requirements for prospective new corporate credit unions. These requirements were issued through IRPS 11-02, which established the requirements and process for chartering a corporate federal credit union (FCU).

The Board believes that it is reasonable to rely on the Federal Corporate Credit Union Chartering Manual for NCUA guidance and procedures on corporate FCU chartering. The Board expects the rescission of IRPS 11-02 to reduce regulatory burden generally by limiting the number of sources that FCUs must check to ensure compliance with laws and regulations.

Proposed Changes to Rule

- The Board proposes rescinding Interpretive Ruling and Policy Statement 11-02.

- Impact on Credit Unions: This proposed rescission would remove guidance regarding procedures and timelines for chartering federal corporate credit unions. This would reduce the regulatory burden by limiting the sources that FCUs must check when chartering a new corporate credit union ensuring all they would need to comply with is the guidance and procedures in the Federal Corporate Credit Union Chartering Manual.

Deregulation Project Dashboard

Deregulation Project Frequently Asked Questions

General

When will the proposed changes take effect? How will today’s action impact supervision and examination?

Once a Notice of Proposed Rulemaking is published to the Federal Register, the public has time to provide comments and suggestions. When the comment period closes, NCUA will review feedback and make final determinations before issuing a Final Rule. That timeframe isn’t fixed but will be expeditious.

Credit unions should continue to follow regulations as they exist in the Code of Federal Regulations until relevant rule changes are final. The first round of regulatory changes should not significantly impact a credit union’s exam or supervision.

Close and return to topWhat is the NCUA Deregulation Project?

The NCUA Deregulation Project is a long-term initiative to review and revise NCUA regulations and policies to ensure the agency is focused on fulfilling our mission and statutory requirements. In 2026 and beyond, NCUA’s mission is to enable access to financial services by facilitating safe, sound, and resilient credit unions.

This project is in response to Executive Order 14192, "Unleashing Prosperity Through Deregulation," and aims to prioritize the safety, soundness, and resilience of credit unions while eliminating unnecessary costs and unduly burdensome requirements.

NCUA encourages the public to provide feedback on the specific proposed changes through Regulations.gov.

Close and return to topWhy is NCUA proposing to change these specific items rather than prioritize other changes?

The Deregulation Project is a long-term initiative that necessitates a thorough review of all NCUA regulations.

We anticipate there will be many proposed changes over the coming year. Through careful examination and deliberation, NCUA prioritized its initial review by focusing on regulations fitting into the following four categories. Those categories are:

- Obsolete Regulations – NCUA identified regulations that may be outdated or that rely on activities no longer commonly used by credit unions or the agency.

- Duplicative – NCUA has identified regulations that are duplicative of existing statutes. In addition, some NCUA regulations simply refer to other regulations, which exist elsewhere.

- Overly Burdensome Requirements – NCUA evaluated regulations that may create unnecessary burden, making it harder for credit unions to serve their members, properly allocate resources, or that block the industry from exploring new innovations.

- Guidance – NCUA identified certain regulations that contain guidance, adding to unnecessary compliance burdens.

The four criteria described above will be used to prioritize initial proposed changes. NCUA may also consider additional regulatory changes as appropriate.

Close and return to topWill NCUA consider additional changes to its regulations?

Yes. NCUA is currently reviewing all its regulations and anticipates further changes.

Close and return to topHow will I know when the changes are final?

After the comment period closes, NCUA will review and analyze all comments received. Based on the review, NCUA will decide whether to proceed with the rulemaking process.

Should NCUA choose to proceed with an action, we will publish a Final Rule in the Federal Register. Unless stated otherwise, most Final Rules take effect 30 days after publication.

Upon the publication of a Final Rule in the Federal Register, NCUA communicates with the public through letters to credit unions, press releases, and other communications to address any questions about implementation.

Close and return to topWhat is not changing?

NCUA will continue to prioritize safety and soundness.

The changes will not reduce your exam frequency or rigor, modify internal controls or cybersecurity expectations, or member-protection requirements.

Until final rules are issued, credit unions should continue following existing regulation. Examiners will not cite a credit union for not adopting changes pending final Board approval.

Close and return to topHow do I provide comments and share feedback on the proposed rules?

Using Regulations.gov, search for the rule.

Once you have found the docket, click on the comment box. There you can type or upload a file with your comments.

Be sure to hit submit once you’ve completed your input.

You will receive a comment tracking number.

Close and return to top