MESSAGE FROM ACTING OMBUDSMAN

The Riegle Community Development and Regulatory Improvement Act of 1994 requires each of the Federal banking agencies and the National Credit Union Administration Board to appoint an Ombudsman. The Ombudsman role was created to act as a liaison between the agency and any affected person regarding any problem such party may have in dealing with the agency resulting from the regulatory activities of the agency. The Ombudsman also assures that safeguards exist to encourage complainants to come forward and preserve confidentiality. To that end, the NCUA’s Ombudsman is a neutral party that investigates complaints and recommends solutions to help ensure fair and transparent interactions with the agency.

The NCUA Board appointed the agency’s first Ombudsman in 1995, as a part-time position. Since then, the NCUA Ombudsman has operated out of various offices and under various structures. In 2023, the NCUA Board created an independent Ombudsman office to better fulfill the mission of the Ombudsman and to deliver a fair and impartial forum for stakeholder feedback and issue resolution.

Using various methods to help stakeholders resolve conflicts or disputes with the agency, the Office of the Ombudsman offers an informal alternative to more formal administrative processes. As a best practice, we are releasing this report to demonstrate transparency of the Ombudsman’s activities as well as process-related recommendations.

This annual report also highlights information and statistical data on the Ombudsman’s core programs, which ensure a fair and transparent process when interacting with the NCUA. It also details stakeholder feedback from the “Post Examination Survey,” an initiative undertaken by the Office of the Ombudsman in 2021. Finally, the report details lessons learned in 2023, emphasizing future opportunities to increase Ombudsman engagement with stakeholders.

We invite your feedback on our inaugural report, which we hope you find useful.

Shameka Sutton

Acting NCUA Ombudsman

Mission

When to Contact the Office of the Ombudsman

- You are uneasy about discussing concerns or questions with your examiner.

- You have a complaint or concern about NCUA supervisory or administrative processes.

- You cannot find NCUA regulatory information.

- You believe an examination was not performed as per agency standards.

- You must resolve a dispute informally regarding a supervisory finding, rating, or decision.

The Office of the Ombudsman fulfills its mission through:

- Dispute Resolution Team

- Management and Data Analysis Program

- Stakeholder Engagement and Outreach Program

Standards of Practice

- Independence. The Ombudsman is independent from NCUA program offices and reports to the NCUA Board.

- Neutral. The Ombudsman remains objective in the treatment of people and issues and does not act as an advocate for any party.

- Confidential. The Ombudsman takes reasonable steps to maintain confidentiality of communications.

- Informal. The Ombudsman acts as a liaison between involved parties; there is no formal adjudicative process

Dispute Resolution Program

When resolving disputes, the Ombudsman uses an array of tools that is best for the type of conflict:

- Facilitation– Use of neutral party to convey information back and forth between the parties

- Mediation– Flexible dispute resolution process where an impartial third-party assists with negotiation of differences

- Independent Reviews– Evaluation of a supervisory process by a neutral party, independent of the program office that is the subject matter of concern or complaint

- Recommendations– May ask Regional Directors, Office Directors, or the NCUA Board to reconsider their respective decisions, but cannot influence final decisions.

449

Resolved Inquiries

79

Information Requests

4

Independent Reviews

9%

Increase in Contacts

Case Management and Data Analysis Program

Inquiries and Information Requests

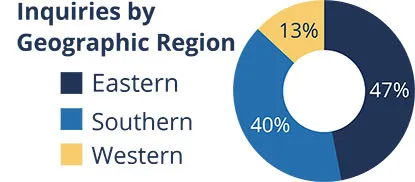

During 2023, the Office of the Ombudsman received a nine percent increase in stakeholder contacts than in the preceding year. An inquiry is any contact from a stakeholder, who has a concern, question, or request for information, and requires follow up by the Ombudsman but does not require independent review of supervisory processes. The Ombudsman helped resolve 449 individual inquiries or information requests from stakeholders across the NCUA regions, to include 39 states and the District of Columbia. Most inquiries were received via email; however, we also assist with inquiries by phone, fax, and postal mail.

Information requests. To improve stakeholder understanding of the NCUA’s processes, the Office of the Ombudsman responds to information requests by answering questions, accepting feedback, and increasing awareness of our services to the public. Stakeholders requested information for a variety of matters throughout 2023. The most common request was from member-owner stakeholders about consumer compliance topics, such as fraud and scams, financial crimes, and fees. Other stakeholders requested information about:

- Ombudsman resources and services

- NCUA Policies and Procedures

- Credit union bylaw amendments

- Consumer complaint procedures and how to file a complaint against a credit union.

- NCUA Contact Information

- Board members, senior leadership, and the Office of Inspector General

Independent Reviews

An independent review is an informal process whereby the Office of the Ombudsman investigates to determine if stakeholders experienced a fair supervisory process. An independent review may be needed in complex complaints which appear to involve gaps in administrative processes, systemic flaws, or require more investigation. It is warranted when stakeholders allege errors in a regulatory process or after a credit union member stakeholder appeals a Consumer Assistance Center decision.

In 2023, the Ombudsman conducted 4 independent reviews of supervisory processes, including the consumer complaint process and the credit union merger or conversion process.

Independent Review—Consumer Complaint Process

The Office of the Ombudsman’s primary constituents are credit union members. We conduct independent reviews upon request from credit union members after receiving an appeal determination from the Consumer Assistance Center. In 2023, we conducted three separate independent reviews at the requests of members seeking the reversal of an investigation decision. However, because the Ombudsman cannot overturn agency decisions, we served as a neutral party to determine if gaps or errors existed in the complaint process, with the goal of resolving the matter informally.

In each review, we facilitated information between involved parties, as needed, and reviewed agency correspondence to ensure the process was fair and transparent. Our independent reviews did not yield errors within the NCUA’s supervisory processes and appeared to be fair and transparent. We closed each independent review and shared the results with each requesting stakeholder.

Independent Review—Credit Union Merger and Conversion Process

We also conducted an independent review of the NCUA’s merger and conversion process for credit unions due to external stakeholders who claimed the process is unfair or inequitable. Stakeholders expressed that member-owners should have input on merger selections and the NCUA should be more inclusive of member-owners during the merger and conversion process.

In this independent review, we reviewed correspondence between involved parties, as well as appliable regulations governing mergers and conversions. We held many meetings with external stakeholders to better understand the desired solution and facilitated discussions with internal stakeholders to explore options. We proposed informal solutions to resolve the matter and shared feedback with the agency’s senior leadership. Although we did not make any recommendations to senior leadership, we continue to invite feedback on this matter and maintain ongoing communications with all stakeholders to ensure transparency.

Stakeholder Engagement and Outreach Program

More than 15 years have transpired since the NCUA had an exam survey process in place. The pilot serves multiple purposes, which include:

- Acclimating credit unions and NCUA staff to a post-exam feedback process.

- Focusing on objective questions that can be answered factually.

- Gathering input and ideas on preferred approaches, sensitivities to the survey process, and types of questions, and

- Obtaining input from credit unions on the specific questions—or types of questions—the agency should include in a permanent post-exam survey.

Post-Examination Survey – Stakeholder Engagement

814

Credit unions responded to the Post Exam Survey

Since the pilot’s inception to year-end 2023, 814 credit unions have responded to the Post-Exam Survey. The largest proportion of credit union chief executive officers or management agreed:

- 99 percent—The exam review areas included those that pose the highest risk to your institution.

- 99 percent—The written exam report documented and explained the examiner’s final conclusions and determinations. This includes CAMELS and Risk Ratings, any Documents of Resolution, any Examiner’s Findings, and any other concerns or conclusions expressed in the written report.

- 98 percent—Examiners offered to keep management (CEO or designated credit union staff) updated throughout the exam.

Engagement and Outreach Activities

25

Outreach Activities

The Office of the Ombudsman regularly participates in a host of outreach activities to raise awareness of our resources and services. In 2023, the Ombudsman participated in over 25 monthly, quarterly, and annual events which include:

- Coalition of Federal Ombuds (COFO) State Proclamation Request. Agency members of COFO helped the American Bar Association Ombuds Day Subcommittee by requesting proclamations from all 50 states and Washington D.C., to increase awareness and improve understanding of the ombuds profession.

- International Ombudsman Day. Hosted by the International Ombuds Association, Annual Ombuds Day — the second Thursday of October — celebrates ombuds worldwide. This celebration helps educate the public about the history and practices of the ombuds profession, including the various ombuds models, the roles they play, the services they offer, and the value provided.

- NCUA National Training Conference. The Ombudsman participated in the 2023 National Training Conference Expo and discussed how the office supports the NCUA’s mission and exhibited its work over the last few years.

- Demystifying the NCUA (series). The Ombudsman participated in the series to give external stakeholders a chance to explore the value of the agency’s new offices and divisions. The NCUA’s Ombudsman regularly engages with fellow ombuds through interagency contacts and membership meetings. Engagement with other relevant stakeholders is at the discretion of the Ombudsman, or upon request.

Lessons Learned

Proactive and Collaborative Engagement Builds Relationships

To date, the Ombudsman’s primary constituents are consumers who have exhausted the Consumer Assistance Center’s complaint process. This is likely due to minimal engagement and outreach to the credit union system by the Office of the Ombudsman and the resulting lack of public awareness. The Ombudsman strives to devote more resources to engagement and outreach and increase constituent awareness of the Ombudsman. A more proactive Ombudsman will facilitate more effective resolutions to issues that are of interest to the credit union system.

For example, other federal Ombudsman offer informational meetings and listening sessions for external stakeholders to better understand concerns or issues of interest. They also participate in industry events such as conferences and trade group meetings with the goal of educating external groups about the assistance the Ombudsman can provide.

As such, the Office of the Ombudsman will initiate development of an outreach plan to guide future outreach efforts.

Leveraged Survey Analytics to Gain Valuable Insight

As noted previously, the Post-Exam Survey enables the agency to solicit feedback from credit unions to improve the quality and consistency of the examination process. From 2022 to 2023, participation increased by four percent from credit unions across each region. However, the response rate is relatively marginal, ranging from 22 percent to 27 percent since the pilot’s inception in September 2021. The survey response rate is the number of credit unions that completed a survey compared to the number of credit unions that were invited to complete the survey.

Feedback from the survey is favorable, but increased participation can yield more accurate analytics when evaluating examination processes. As a result, the Office of the Ombudsman will procure a third-party vendor to assist with streamlining the survey transmission, while maintaining responsibilities for the analysis and reporting of survey results. We anticipate sharing enhancements to the Post-Exam Survey as planning and details become final.

Contact Information

Office of the Ombudsman

1775 Duke St.

Alexandria, VA 22314

703.518.1175 (phone)

703.518.1757 (fax)