MESSAGE FROM THE ACTING OMBUDSMAN

In 2024, the Office of the Ombudsman continued its mission of serving as an independent, neutral, and confidential resource for stakeholders interacting with the NCUA. As in previous years, we requested feedback on the agency’s regulatory activities to inform and improve supervisory processes.

As detailed in this report, the Ombudsman’s Office received numerous inquiries regarding expectations from credit union members on NCUA’s roles and responsibilities in cyber incidents and data breaches. By August 31, 2024, more than 1,000 cyber incidents were reported to the NCUA. Regulatory processes for cyber incidents remain a primary concern of external stakeholders.

Feedback received through the Ombudsman matters. The office facilitated feedback to examiners during agency training conferences to ensure that NCUA can improve the way in which we communicate with those we regulate.

Looking ahead, my office looks forward to continuing to serve credit unions and the public. I hope you find the report valuable, and I welcome your feedback.

Shameka Sutton

Acting NCUA Ombudsman

About the Office of the Ombudsman

The Riegle Community Development and Regulatory Improvement Act of 1994 requires each of the Federal banking agencies and the NCUA Board to appoint an Ombudsman. The Ombudsman role was created to act as a liaison between the agency and any affected person regarding any problem such party may have in dealing with the agency resulting from the regulatory activities of the agency. The Ombudsman also assures that safeguards exist to encourage complainants to come forward and preserve confidentiality. To that end, the NCUA’s Ombudsman is a neutral party that investigates complaints and recommends solutions to help ensure fair and transparent interactions with the agency.

The NCUA appointed the agency’s first Ombudsman in 1995. Since then, the NCUA Ombudsman has operated out of various offices and under various structures. In 2023, the NCUA created an independent Ombudsman office to better fulfill the mission of the Ombudsman and to deliver a fair and impartial forum for stakeholder feedback and issue resolution.

The Office of the Ombudsman fulfills its mission through:

- Dispute Resolution Program

- Case Management and Data Analysis Program

- Stakeholder Engagement and Outreach Program

Working with the Ombudsman

Any person, institution or stakeholder may contact the Office of the Ombudsman directly through phone, mail, or email. Once an inquiry or complaint is received, it is reviewed and addressed as appropriate. For example, if the request is a media inquiry, it would be referred to another office within NCUA. As another example, if a matter is related to the jurisdiction of another government agency, the Ombudsman may refer the matter to that agency.

Items identified for further action by the Ombudsman will be considered for mediation, facilitation of communication, or an independent review. The Ombudsman will communicate with the inquirer or complainant to inform them of the next steps in the process, even if the Ombudsman takes no additional action.

Standards of Practice

- Independence. The Ombudsman is independent from NCUA program offices and reports to the NCUA Board.

- Neutral. The Ombudsman remains objective in the treatment of people and issues and does not act as an advocate for any party.

- Confidential. The Ombudsman takes reasonable steps to maintain confidentiality of communications.

- Informal. The Ombudsman acts as a liaison between involved parties; there is no formal adjudicative process.

Case Management and Data Analysis

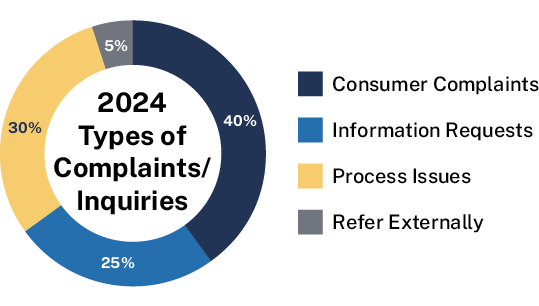

Year over year, the total number of inquiries and complaints to the Ombudsman from the public have increased. In 2024, the Ombudsman processed a total of 598 inquiries or complaints, an increase of 33 percent from the previous year.

Inquiries and complaints involved the following regulatory activity: (a)removal of prohibition orders, (b)exam processes, (c)consumer complaint processes, (d)and merger processes.

Notably, many inquiries and complaints involved regulatory processes related to data breaches and cyber threats at credit unions. In 2024, the Ombudsman processed 44 inquiries and complaints related to data breach or cyber threats at federally insured credit unions. Most were from members of credit unions who were concerned about the privacy of their data and applicable coverage of Share Insurance if their credit unions were to fail.

The Ombudsman received higher than usual contacts after a particular credit union experienced a ransomware attack. Following the incident, we assisted stakeholders by referring them to pertinent state notification requirements.

In response, the NCUA contends it is not the authoritative source for cyber threat/data breach information and asserts other agencies, such as the U.S. Department of the Treasury, the Federal Bureau of Investigation, and the Cybersecurity and Infrastructure Agency, are responsible for industry-wide communications and response.

598

Inquiries

2024

449

Inquiries

2023

411

Inquiries

2022

Independent Reviews

An independent review is an informal process whereby the Office of the Ombudsman investigates to determine if stakeholders experienced a fair supervisory process. An independent review may be needed in complex complaints which appear to involve gaps in administrative processes, systemic flaws, or require more investigation. It is warranted when stakeholders allege errors in a regulatory process or after a credit union member stakeholder appeals a Consumer Assistance Center decision. In 2024, we conducted ten independent reviews regarding the consumer complaint process.

Independent Review – Consumer Complaint Process

The Ombudsman conducts independent reviews upon request from credit union members after receiving an appeal determination from the Consumer Assistance Center (CAC). Of the ten CAC-related requests received, eight separate independent reviews were conducted for credit union members seeking reversal of an investigation decision issued by the CAC.

The Ombudsman cannot overturn agency decisions. Rather, the Ombudsman serves as a neutral party to determine if gaps or errors existed in the complaint process. In 2024, our independent reviews did not yield errors within the NCUA’s supervisory processes and appeared to be fair and transparent. We closed each independent review and shared the results with each requesting stakeholder.

The remaining two independent reviews were conducted as a result of complaints from credit union members about their inability to use the CAC complaint portal because they reside abroad. Specifically, credit union members living internationally could not submit complaints using the consumer complaint portal. The results of the independent reviews revealed inefficiencies in the complaint process, and the Ombudsman issued one recommendation to the Office of Consumer Financial Protection (OCFP) aimed at expanding address inputs in the portal. OCFP is working on efforts to address the matter to accept complaints from credit union members with international addresses.

Stakeholder Engagement and Outreach

The Office of the Ombudsman provides opportunities to solicit stakeholder feedback and observations on NCUA processes. In 2024, the Ombudsman participated in 21 engagement and outreach events which included:

-

2024 International Ombuds Association Conference

- Ombudsman staff participated and networked with other federal Ombuds to discuss hot topics and emerging issues in the profession, including artificial intelligence, ethics, and emotional intelligence in mediation.

-

2024 NCUA Problem Case Officer Forum

- The Ombudsman gave a presentation highlighting case studies, resources, and tools to use when referring troubled credit unions to the office.

-

2024 NCUA Consumer Compliance Conference

- The Ombudsman gave a presentation highlighting case studies, resources, and feedback from credit unions regarding the agency’s consumer compliance program.

10

Independent Reviews Conducted

1

Recommendation Issued

21

Events Participated In

Post-Exam Survey

In its third year of circulation, results from the NCUA Post Exam Survey showed 94 percent positive responses related to the collaboration, narrative, and delivery of the examination report.

Post-Examination Survey

94%

Positive Responses

The 2024 survey questions focused on four different areas of the exam: (a) pre-exam questions, (b) exam procedures, (c) exam-related communications with management and officials, and (d) the exam report.

For favorable responses, participants had the option to strongly agree, agree, or somewhat agree. For adverse responses, participants had the option to strongly disagree, disagree, or somewhat disagree.

| Question | Positive | Negative |

|---|---|---|

| The written exam report documented and explained the examiner’s final conclusions and determinations. This includes CAMELS Ratings, Risk Ratings, corrective action plans, and any other concerns or conclusions. | 100% | 0% |

| Any corrective actions required were appropriate for the size and complexity of the credit union when possible (that is, when there was discretion to do so under applicable law or regulation). | 94% | 6% |

| Examiners provided the opportunity for management to provide corrective actions and considered management’s input in the final examination report. | 95% | 5% |

| The final exam report was delivered at, or prior to, the exit meeting with the CEO or designated credit union staff; or at, or prior to, the joint conference with the credit union’s Board of Directors (if one was held); or if changes resulted from either of these meetings, was delivered within ten business days thereafter. | 96% | 4% |

| If examination conclusions changed (Documents of Resolution, Examiner Findings, CAMELS Ratings, Risk Ratings, etc.) after drafts were provided to management, were the changes communicated to management? | 87% | 13% |

For questions focused on exam procedures, credit unions emphasized a need for the agency to reduce duplicative requests for data and information during the exam. Forty-one percent of credit union survey participants do not agree with the statement that duplicate requests for data and information are avoided during the exam.

Post Exam Survey – Results

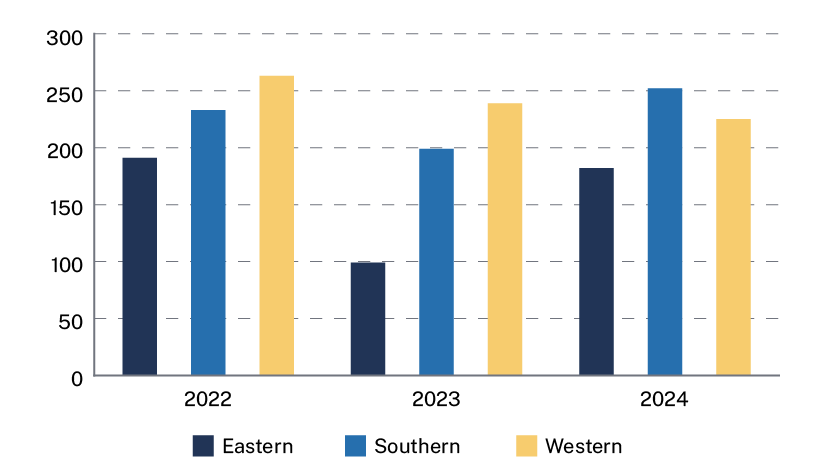

Overall Participation Each Year

This chart highlights overall participation in the Post Exam Survey by credit unions and examiners in charge.

Regional Participation

This chart highlights participation in the Post Exam Survey based on the regional location of credit unions and examiners in charge.

Summary

The Office of the Ombudsman remains an independent and confidential resource for stakeholders interacting with the NCUA. We invite your observations or concerns about regulatory activity as the Ombudsman is an independent office. NCUA staff may not retaliate against an insured credit union making any type of complaint or appeal. Looking ahead, we set forth to implement strategic goals to guide our decision making, with measurable objectives to enhance transparency and engagement with credit union stakeholders.

Contact Information

Office of the Ombudsman

1775 Duke St.

Alexandria, VA 22314

703.518.1175 (phone)

703.518.1757 (fax)