INTRODUCTION

In 1934, Congress established a 1 percent per month (12 percent per year) loan interest rate ceiling for loans made by federal credit unions (FCUs). Public Law 96-221, enacted in 1980, raised the FCU loan interest rate ceiling from 12 percent to 15 percent per year.1 The law also authorized the NCUA Board to raise the loan interest rate ceiling, when certain conditions were met, for up to 18 months at a time.

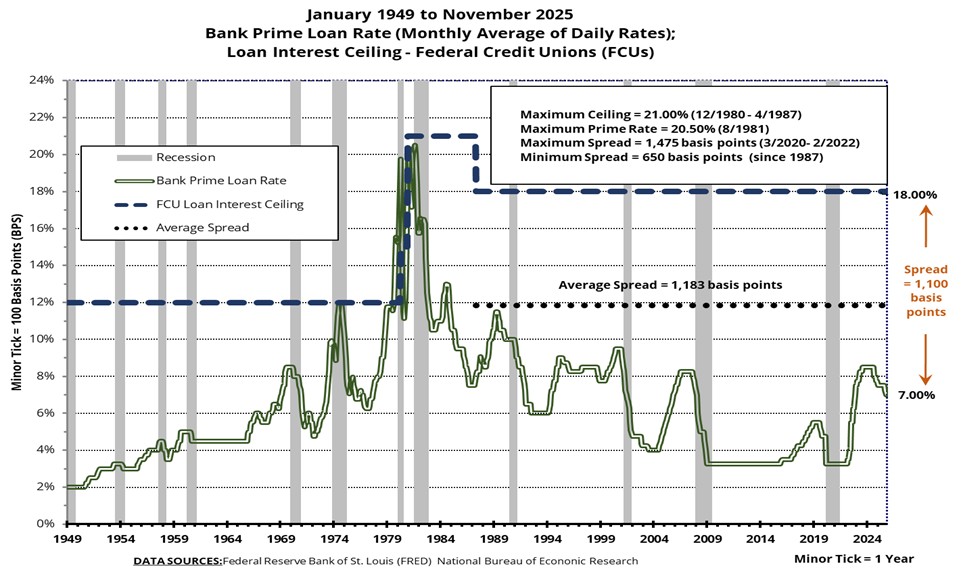

In December 1980, the NCUA Board voted to raise the loan interest rate ceiling to 21 percent. In May 1987, the loan interest rate ceiling was reduced to the current level of 18 percent. Since then, the NCUA Board has voted 24 times to maintain the FCU loan interest rate ceiling at 18 percent.2 Figure 1 shows the graphical history of the loan interest rate ceiling since January 1949.

Figure 1: Bank Prime Rate vs. Federal Credit Union Loan Interest Rate Ceiling

STATUTORY CRITERIA

In addition to a consultation requirement, the Federal Credit Union Act (FCUA) includes the following two requirements that must be satisfied for the NCUA Board to raise the FCU loan interest rate ceiling above 15 percent.

1. Money Market Interest Rates

A FCUA condition of raising the FCU loan interest rate ceiling is that money market interest rates must have risen over the preceding six months. Table 1 illustrates fluctuations in money-market interest rates as evidenced by changes in the 30-day average Secured Overnight Financing Rate (SOFR)3 and one-month constant maturity treasury rate (CMT)4 during the six-month period starting on June 1, 2025, and ending on November 30, 2025:

| Money Market Rates | Preceding Six Month Period Dates | Preceding Six Month Period Dates | Preceding Six Month Period Dates | Sample Period of Rising Rates | Sample Period of Rising Rates | Sample Period of Rising Rates |

|---|---|---|---|---|---|---|

| 30-Day Average SOFR | 4.31 | 4.01 | -0.30 | 4.31 | 4.34 | +0.03 |

| 1-Month Constant Maturity Treasury | 4.30 | 4.05 | -0.25 | 4.18 | 4.48 | +0.30 |

While interest rates have, on average, moderated lower over the preceding six-month period, there have been several occasions within this timeframe when they have risen. For example, during the monthly period between June and August 2025, the 30-day average SOFR and one-month constant maturity treasury rate rose by 3 and 30 basis points respectively.

2. Federal Credit Union Safety and Soundness

The second FCUA condition of raising the FCU loan interest rate ceiling is that “prevailing interest rate levels threaten the safety and soundness of individual credit unions as evidenced by adverse trends in liquidity, capital, earnings, and growth.”

As of September 30, 2025, there are 2,073 (76 percent) FCUs that issued loans with interest rates above 15 percent. Loan balances with interest rates above 15 percent totaled $44.1 billion, and these loans carry an average interest rate of 17.30 percent. Table 2 summarizes this information and shows the breakdown of these FCUs that:

- have a low-income (LI) designation or are certified as a Community Development Financial institution (CDFI).

- offer loans under the Payday Alternative Loans (PALs) program.

- have more than 10 percent of their assets concentrated in loans with interest rates above 15 percent.

| Type | # of FCUs | Total Loan Balances with Interest Rates >15% | LOANS WITH Interest RATES >15% TO TOTAL Loans | Median Asset Size OF FCU | Average Rate on Loans WITH interest RATES >15% |

|---|---|---|---|---|---|

| FCUs with loans with an interest rate >15% | 2,073 | $44.1B | 5.2% | $78M | 17.30% |

| LI/CDFI FCUs | 1,380 | $8.8B | 2.1% | $74M | 16.93% |

| FCUs with >10% of assets in loans with interest rates >15% | 49 | $27.6B | 19.6% | $5M | 17.46% |

| FCUs with PALs | 445 6 | $5.1B 7 | 2.6% | $70M | 17.03% 8 |

A reversion to a 15-percent FCU loan interest rate ceiling would adversely affect the safety and soundness of a significant number of FCUs. Given prevailing interest rates, staff estimates that reversion to the statutory loan interest rate ceiling would threaten the safety and soundness of as many as 1,068 FCUs, given the impact on one or more areas of performance in liquidity, capital, earnings, and growth (risk categories). Pursuant to the safety and soundness analysis, an FCU with loans with interest rates greater than 15 percent is assigned to one or more of the four risk categories based on the following:

- Liquidity: Low liquidity level, or below average liquidity level and significant recent decline.

- Capital: Low net worth level, or below average net worth level and significant recent decline.

- Earnings: Negative earnings, below average earnings and significant recent decline, a low net interest margin, or a below average net interest margin and significant recent decline.

- Growth: Significant recent decline in membership or unsecured loan volume.

# of Risk Categories Triggered | # of FCUs | Balance of Loans with Interest Rates >15% ($MM) | Loans with Interest Rates >15% to Total Loans | Average Interest Rate of Loans with Rates >15% |

|---|---|---|---|---|

4 | 6 | $7 | 1% | 16.89% |

3 | 45 | $215 | 1% | 16.70% |

2 | 283 | $1,862 | 2% | 17.02% |

1 | 734 | $36,145 | 8% | 17.38% |

Total ≥ 1 | 1,068 (52%) | $38,230 | 6% | 17.35% |

0 | 1,005 (48%) | $5,857 | 3% | 16.94% |

Total | 2,073 | $44,087 | 5% | 17.30% |

For FCUs making loans with an interest rate greater than 15 percent, the adverse impacts of the interest rate ceiling reverting to 15 percent would be particularly pronounced, especially for 315 FCUs already struggling with negative earnings, 34 FCUs with low net worth ratios, and 49 FCUs with greater than 10 percent of their assets in loans with interest rates greater than 15 percent.

Reverting to a 15 percent loan interest rate ceiling would also constrain the ability of FCUs with loans with interest rates greater than 15 percent to continue to safely make loans to a broader range of members in the current interest rate environment. This includes an impact on 445 FCUs offering loans under the PALs program with interest rates greater than 15 percent. If the FCU loan interest rate ceiling reverts to 15 percent, the maximum allowable PAL rate would also fall to 15 percent.9

Footnotes

1 12 U.S.C. §1757(5)(A)(vi)(I).

2 The NCUA Board last approved the 18-percent loan interest rate ceiling at its July 2024 board meeting for a term beginning September 11, 2024, through March 10, 2026.

3 The SOFR is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR is calculated as a volume-weighted median of transaction-level tri-party repo data collected from the Bank of New York Mellon as well as General Collateral Finance Repo transaction data and data on bilateral Treasury repo transactions cleared through the Fixed Income Clearing Corporation's Delivery-vs-Payment service, which are obtained from the U.S. Department of the Treasury’s Office of Financial Research.

4 The CMT Index represents yields on Treasury securities that are interpolated by the Department of the Treasury from the daily yield curve. This interpolation is based on the closing market bid yields of the actively traded Treasury securities in the over-the-counter market and calculated from the composites of quotations obtained by the Federal Reserve Bank of New York. This interpolation method provides a yield for a particular maturity even if no outstanding security has exactly that fixed maturity.

5 Sourced from NCUA 5300 Call Report data as of September 30, 2025.

6 There are 467 FCUs that report offering loans under the PALs program, but 22 of them report no loans with interest rates above 15 percent.

7 PALs program balances total $139 million.

8 The current loan interest rate ceiling on PALs is 28 percent, which is determined by adding 1,000 basis points to the loan interest rate ceiling set by the NCUA Board. 12 C.F.R. § 701.21(c)(7)(iii) & (iv).

9 12 C.F.R. § 701.21(c)(7)(ii): “Except when the Board establishes a higher maximum rate, federal credit unions may not extend credit to members at rates exceeding 15 percent per year on the unpaid balance inclusive of all finance charges.”