CUOnline Changes

As discussed in the last cycle, the NCUA is implementing a forced Profile edit to clarify some Profile data. The Sites tab edit was forced for the December 2025 cycle, and the Contacts tab edit will be forced for the March 2026 cycle. These edits will not be visible until you try to certify and submit the Profile. For some credit unions there may be many items to correct, and the Profile cannot be certified and submitted until all forced edits are corrected. Steps to clear the forced edits are described below.

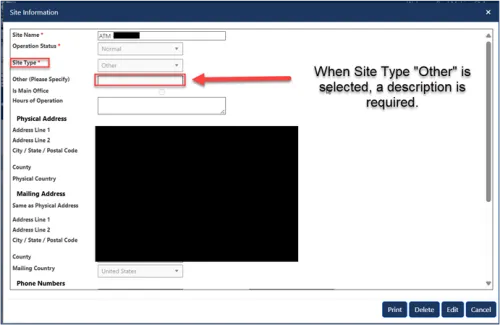

Sites tab

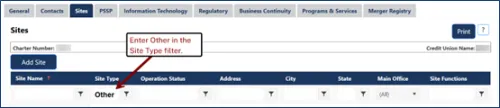

A few cycles ago the NCUA implemented a Profile edit that requires a description to be entered for any Site Type listed as "Other". This edit occurs only when you add a new site or change an existing site. Starting with the December 2025 Call Report cycle, the forced Profile edit will identify all the Other sites without a description. You will not be able to certify and submit your Profile until all forced edits are corrected.

To identify the “Other” sites, you may want to use the filters on the Sites tab.

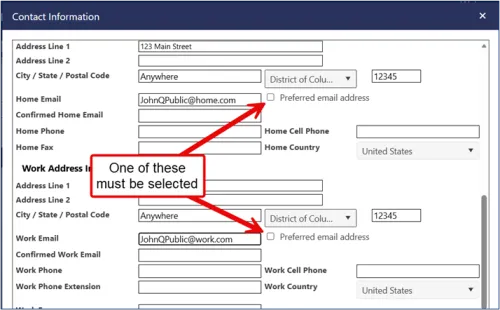

Contacts tab

The NCUA also previously implemented an edit that requires credit unions to identify the preferred email address for mandatory job titles. This edit occurs only when you add or modify a contact with a mandatory job title. Starting with the March 2026 cycle, the NCUA will implement a forced Profile edit that requires the preferred email address to be selected for all contacts with mandatory job titles regardless of how many emails are entered. So, if you enter just one email, you will still have to select the appropriate preferred email address.

Since most credit unions have not selected a preferred email address for mandatory job titles, the NCUA advises you to correct as many as possible prior to the March 2026 cycle. You will not be able to certify and submit your March 2026 Profile until all forced edits are corrected.