Chairman’s Message

Under the Federal Credit Union Act, the purpose of the credit union system is to meet the credit and savings needs of credit union members, especially those of modest means. An essential component to achieving that statutory mission is the work of minority depository institutions. Otherwise known as MDI credit unions, these institutions have long been well positioned to provide access to safe, fair, and affordable financial products and services within under-resourced communities. MDI credit unions also often assist people of modest means in building a measure of financial security. The National Credit Union Administration, therefore, considers supporting the work of and preserving MDI credit unions as a fundamental responsibility.

Each year, the NCUA reports to Congress on the composition and financial condition of the MDI credit unions we supervise and insure as well as our ongoing actions to preserve and protect them. These reports are pre-pared and submitted as required under Section 308 of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended by Section 367 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. We hereby submit our annual report on MDI credit unions for 2022.

The products and services MDI credit unions provide benefit their members and communities. They also further the broader vision of advancing economic equity and justice within the U.S. financial system. Their existence means an entrepreneur who might have been overlooked by other financial institutions gets the loan needed to start a business. It also means a young couple who live in an under-resourced neighborhood can begin saving for their child’s college education or to purchase a new home. And, it means a family has a way to learn financial management skills. Simply put, for millions of Americans, the work of MDI credit unions means they have a chance to build better and more secure financial futures.

During 2022, MDI credit unions continued to perform well. This report provides a wealth of details, but it’s clear that, given the great majority of MDIs are small credit unions, they punched above their weight. In fact, their performance in some categories was stronger than the credit union system overall.

MDIs reported $42.2 billion in loans outstanding in 2022, an $8 billion increase from the previous year. As-sets and membership both increased. Net worth and return on average assets were also robust.

Similarly, the NCUA expanded its support for MDIs in 2022 and continued to look for ways to more effectively target its efforts. During the year, the agency finalized plans to adjust its examination processes to recognize the distinctive business model of MDI credit unions. This evolution in supervision the NCUA with greater insight into MDI credit union strategies and member needs while simultaneously providing MDI credit unions with useful metrics to benchmark their work against true peers.

Additionally, a report by the NCUA’s Office of the Inspector General issued in September found that the MDI Preservation Program achieved its goals. The report also offered advice — based on a survey the office con-ducted of MDI credit unions — on where the agency should focus future efforts. The agency is now incorporating those suggestions into its preservation program and support initiatives.

Based on that report and other research and discussion, the NCUA has laid out a plan for its MDI preservation activities in the future. One step has already been completed; at the agency’s request, Congress added the MDI designation as an eligibility category for 2023 Community Development Revolving Loan Fund funding.

The importance of supporting MDI credit unions has taken on a new meaning as financial institution regulators like the NCUA prepare for the impacts of climate change on our financial system. Just as MDIs were essential in assisting their members and communities during the COVID pandemic, they must be prepared to fill the same role as climate change advances. A 2021 Environmental Protection Agency report stated, “minorities are most likely to currently live in areas where the analyses predict the highest level of climate change impacts.” As the NCUA’s Office of the Chief Economist explained in a recent Research Note, MDI credit unions serve populations that will be particularly vulnerable financially to the changes that are coming, and two-thirds of total MDI assets are invested in these communities.

Promoting service, opportunity, and financial security are fundamental to the credit union system’s work and to that of the NCUA. As always, the NCUA welcomes feedback from lawmakers and industry stakeholders. If you have questions about this report, please contact us. We also encourage you to visit MDI credit unions in your state or district to see firsthand how they are improving the financial well-being of their members and the communities they serve.

Todd M. Harper

NCUA Chairman

Minority Depository Institutions

Minority depository institution credit unions exist to provide access to safe, fair, and affordable financial products and services to minority communities, individuals, and populations traditionally underserved by the financial system. The NCUA regards supporting and preserving MDIs to be part of its vision of promoting greater financial inclusion and broader opportunities, particularly to under-resourced people and communities.

Federally insured credit unions self-designate as MDIs by affirming in the NCUA’s Credit Union Online Profile that more than 50 percent of their current members, the communities they serve, and their boards are from one or a combination of the four minority categories defined in FIRREA: Asian Americans, Black Americans, Hispanic Americans, or Native Americans.

Appendix 3 of this report lists all federally insured, MDI-designated credit unions as of December 31, 2022.

Financial Performance Highlights for MDI Credit Unions in 2022

At the end of 2022, there were 503 federally insured credit unions designated as MDIs, about one in 10 of all federally insured credit unions. They were located in 35 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

MDIs traditionally tend to be small institutions; at the end of 2022, the average MDI credit union held $128.6 million in assets. By comparison, average assets for all federally insured credit unions were $455.4 million.

Generally, MDI credit unions saw improved financial performance metrics in 2022, in several categories outpacing growth in the credit union system overall:

- The 503 MDI credit unions reporting at the end of 2022 is a slight decrease from year-end 2021, when there were 509. This was largely due to mergers and credit unions no longer self-designating as MDIs. Over the course of 2022, 19 credit unions became newly designated.

- The 503 MDI credit unions served more than 5 million members, up from approximately 4.5 million in 2021. This represents an increase of 14.1 percent compared to the 4.4 percent membership growth in federally insured credit unions generally during the same period.

- Of those 503 MDI credit unions, 411 also held the low-income credit union designation, and 104 were certified as Community Development Financial Institutions.

- MDI credit unions’ total assets were $64.7 billion, up from $58.9 billion in 2021, an increase of 9.8 percent compared to the 5.2 percent growth in assets of all federally insured credit unions as a group during the same period.

- MDI credit unions reported $42.2 billion in loans outstanding compared to $34.2 billion in 2021, primarily concentrated in one-to-four-family unit first-mortgage loans ($15.7 billion) and vehicle loans ($14.7 billion). The loan growth rate, 23.2 percent, was slightly higher than the 20 percent growth in federally insured credit unions overall during the same period.

- The net worth ratio for MDI credit unions at the end of 2022 was 12.21 percent, higher than the credit union industry’s net worth ratio of 10.74 percent for the year.

- Return on average assets was 98 basis points at the end of 2022 compared to 89 basis points for federally insured credit unions as a whole.

- MDI credit unions had a delinquency rate of 73 basis points, slightly higher than the rate of 61 basis points for federally insured credit unions overall.

- MDI credit unions had a net charge-off rate of 39 basis points compared to 26 basis points for all federally insured credit unions.

- MDI credit unions had a loan-to-share ratio of 66.3 percent compared to 70.2 percent for federally insured credit unions overall.

- Of the 503 MDI credit unions reporting at the end of 2022, 480, or more than 95 percent, reported a net worth ratio of at least 7 percent, the statutory standard for a “well-capitalized” institution, which aligns closely to the 97 percent for federally insured credit unions overall.

A package of tables and charts in Appendix 1 provides detailed information about the financial trends in MDI credit unions as of December 31, 2022. The three charts below show the distribution of MDIs, membership, and assets state-by-state.

This is a chart in the shape of a map of the United States showing total numbers of minority depository institutions located in every state, the District of Columbia, Puerto Rico, and the Virgin Islands at the end of 2022, with the number appearing in each entity.

A legend appears on the lower right-hand vertical margin showing the range of MDIs per entity, in descending order, from zero to 80 or more.

This is a chart in the shape of a map of the United States showing the total number of members, in thousands, in minority depository institutions in every state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands at the end of 2022. The number of members appears in each entity.

A legend appears on the lower right-hand vertical margin showing, in descending order, the range in the number of members, in thousands, from zero to 1,001 or more.

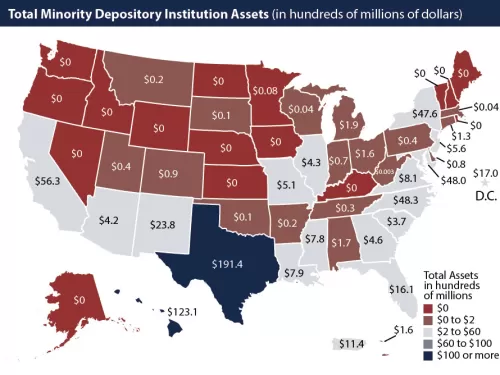

This is a chart in the shape of a map of the United States showing the total amount of assets, in hundreds of millions of dollars, in minority depository institutions in every state, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands at the end of 2022. Total asset amounts appear in each entity.

A legend appears on the lower right-hand vertical margin showing, in descending order, the range in assets, in hundreds of millions of dollars, from zero to 100 or more.

MDI Credit Union Preservation Program

The NCUA Board approved, on June 18, 2015, a final MDI Preservation Program Interpretive Ruling and Policy Statement that detailed the NCUA’s objectives for preserving and encouraging MDI credit unions in accordance with FIRREA goals. These objectives are consistent with the NCUA’s mission and strategic goal of ensuring a safe, sound, and viable system of cooperative credit that protects consumers. Since its inception, the program has evolved to better meet the needs of MDI credit unions, their members, and their communities.

MDI Preservation Activities in 2022

During 2022, the NCUA’s support for MDIs included:

- Chartering two new MDI credit unions: WeDevelopment Federal Credit Union in Kansas City, Missouri, and People Trust Federal Credit Union in North Little Rock, Arkansas.

- Approving field-of-membership expansions for 26 MDIs, thereby adding 833 new member groups or geographic areas and more than 7.7 million potential members.

- Providing $270,000 in technical assistance grants funded by the Community Development Revolving Loan Fund to 16 MDI credit unions. Appendix 2 has a complete list of MDI credit unions that received CDRLF awards in 2022.

- Awarding two of the three CDRLF small credit union and MDI mentoring grants of $25,000 each to MDI credit unions to support their partnerships with stronger, more experienced credit unions that provided technical and other assistance.

- Launching the Small Credit Union and MDI Support Program, which directed agency resources to identify the needs of these credit unions. The most common areas of assistance were examinations, staff training, and improving earnings in a rising interest-rate environment. The NCUA dedicated 1,534 staff hours per region to this effort, and 136 MDI credit unions participated.

- Adding an MDI filter for financial performance reports, enabling users to search by the MDI designation.

- Facilitating contacts between MDIs and the Government National Mortgage Association for Ginnie Mae’s initiative for minority communities.

- Distributing information to credit unions designated as community development financial institutions, many of which are MDIs, about the Community Development Financial Institutions Fund’s Equitable Re-covery Program.

MDI Mentoring Cohort

The 2022 MDI Mentoring Cohort included the four MDIs awarded MDI Mentoring Grants during 2021 and their three mentors, one of which was also an MDI.

The NCUA launched its MDI Mentoring Grants program in 2019, funded through the agency’s CDRLF appropriation. Mentoring grants have facilitated the ability of small, low-income MDIs to establish support relationships with stronger, more experienced low-income credit unions that provide expertise and guidance in serving low-income and underserved populations.

Mentor credit unions assist their mentees in a variety of ways that lead to better service to members and their communities, including:

- Providing advice on strategic planning;

- Offering suggestions for improving credit union operations; and

- Making recommendations on building staff capacity and expanding membership.

The cohort held quarterly video conferences where the credit unions could hear from NCUA subject-matter experts and guest speakers and discuss successful strategies in meeting their goals. Mentees also participated in the “Federal Funding Sources for MDI and Other Credit Unions” webinar, a joint presentation of the NCUA and the Community Development Financial Institutions Fund.

Training and Education

The NCUA’s Learning Management System is an online service providing training at no cost to credit union board members, management, and staff. The LMS offers on-demand courses that cover topics like management and governance, operations, regulations, and federal programs. During 2022, 109 LMS users who were affiliated with MDI credit unions accessed content there.

In addition to online education, the agency hosted seven webinars on topics of particular interest to MDIs:

- “Federal Funding Sources for MDI and Other Credit Unions,” co-hosted with the Community Development Financial Institutions Fund;

- “How to Submit a Successful CDRLF Grant or Loan Application”;

- “Small Credit Union Challenges”;

- “Overdraft Programs: Searching for New Solutions”;

- “Bank Secrecy Act Update: Challenges for Small Credit Unions”; and

- “Ransomware in the Financial Sector.”

Other MDI Assistance

NCUA field staff and staff from the agency’s Office of Credit Union Resources and Expansion provided various kinds of support to MDIs during 2022, including:

- Assisting with merger planning;

- Helping with a request for secondary capital;

- Assisting with CDRLF grant applications; and

- Assisting credit unions seeking Community Development Financial Institution certification and Rapid Response Program grants.

Inspector General's Report

In September 2022, the NCUA’s Office of the Inspector General released a report on the performance of the agency’s MDI Preservation Program. The report found the program had achieved its goals and offered two recommendations:

- The NCUA should evaluate its communications with MDI credit unions to determine how they could be made more effective. This recommendation was made based on a survey the Inspector General’s office performed with 207 MDI credit unions. CURE staff are implementing improvements to these communications in response to the results of that survey.

- The NCUA should implement and document an appropriate policy and procedures to validate credit unions’ continued status as MDIs. The agency is working to implement this recommendation.

Going Forward

In addition to incorporating the recommendations from the Inspector General’s report, NCUA will build on its success supporting MDI credit unions in several ways during 2023:

- Increasing staff hours allocated to MDIs under the Small Credit Union and MDI Support Program from 1,534 for each region in 2022 to 5,500 hours across the three regions.

- Adjusting its examination processes to recognize the distinctive business model of MDI credit unions, providing greater insight into MDI credit union strategies and member needs while simultaneously providing MDI credit unions with useful metrics to benchmark their work against true peers.

- Hosting an MDI Awareness Month and an MDI Symposium to promote greater visibility and understanding about MDIs’ mission and encourage eligible credit unions to become designated. The MDI Symposium will bring credit union system stakeholders together to develop a long-range plan for MDI support, facilitated by the agency.

- Evaluation of various strategies for supporting MDIs by the Advancing Communities through Credit, Education, Stability, and Support, or ACCESS, initiative’s MDI working group. The working group will make recommendations to help the NCUA more effectively support existing MDIs and encourage new ones.

- Offering grants to MDIs that were not previously eligible for CDRLF support following Congress’ addition of the MDI designation as a qualifying factor and a larger congressional funding allocation for 2023.

- Continuing to provide targeted training to MDIs on topics like financial statement analysis and credit union board responsibilities.

The NCUA’s Role in the Credit Union System

Created by the United States Congress in 1970, the National Credit Union Administration is an independent federal agency that insures deposits at federally insured credit unions, protects the members who own credit unions, charters and regulates federal credit unions, and promotes widespread financial education and consumer financial protection. The NCUA protects the safety and soundness of the credit union system by identifying, monitoring, and reducing risks to the National Credit Union Share Insurance Fund. Backed by the full faith and credit of the United States, the Share Insurance Fund provides up to at least $250,000 of federal share insurance to more than 135 million members in all federal credit unions and most state-chartered credit unions.

The NCUA’s mission is to protect the system of cooperative credit and its member-owners through effective chartering, supervision, regulation, and insurance.

Credit unions are member-owned, not-for-profit cooperative financial institutions that provide members with affordable financial products and services and allow them to participate in their institutions’ governance.

The NCUA’s Office of Credit Union Resources and Expansion supports the growth of all credit unions, with a particular focus on low-income-designated credit unions and minority depository institutions. In addition to overseeing the MDI Preservation Program, CURE is responsible for chartering and field-of-membership services, grants and loans, and providing online training at no charge through the agency’s Learning Management System.

Some of CURE’s programs, including grants and loans, have specific eligibility requirements. Others, such as training resources, are available to any credit union.

The NCUA continually evaluates and refines its efforts to assist credit unions, especially with regards to underserved outreach, promoting financial security, improving member service, and expanding membership.